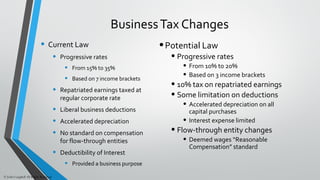

The presentation discusses potential tax law changes for 2017, focusing on individual, business, and estate taxes. Key proposals include reducing the top individual tax bracket to 33%, simplifying deductions, and altering business tax structures, such as reducing the highest rate to 25%. The future of estate taxes may involve a full repeal at the federal level, impacting state tax dynamics as well.