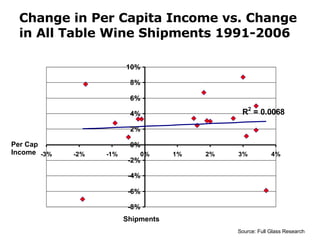

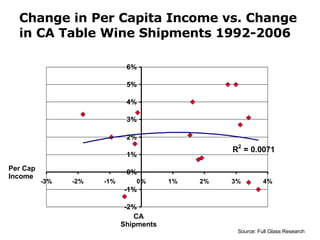

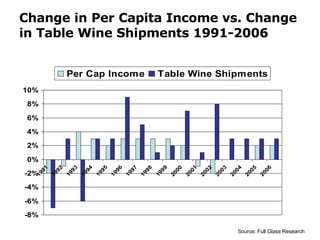

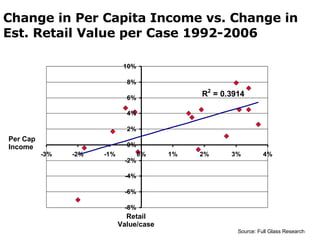

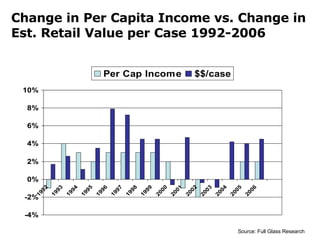

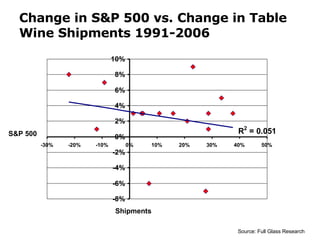

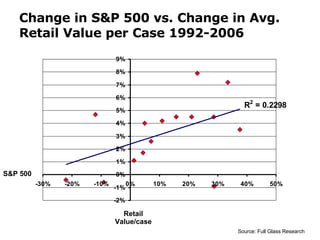

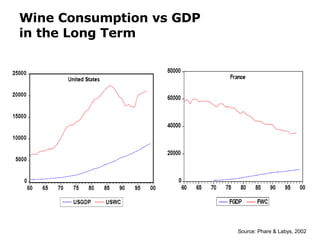

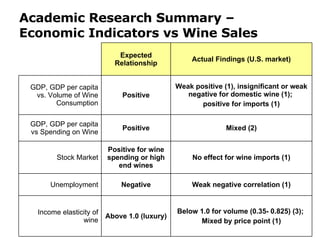

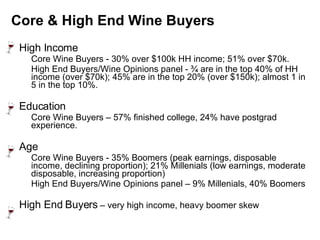

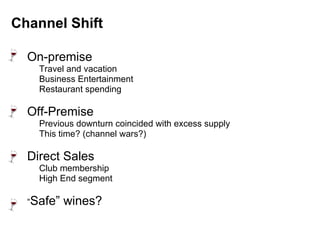

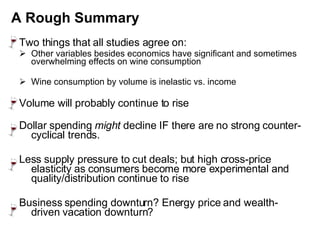

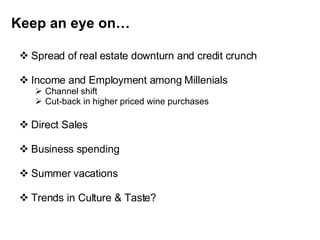

The document discusses how the economy may impact wine sales in 2008. It reviews historical data showing a weak negative correlation between economic indicators like unemployment and wine sales. Academic research shows income elasticity of demand is below 1.0 for wine volume but mixed for higher-end wines. The core wine-drinking demographic tends to be older, wealthier consumers, but a recession may still reduce their spending. Several factors like channels of purchase and business spending are uncertain and require monitoring in terms of effects on the wine industry.