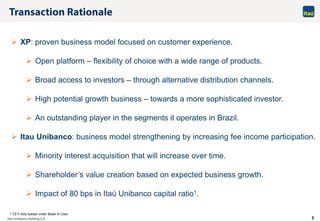

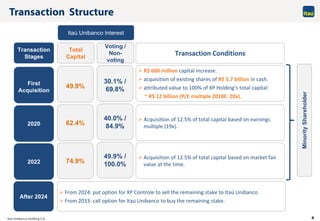

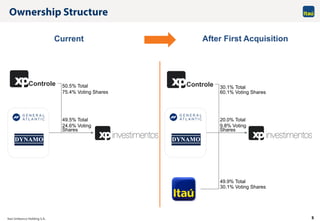

The document summarizes an agreement where Itaú Unibanco will acquire a minority stake in XP Inc. over time. Specifically:

- Itaú Unibanco will initially acquire a 12.5% stake in XP Inc. for $600 million in new capital and $5.7 billion for existing shares, valuing XP Inc at $12 billion.

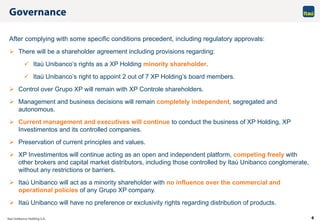

- Over time, Itaú Unibanco can increase its stake to 49.9% through additional acquisitions based on earnings multiples.

- After 2024, XP Controle has a put option to sell its remaining shares to Itaú Unibanco, and after 2033 Itaú Unibanco has a