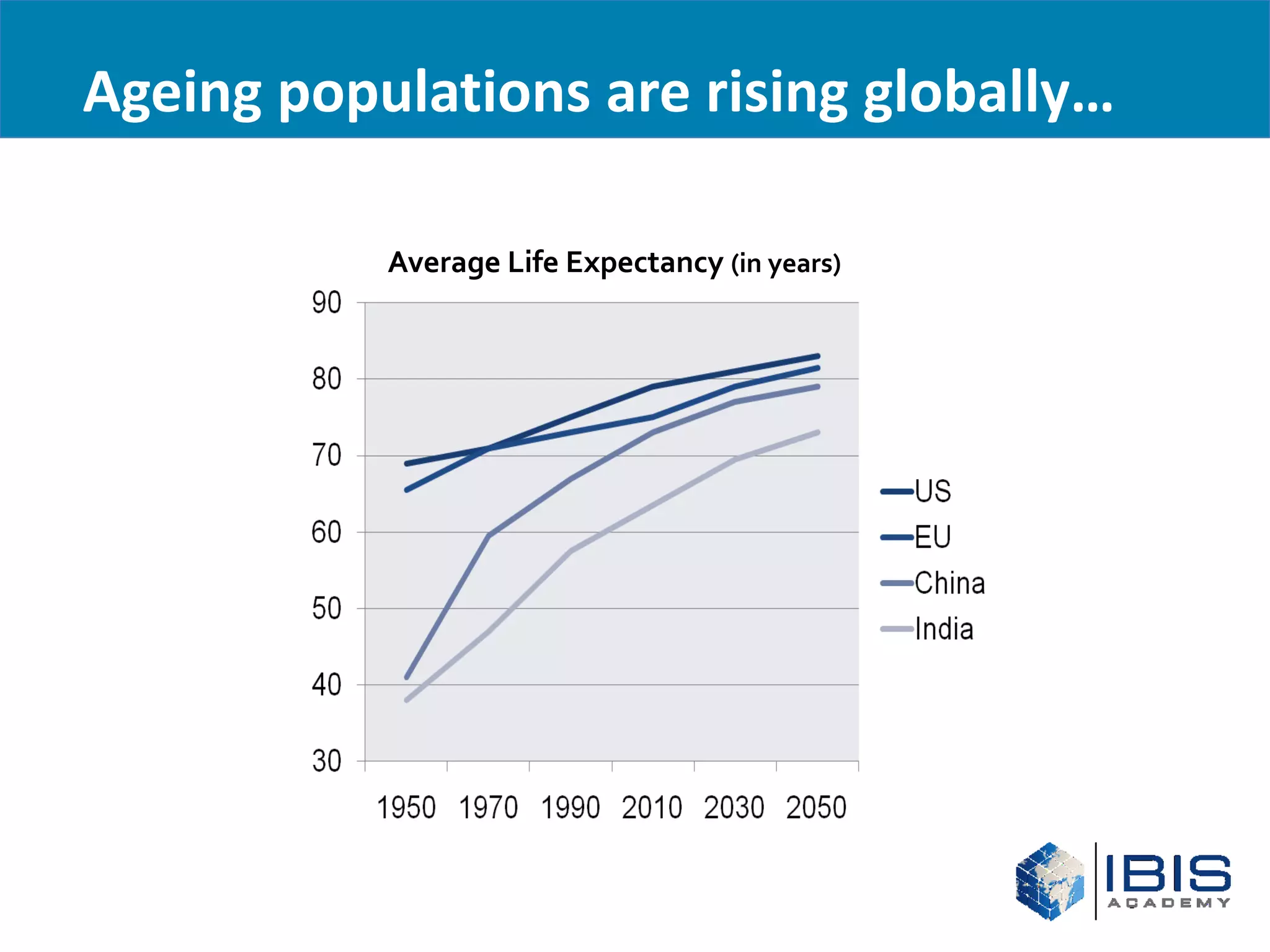

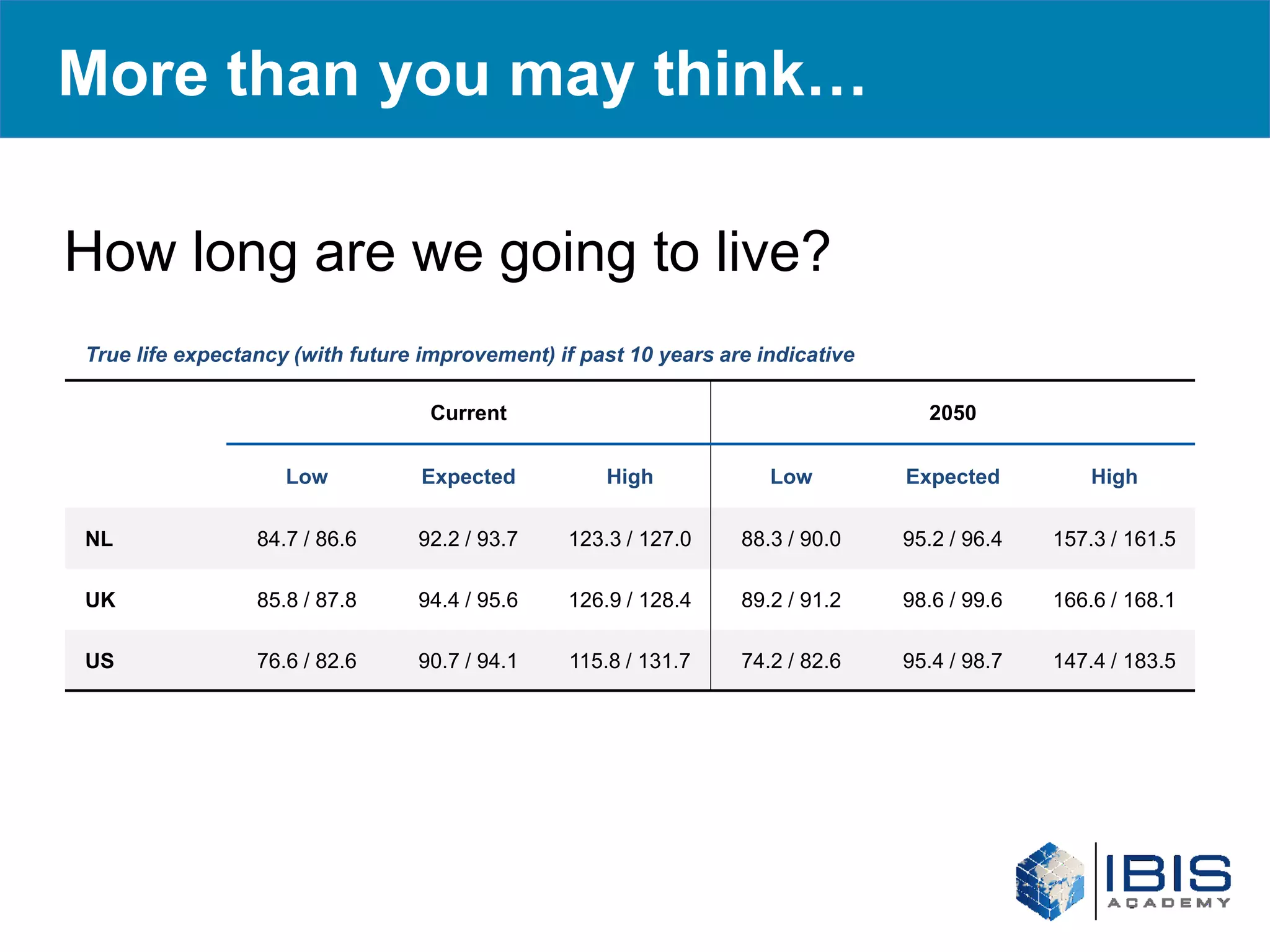

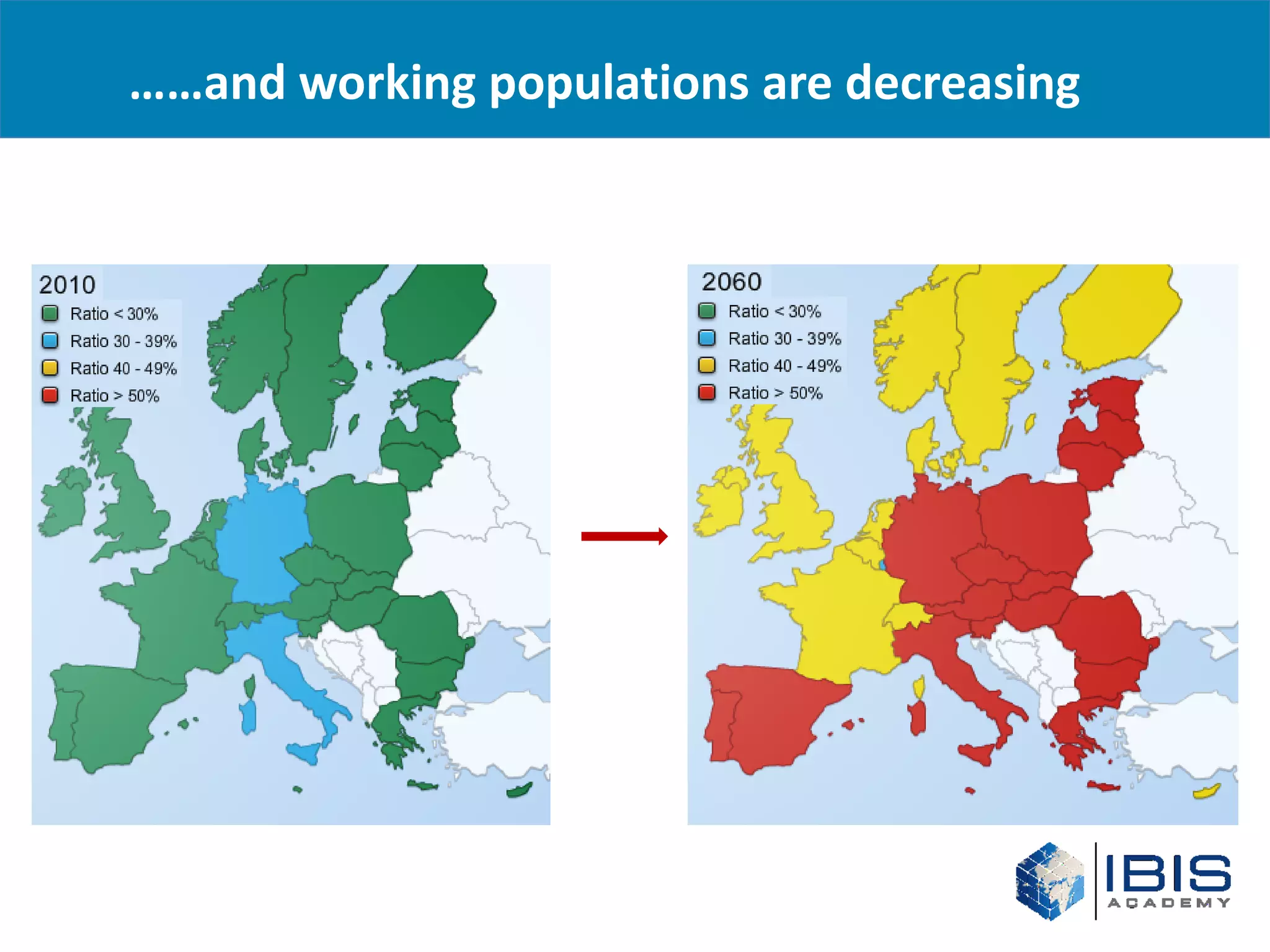

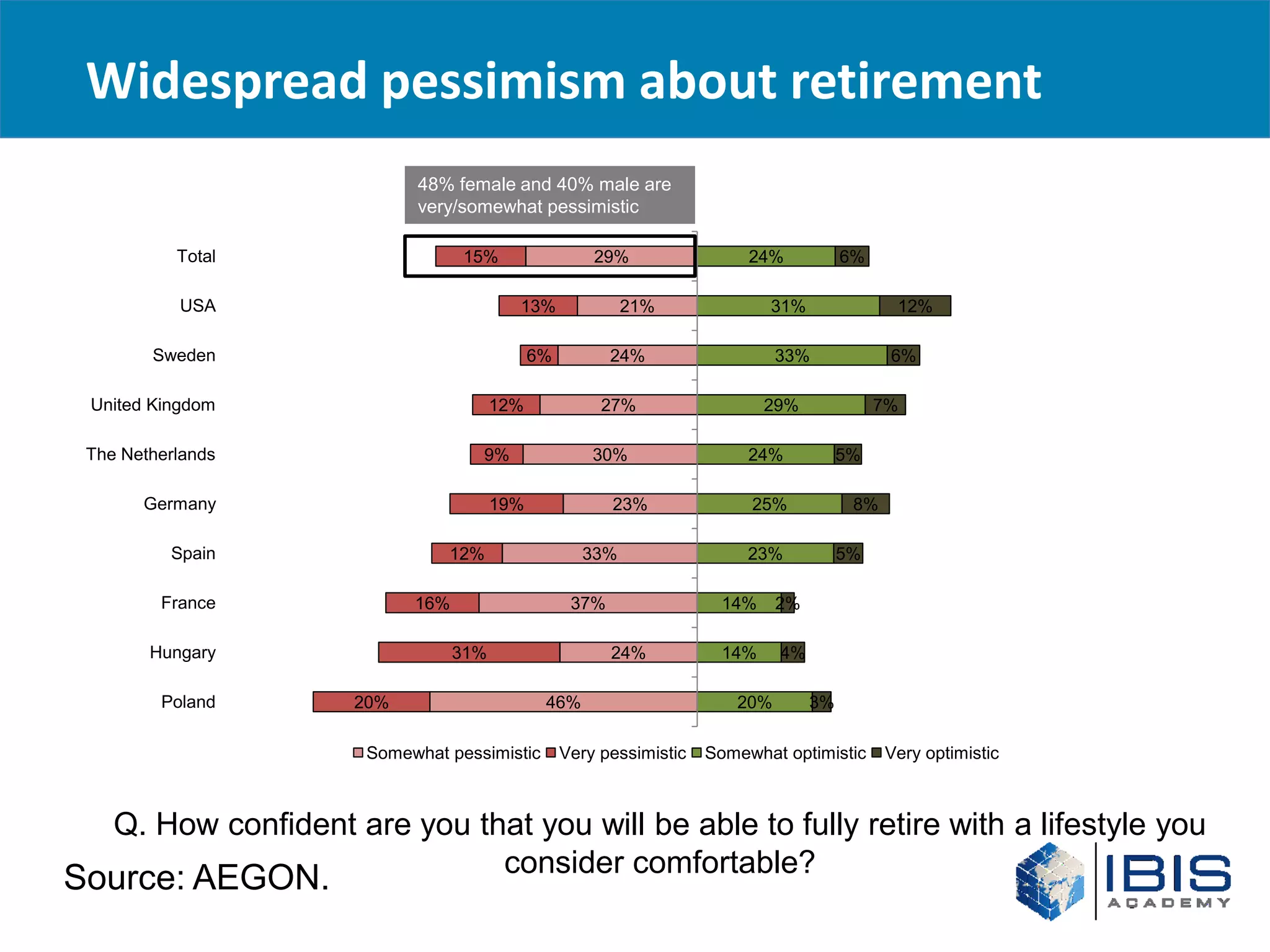

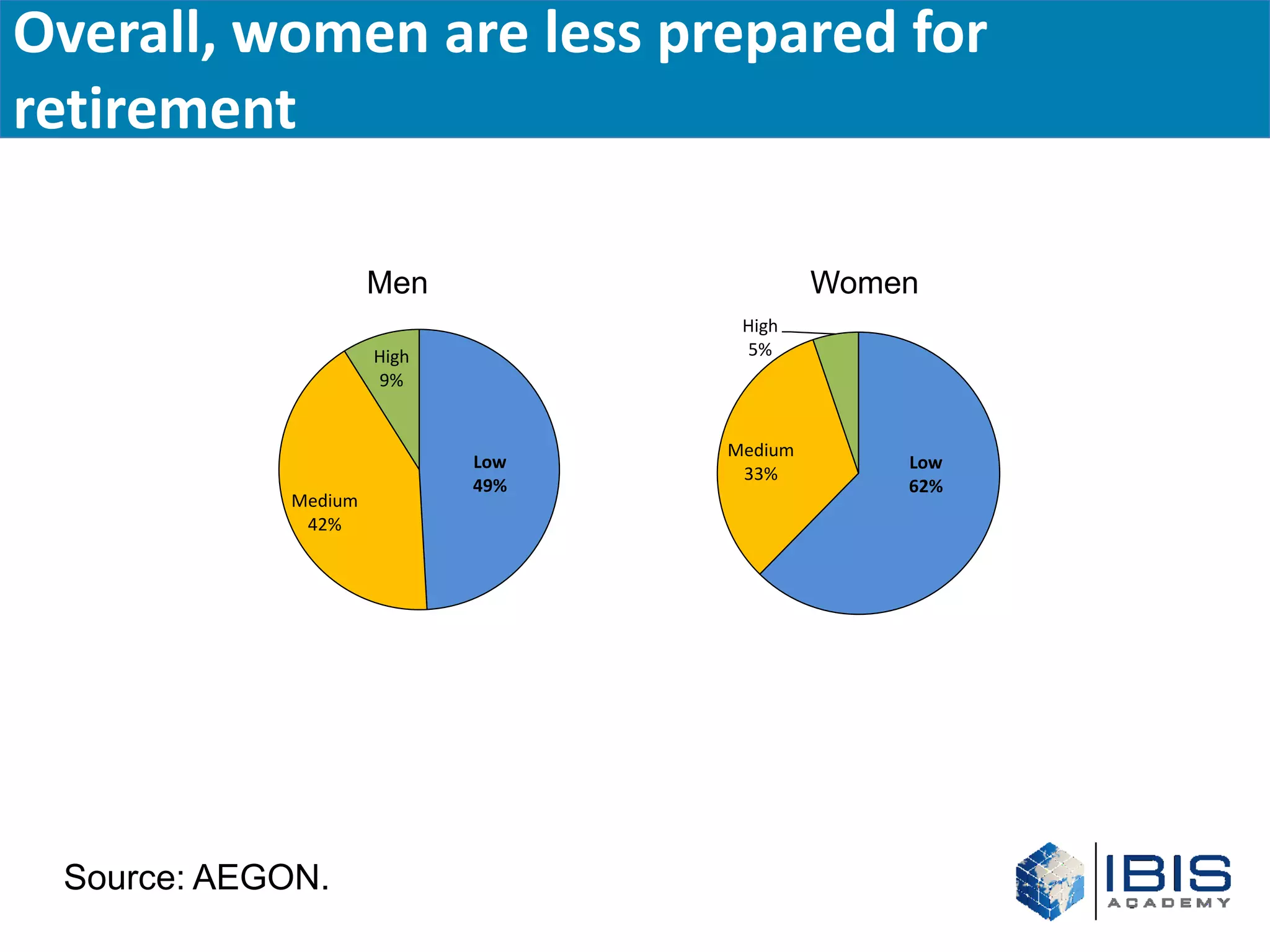

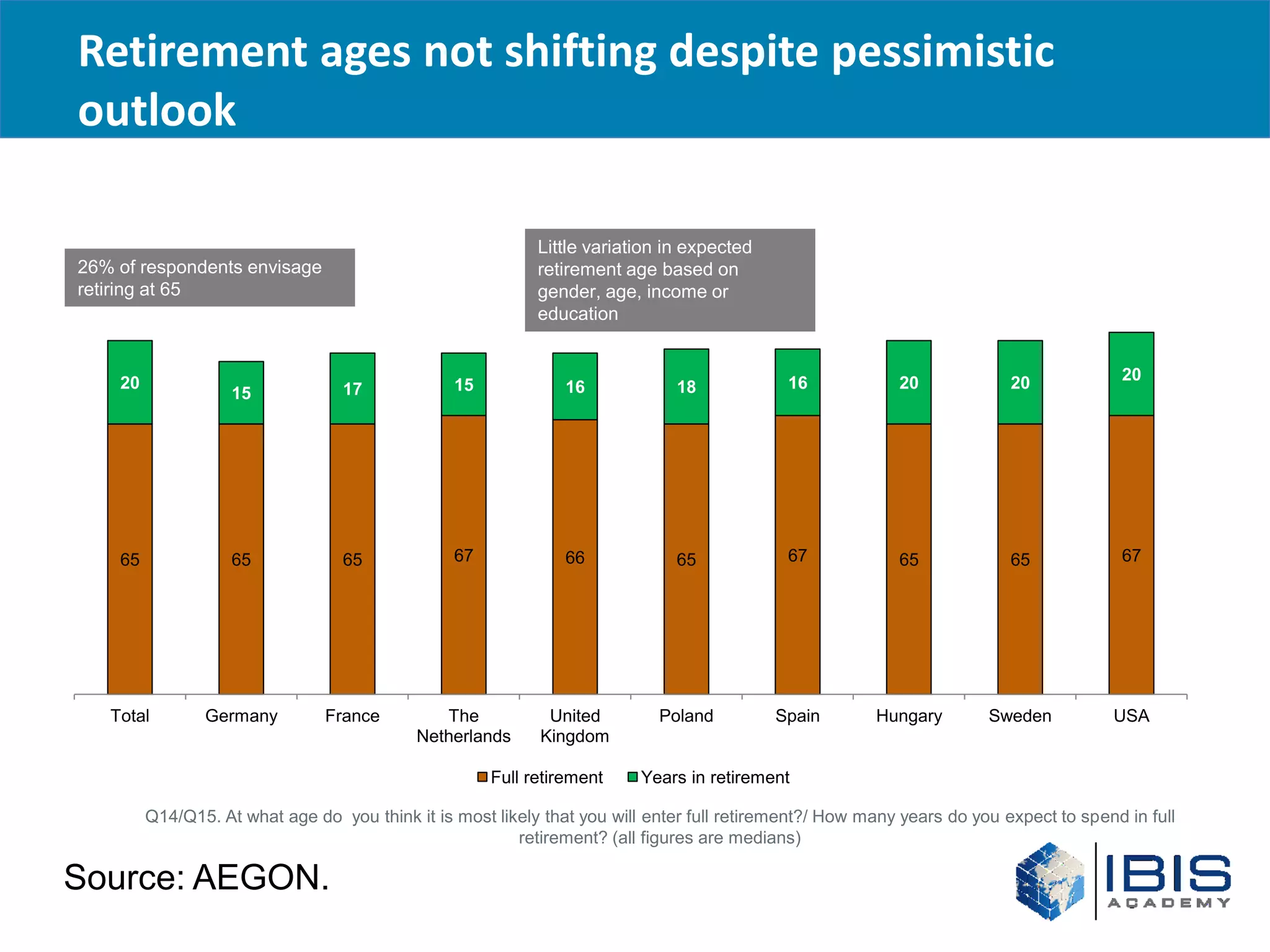

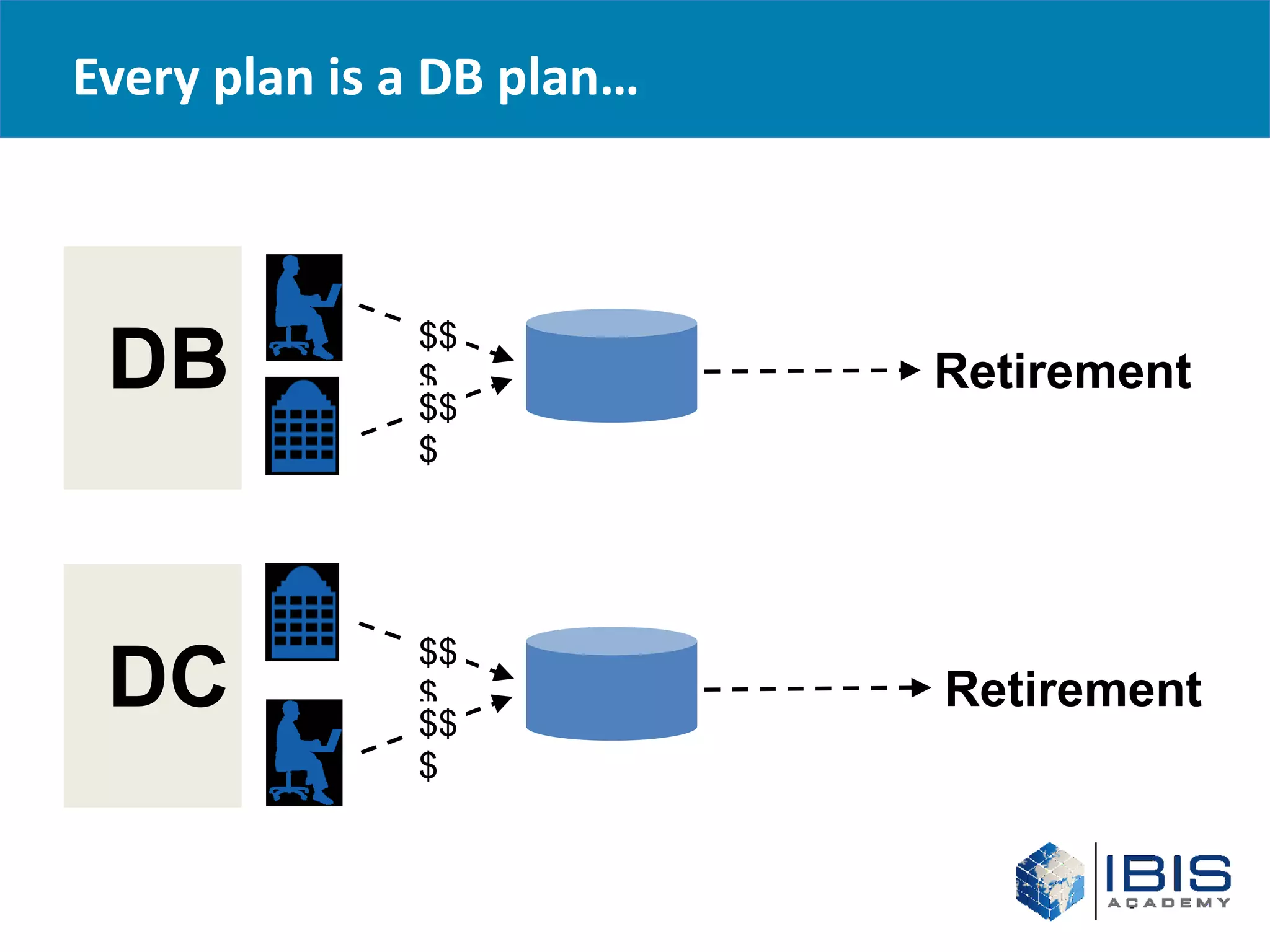

The document discusses retirement readiness and pensions. It notes that (1) life expectancies are rising globally and working populations are decreasing, (2) many people are pessimistic about having enough savings for a comfortable retirement, but (3) expected retirement ages have not shifted much despite these concerns. It suggests that (3) companies can help improve retirement readiness by providing better pension plans, education, and investment options to support employees.