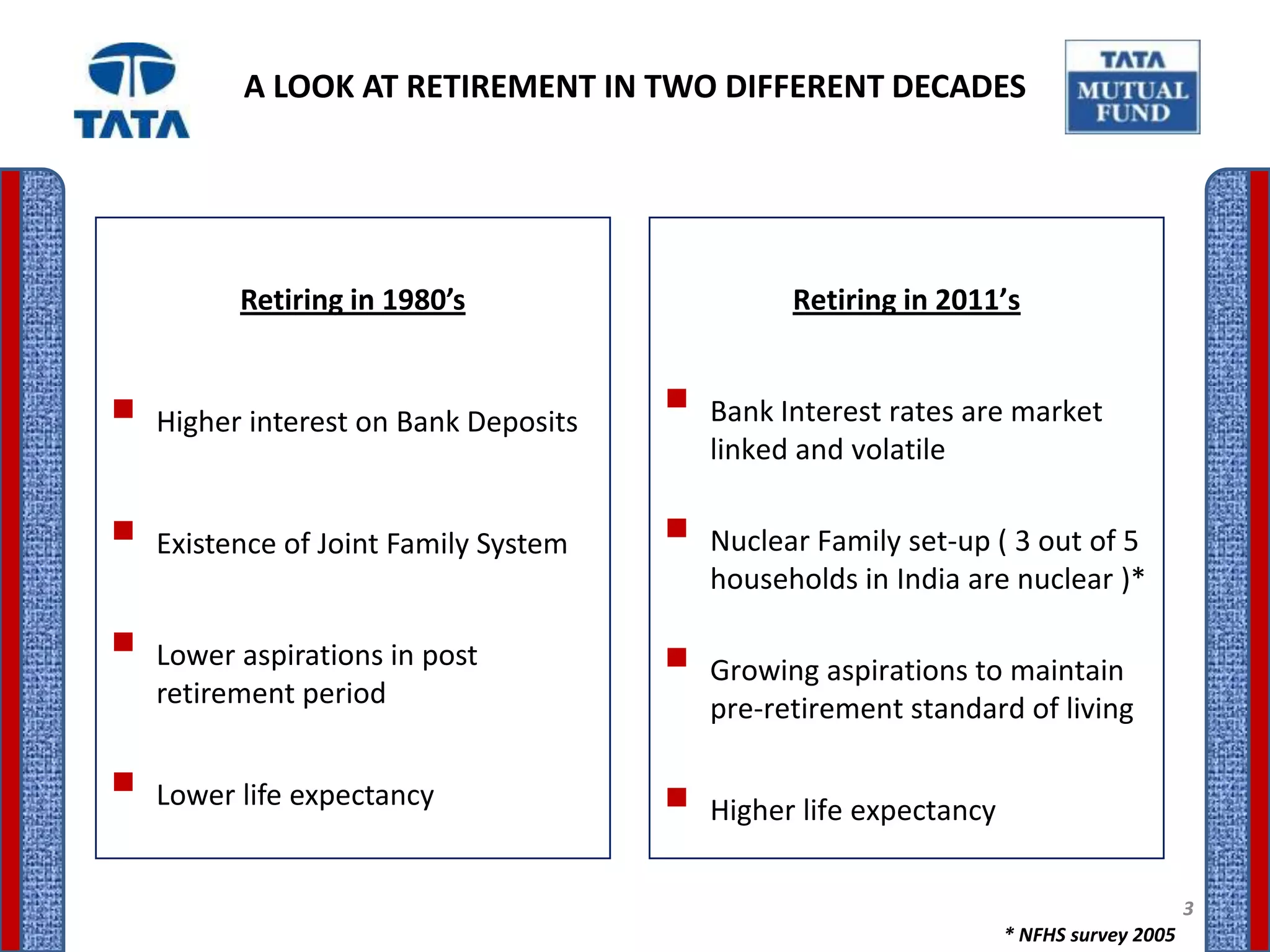

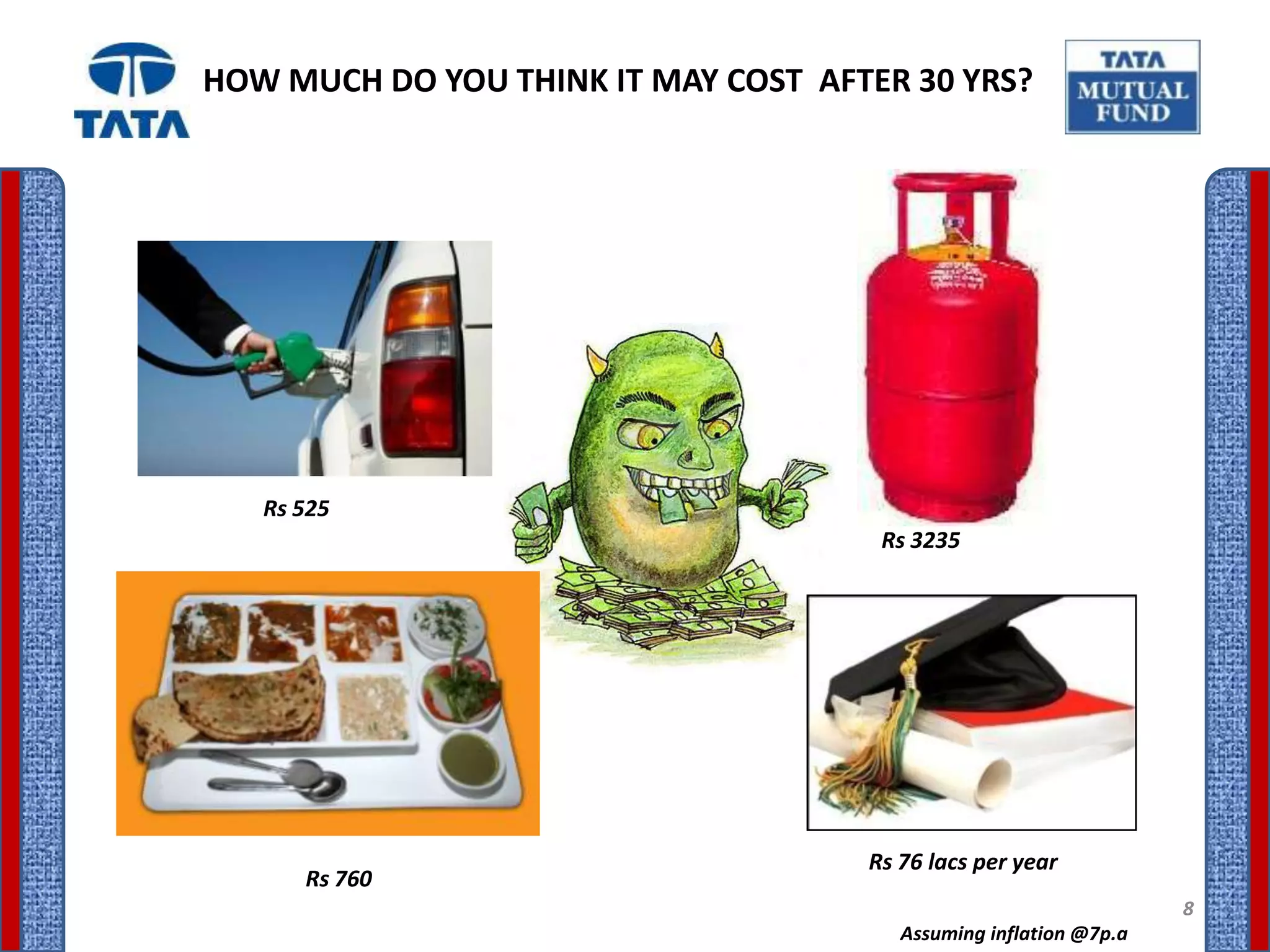

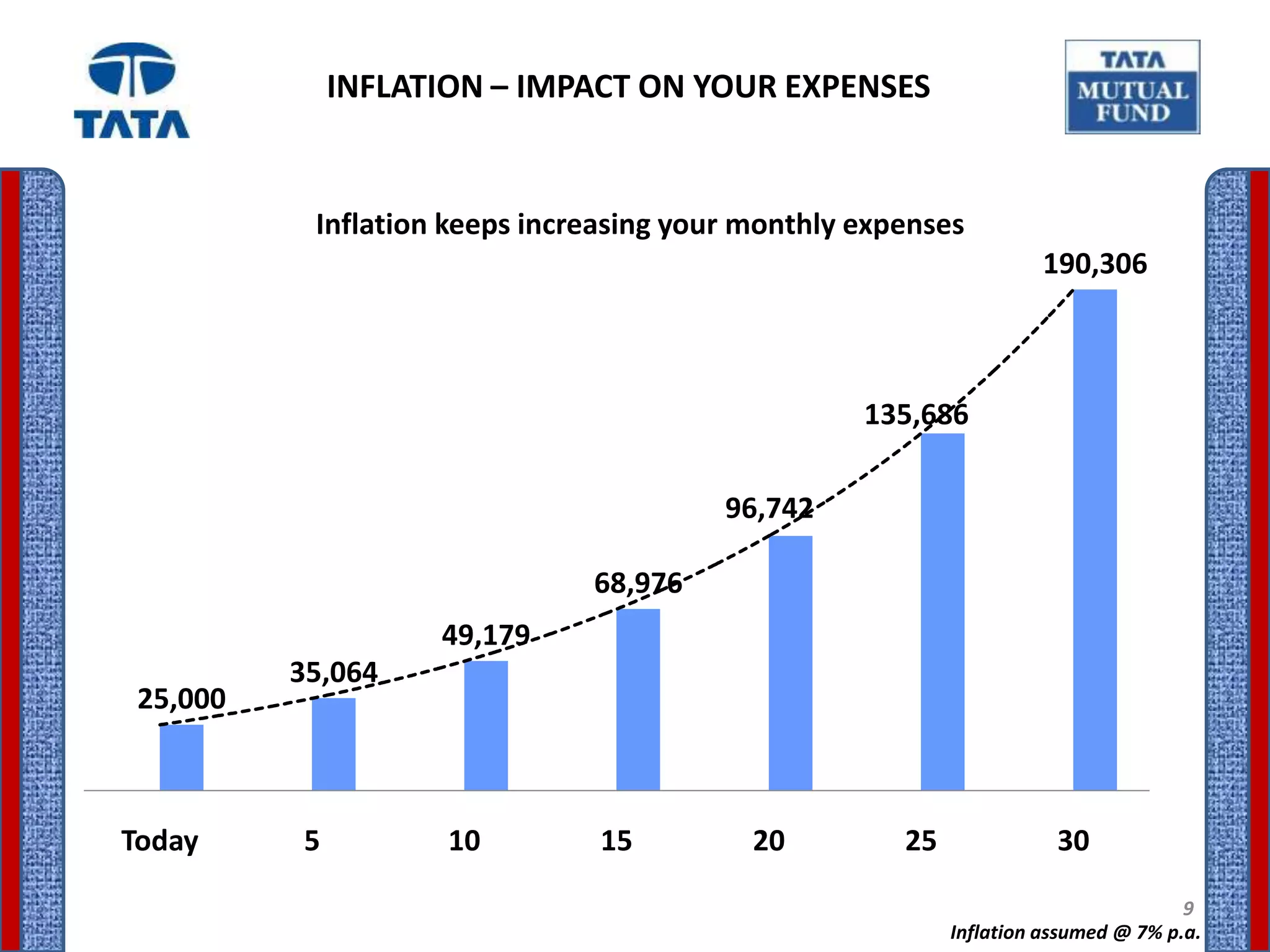

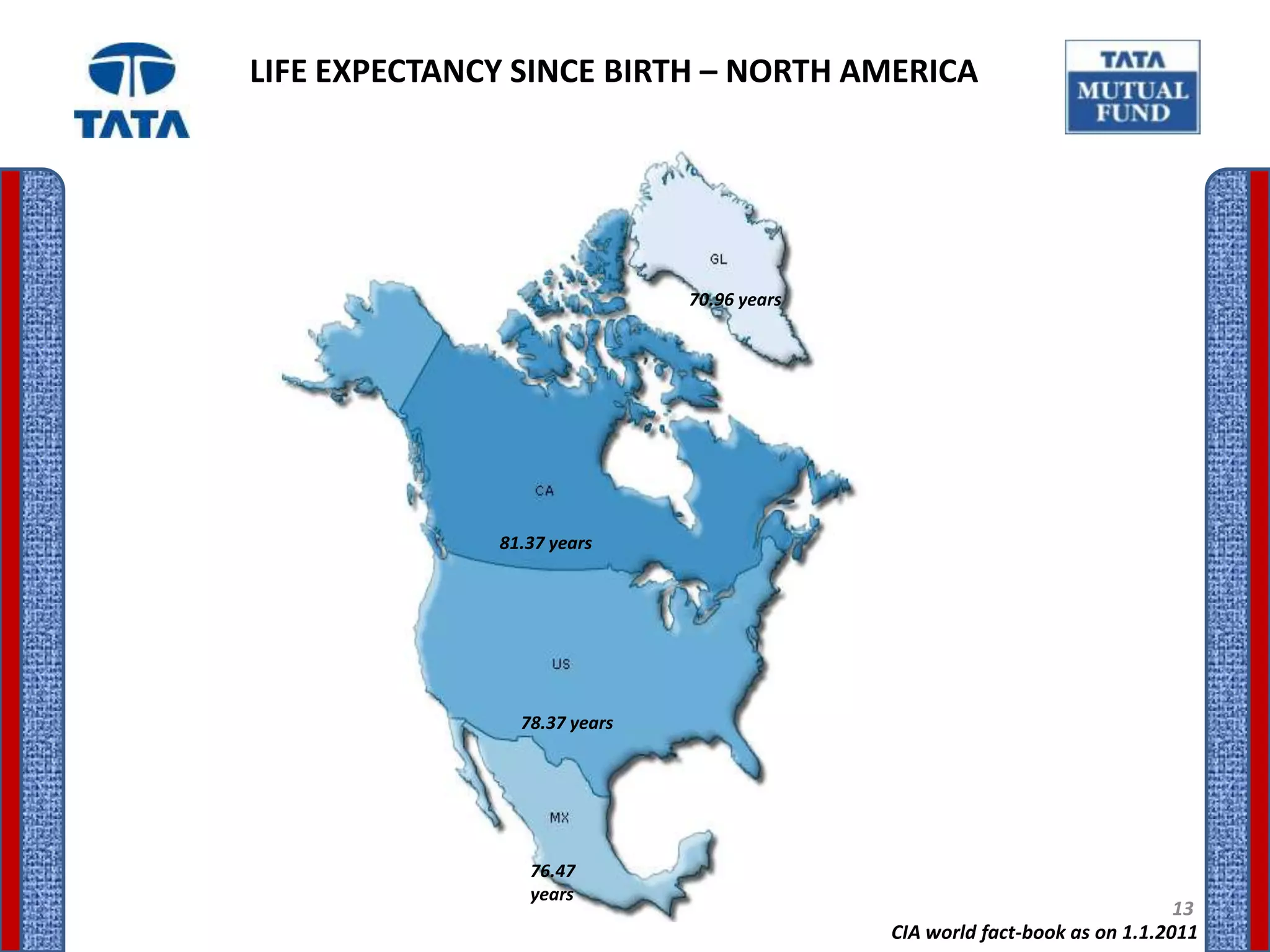

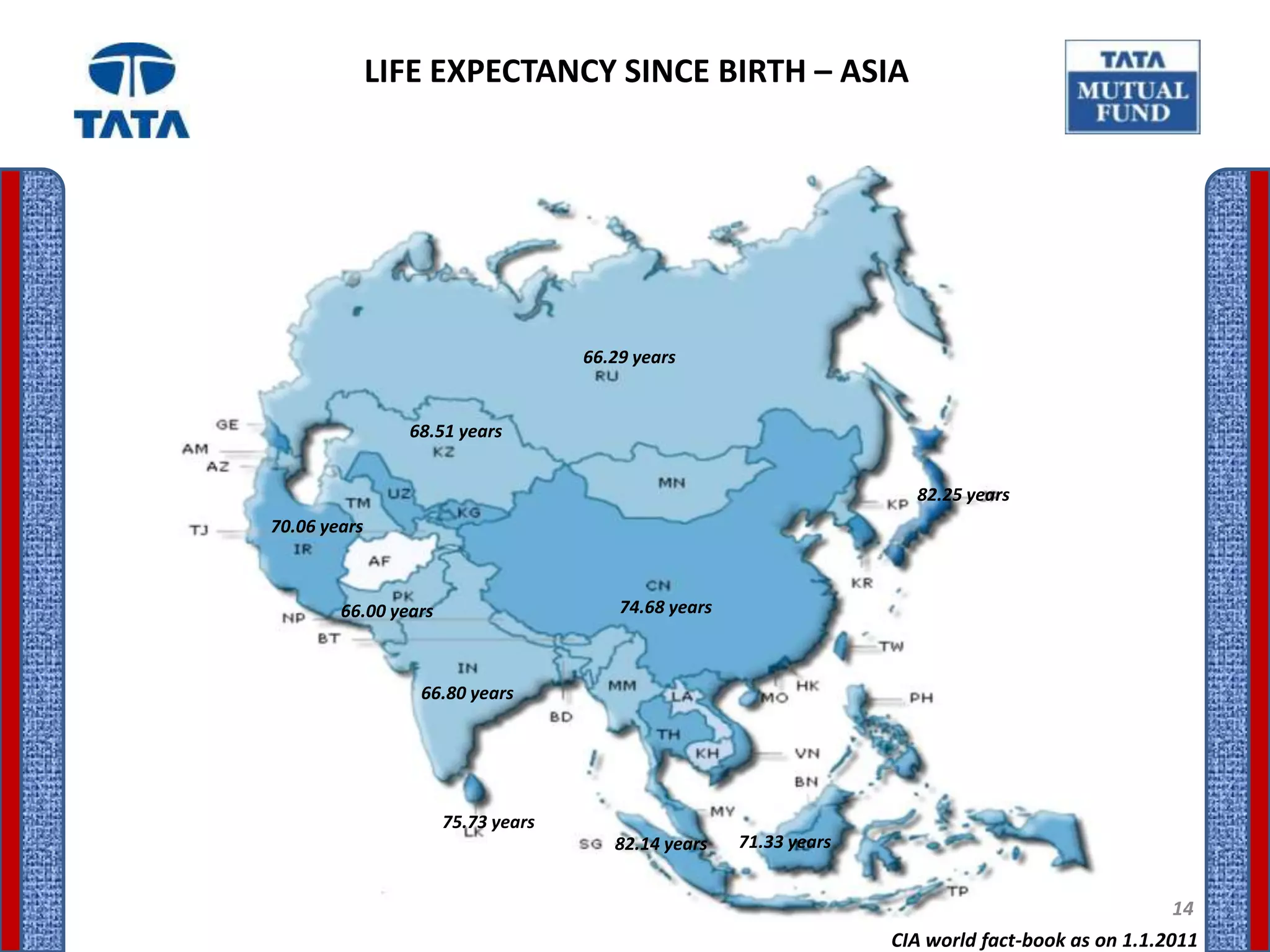

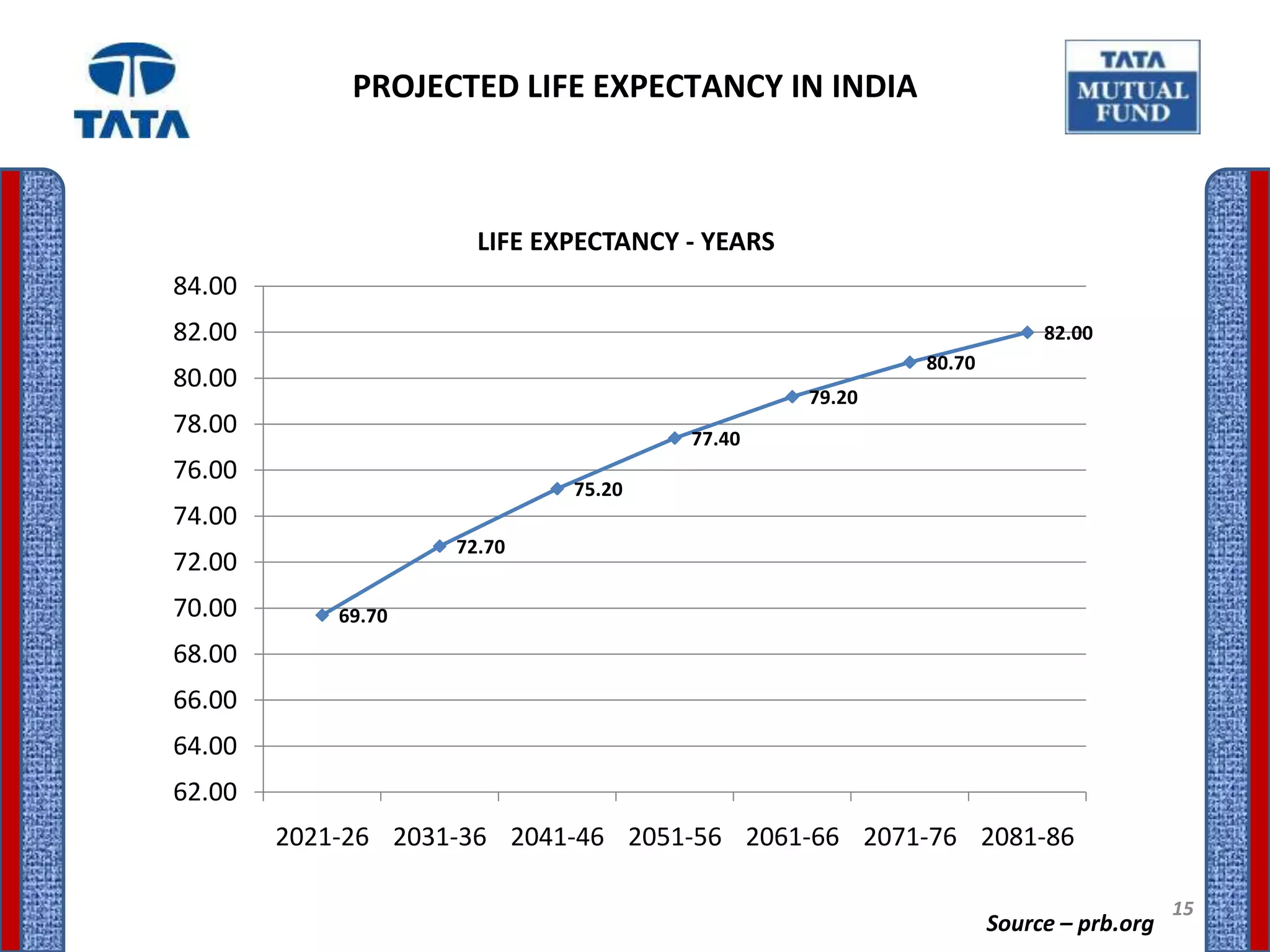

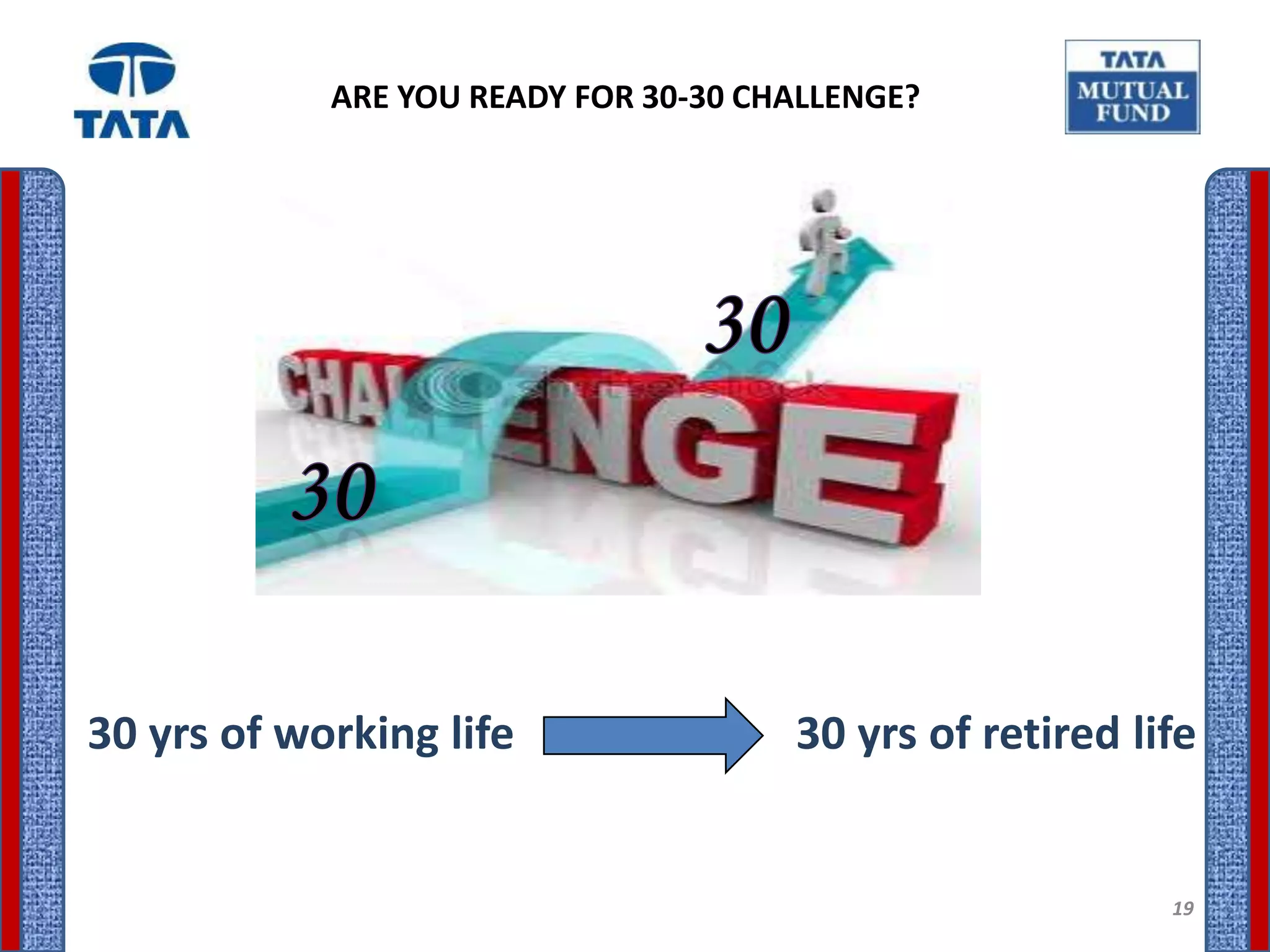

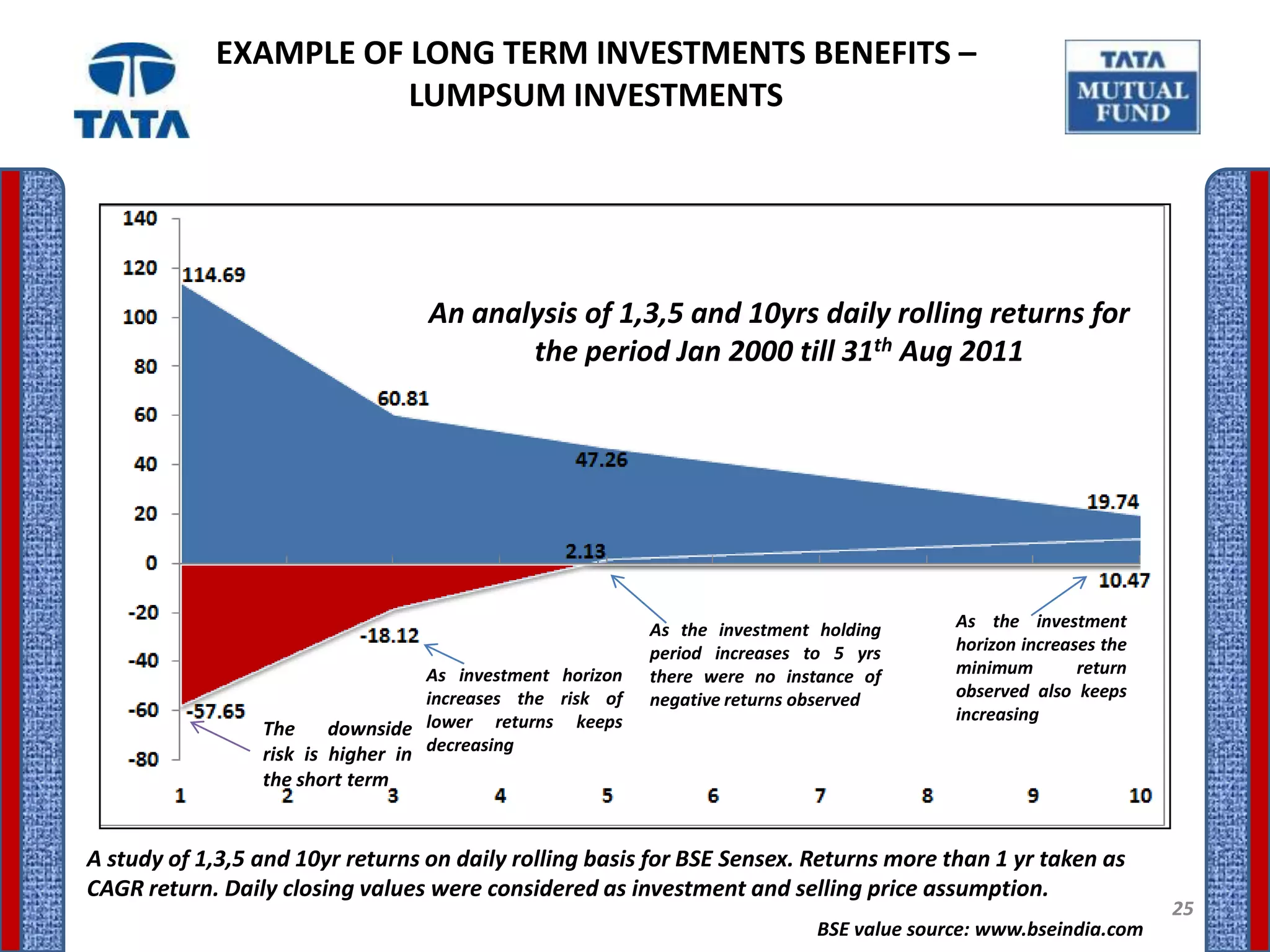

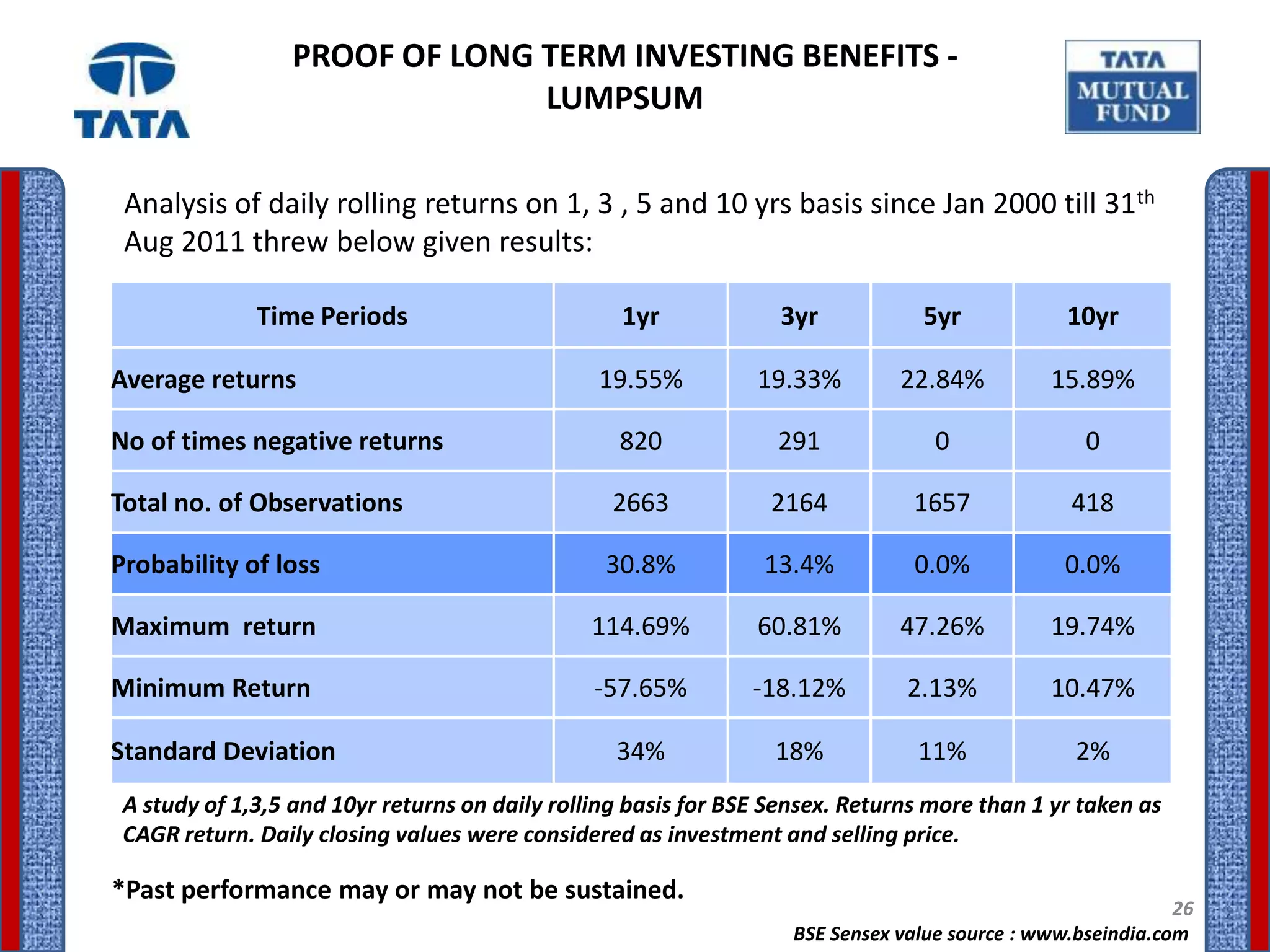

The document compares retirement in the 1980s versus retirement in the 2010s. It notes that in the 1980s, retirees experienced higher interest rates on bank deposits, more joint families for support, and lower aspirations post-retirement. However, by the 2010s, interest rates are market-linked and volatile, nuclear families are more common, and retirees want to maintain their pre-retirement standard of living. The document emphasizes that retirement planning is now a necessity due to factors like inflation, increased healthcare costs, and rising life expectancies. It provides statistics showing increasing healthcare and living costs over time if no retirement planning is done.