IISWBM is a premier management institute in eastern India that has introduced a unique PG Diploma program in Telecom Management in collaboration with BSNL. Tata Teleservices Limited (TTSL) is part of the Tata Group and is a major telecom company in India that offers services like telephony, media, data and infrastructure. TTSL has faced financial difficulties in recent years with losses widening from Rs. 13 billion in 2010 to Rs. 42 billion in 2011-12 due to intense competition and high debt. While its data business and focus on the SME segment have grown, retaining customers and profitability in the voice segment remain a challenge.

![IISWBM, Internship Project 2013-14

2

About TATA TELESERVICES LIMITED

TataGroupin CommunicationIndustry

Communication is among the Tata Group's larger investments, with over $7.5 billion already

committed. The Group'sobjective istoprovide end-to-endtelecommunications solutions for business

and residential customersacrossthe nationandinternationally. The Group's communications activities

are currently spread primarily over four companies:

Tata Teleservices Limited

Tata Teleservices (Maharashtra) Limited

Tata Communications (erstwhile VSNL)

Tata Sky

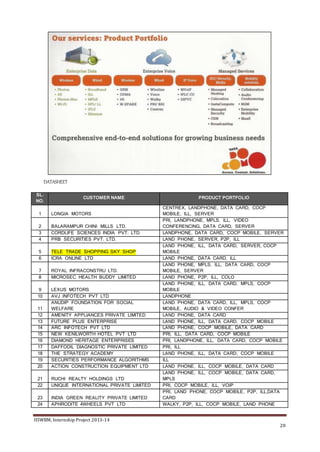

Together, these companies cover the full range of communication services, including:

Telephony Services: Fixed and Mobile

Media & Entertainment Services: Satellite TV

Data Services:LeasedLines,ManagedData Networks,IP/MPLSVPN,Dial-upInternet, Wi-Fi and

Broadband

Value-added Services: Mobile and Broadband Content/Applications, Calling Cards, Net

Telephony and Managed Services

Infrastructure Services: Submarine Cable Bandwidth, Terrestrial Fiber Network and Satellite

Earth Stations and VSAT Connectivity

TataCommunications

Among these four companies, Tata Communications is the oldest one connecting 99.75% of the

world’sGDP.Tata CommunicationsisaUSD $3.2 billion(FY'13) global communicationsandenterprise IT

service provider that owns and operates the world’s most advanced subsea optic fibre cable network,

delivering first-class infrastructure, enterprise solutions and partnerships to carriers and businesses

worldwide.Itsnetworkistrulyglobal,extendingfromdevelopedmarketstothe world’sfastest growing

emerging economies.

TataTeleservicesLimited

Tata Teleservices Limited (TTSL) spearheads the Tata Group’s presence in the telecom sector.

Incorporatedin1996, Tata TeleservicesLimitedwasthe pioneerof the CDMA 1x technology platform in

India, embarking on a growth path after the acquisition of Hughes Tele.com (India) Ltd [renamed Tata

Teleservices (Maharashtra) Limited] by the Tata Group in 2002. In 2005, TTSL launched CDMA wireless

services under the brand, Indicom.

TTSL also has a significant presence in the 2G GSM space, through its joint venture with NTT

DOCOMO of Japan, andoffers differentiated products and services. Tata DOCOMO was born after Tata

Group’s strategic alliance with Japanese telecom major NTT DOCOMO in November 2008 when the

lattergot 26 percent stake of TTSL. It wasalsothe firstprivate operatortolaunch3G servicesinIndia. It

receivedapan-Indialicense to operate GSMtelecom services and rolled out GSMservices in all the 18](https://image.slidesharecdn.com/b474b1dc-ce66-4031-9eab-e110f6e621ee-160330095543/85/TATA-INTERNSHIP-PROJECT-2-320.jpg)