1) The Congressional Budget Office presentation discusses the challenges of estimating the federal budget and economic recovery given uncertainty.

2) It predicts a slow recovery due to financial market fragility and restrained household spending despite stimulus efforts.

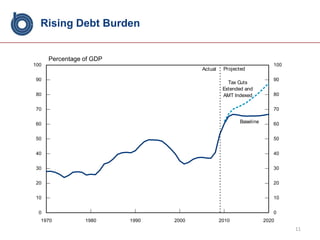

3) Under current policies, the budget deficit is projected to rise significantly with debt exceeding revenues and crowding out private investment by 2020.