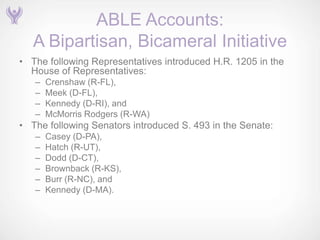

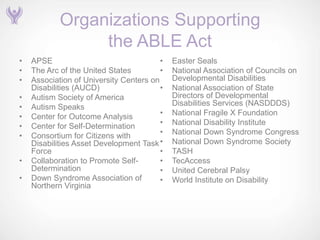

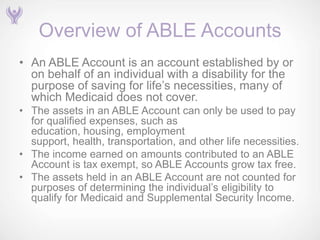

The ABLE Act allows individuals with disabilities to open tax-advantaged savings accounts called ABLE accounts to pay for qualified living and health expenses. ABLE accounts have an annual contribution limit of $500,000 and their earnings are tax-exempt. Withdrawals for qualified expenses are also tax-free, while other withdrawals incur taxes and penalties. The ABLE Act has bipartisan support and would encourage savings for individuals with disabilities without jeopardizing their eligibility for public benefits like Medicaid.

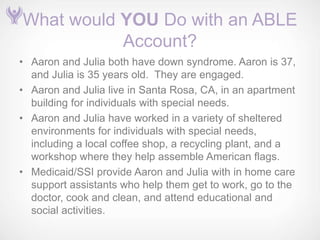

![What would YOU do with an ABLE

Account? (cont.)

• How would Aaron and Julia use the money in an ABLE

Account? [Note: each state’s Medicaid program varies

as to what expenses it covers.]

– Go to the dentist. California’s Medicaid program covers one

teeth cleaning a year, but dentists recommend getting two

cleanings. CA Medicaid also doesn’t pay for dental crowns.

– Join a health club. CA Medicaid doesn’t cover exercise or

other preventative health programs.

– Get a hearing aid. CA Medicaid doesn’t cover hearing aids for

the partially hearing impaired.

– Replace a pair of lost glasses. CA Medicaid’s vision benefits

are very limited.

– Go on a honeymoon. CA Medicaid/SSI does not allow

individuals with disabilities to save enough money to take a

vacation.](https://image.slidesharecdn.com/uaf-able-font-friendly-120614135422-phpapp02/85/The-ABLE-Act-14-320.jpg)