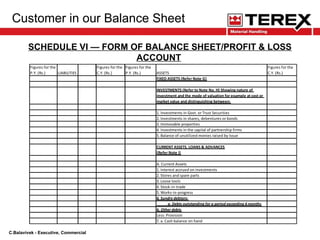

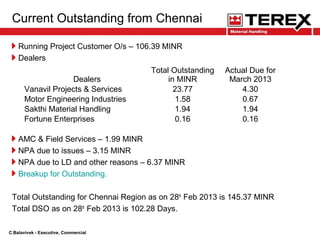

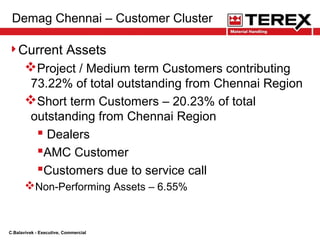

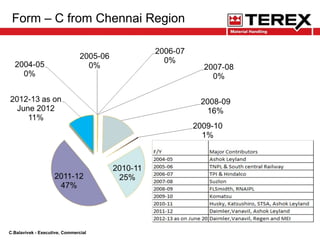

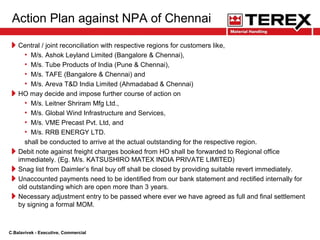

This document discusses customer debtors in the balance sheet of a company. It notes that debtors, or major customers from whom revenue is due, are classified as a current asset. Current assets can be further broken down into performing assets (customers paying within 180 days) and non-performing assets (those over 180 days overdue). Risks of performing assets turning non-performing include delays in project execution or documentation issues. The document provides an action plan for the Chennai region to reduce non-performing assets, including reconciliations, closing snag lists, identifying payments, and debt adjustments.