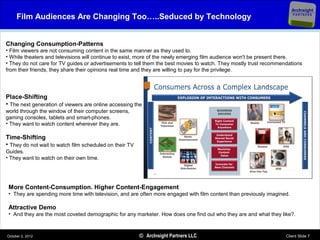

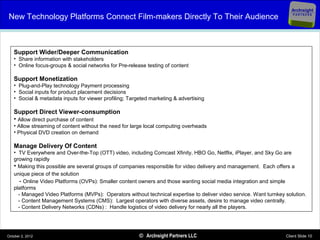

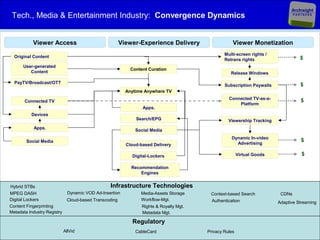

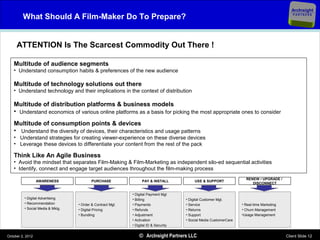

ArcInsight Partners focuses on strategic advisory services that leverage technology innovations to enhance monetization within the film and media industry. The document discusses the changing landscape of media consumption, emphasizing the rise of digital platforms and the disruption of traditional film finance, marketing, and distribution models. It highlights the importance of adapting to new consumer behaviors and technologies to remain competitive in a rapidly evolving market.