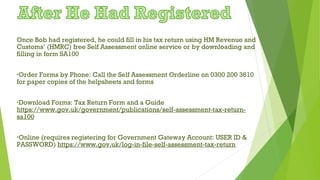

This document outlines the self-assessment process for sole traders in the UK. It explains that sole traders must register with HMRC as self-employed, file an annual self-assessment tax return reporting their business profits and personal income, and pay income tax and national insurance on profits. It provides details on registration deadlines, how to file tax returns online or via paper, and deadlines for paying any taxes owed.