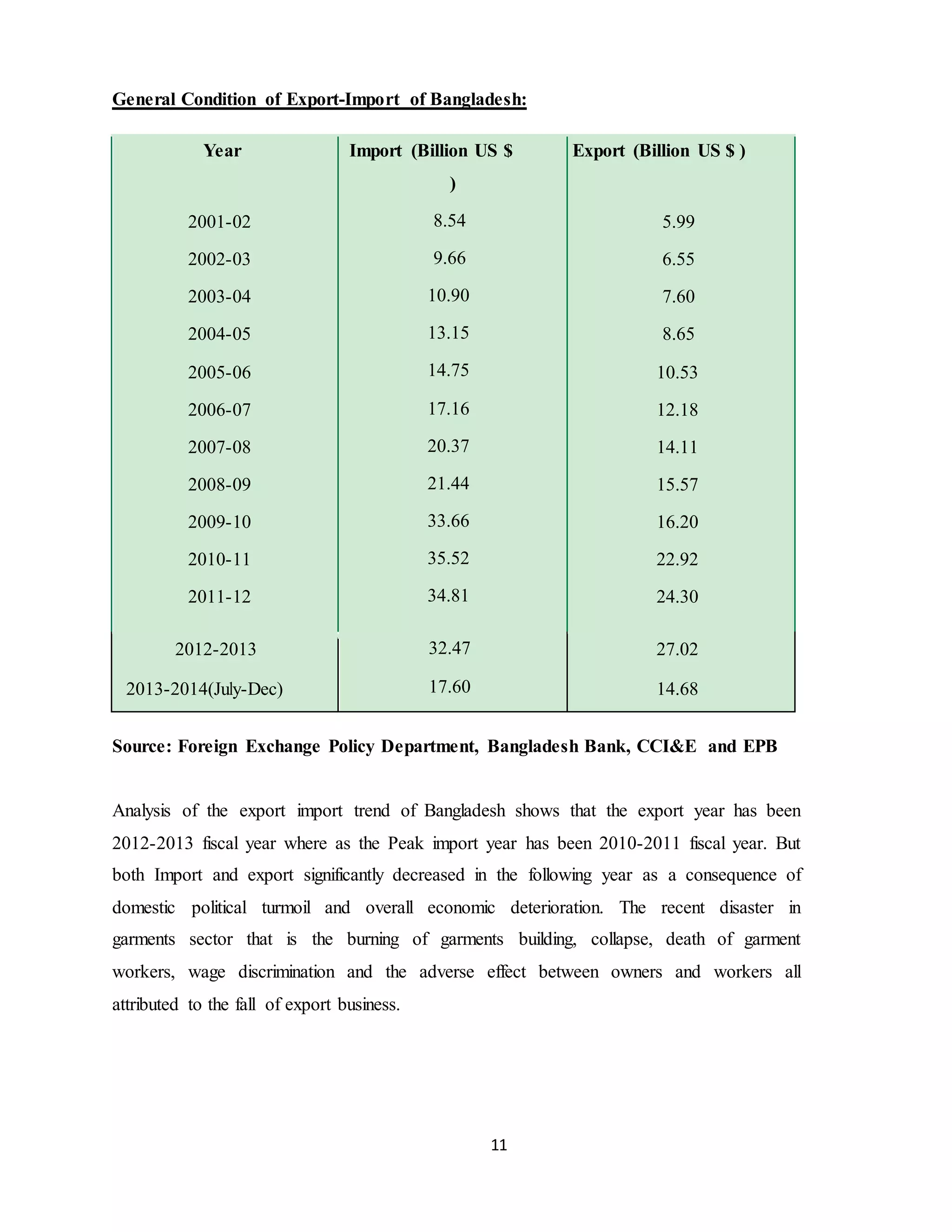

This document provides an overview of Bangladesh's export-import policy and trade. It discusses Bangladesh's history of international trade and its status as a founding member of the WTO. It then analyzes Bangladesh's current export-import situation, including its major export and import commodities and trade partners. Finally, it reviews Bangladesh's export-import trends over time and its persistent trade deficit.