Embed presentation

Download to read offline

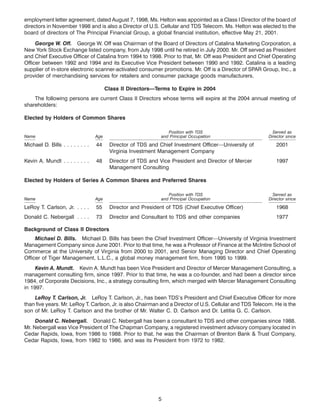

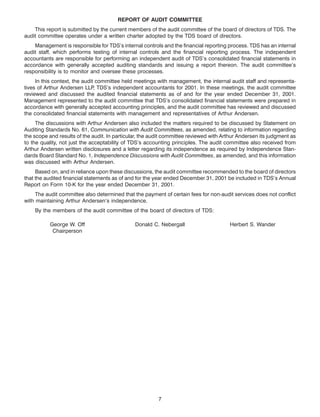

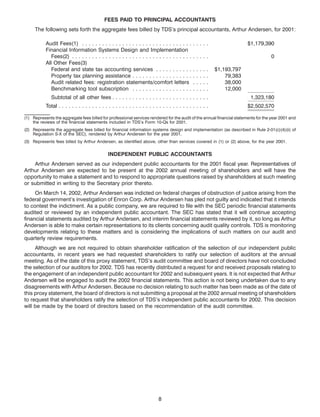

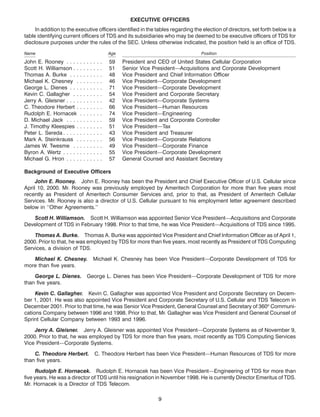

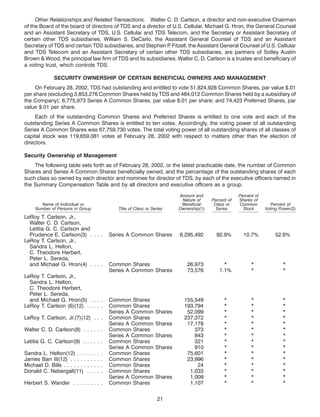

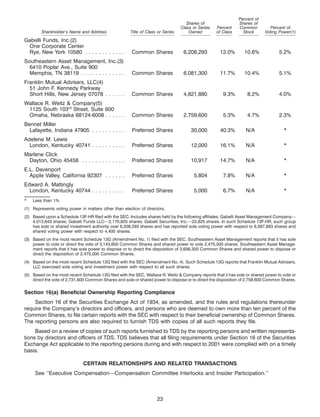

The document is a letter inviting shareholders of Telephone and Data Systems, Inc. to attend its 2002 annual meeting on May 23, 2002. It provides details on the location, time, agenda which includes electing four Class III directors, and recommendations of the board of directors. Shareholders are asked to sign and return the enclosed proxy cards to vote for the board's nominees for election as directors, whether or not they plan to attend the meeting.