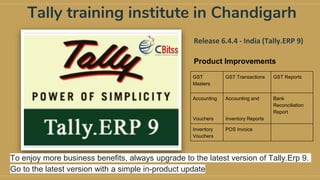

Tally training institute in Chandigarh

- 1. Tally training institute in Chandigarh Release 6.4.4 - India (Tally.ERP 9) Product Improvements GST Masters GST Transactions GST Reports Accounting Vouchers Accounting and Inventory Reports Bank Reconciliation Report Inventory Vouchers POS Invoice To enjoy more business benefits, always upgrade to the latest version of Tally.Erp 9. Go to the latest version with a simple in-product update

- 2. Highlights ●According to the latest change file GSTR-3B: Tally.ERP 9 version 6.4.4 GSTR-3B supports the latest changes in offline tool version 4.0 according to the changes created by GSTN. ●According to the latest change fixed asset purchases in account invoice mode: For your convenience, you will be able to record fixed asset purchases together in account invoicing mode. It can be obtained in the first credential mode. GST Masters ● VAT Registration Details Appeared in an account bundled under Fixed Assets. This issue has been solved. ● The Type of Ledger Twice given to create a purchase account. It was only in the GSTI structure company which was configured to keep only the idea. This issue has been solved. ● In a competent company for GST structure, GSTIN / UIN area bank accounts, bank OD A / C, or bank OCC A / C did not appear in the laser grouped under. This issue has been solved.

- 3. GST Transactions ● The sales invoice voucher printed screen e-they appeared before the bill details of the bill screen. This happened when the voucher was saved to save the voucher type after it was configured to print the voucher. This issue has been solved. ● Even after e-bill is enabled, you can save the party details quickly in the delivery note. ● The company's primary mailing details appeared in printed invoices and reports, even if it was removed from company mailing details. This issue has been solved. ●The primary address laser voucher appeared in the columnar report, even if the secondary address is selected in the party details screen of a receipt or payment voucher. This issue has been solved. ●When the sales transaction was printed or exported in MS Excel format, the cess amount had doubled. This happened when the stock item was configured with account allocation for GST and Cess. This issue has been solved. ● In the delivery note, when the secondary address was selected in the party details, the location of the supply was not correctly revealed. This issue has been solved. ● Now you can quickly save the voucher in a company where the e-bill is enabled.

- 4. ● In case the preview was disabled, invoices were not printed and print option item-wise GST details? This issue was resolved. ● An error occurred when a GST invoice was printed in dot matrix or quick / draft mode. This happened when more than 15 items were included in the invoice. This issue has been solved. ●In the credit note tracked against the sales invoice, the option provides GST details? did not appear. This happened when negative value was entered for additional account holders grouped under the sales accounts. This issue has been solved. ●In the debit or credit note, do alternatives provide GST details? did not appear. This happened when the GST statement was not defined in the laser, or the nature of the invoice and tax details were overridden in the invoice. This issue has been solved. ●Party's Pincode Invoice did not appear in the e-bill details screen, if the party's account name and mailing name were different. This issue has been solved. ●In the GST structure company, you can now enter the motor vehicle number and shipment / LR-RR number with date in the party details screen of an invoice. ●In the transaction recorded in the voucher mode, there was an error in the calculator panel when stock items attracting slab rates were selected. This issue has been solved

- 5. When emailing the e-bill to the JSON file with the sales invoice, the format was reset to XML (data interchange). This issue has been solved. ● Cess amount in the challan recorded with foreign currency appeared wrongly. This occurred when the stock item was set to have a valuable type of ces on the basis of quantity. This issue has been solved. ● If the party account name and mailing name were different, then in the Party Details screen in the voucher mode: o The State did not appear for purchases. o The State and Place of supply did not appear for sales. o When these details were revised while recording the transaction, the name of the company's name appeared as a supply and supply place in the change mode of sale. These issues have been resolved.

- 6. ● The tax analysis section did not appear in the printout of a payment voucher recorded for taxable sales. This issue is resolved. ● In a printed GST advance receipt, the party's primary address appeared even when the secondary address was selected in the transaction. This issue is resolved. ●In printed invoices, tax rebates appeared for both discounts and taxable stock items. This happened when the invoice was first filed by selecting discount rebate item, from which date the exemption was applicable. This issue has been solved. ●When a party was selected in the update screen of a cash purchase invoice, the registration type and GSTIN / UIN did not change accordingly. This issue is resolved. ● The printed GST invoice from the Multi Voucher Printing menu showed the default print head instead of the user- defined title. This issue has been solved. ● Depending on the type of supply, the column title of the printed invoice will now show details of the goods, description of the service, or details of goods and services. ● The e-bill was not visible in the printed invoice of sales recorded in voucher mode, even if the option print e-way bill number? Print was enabled in the configuration. This issue has been solved.

- 7. ● Now that you have a high number of stock items, you can enter the amount and rate for each stock item, and you can save the invoice immediately, even if the e-bill is enabled. ● You can now enter the vehicle number of more than 10 characters for the e-bill in the legal details screen of an invoice. In the e-way bill report, vehicle number will be caught according to the format prescribed by the department. ● When the e-bill was enabled, did it take enough time for the GST to record the transaction in the invoiced configured to allow tax modification? . When selecting sales delays, it is delayed when entering GST details and selecting each stock item. This issue has been solved. ●For cash sale invoices, the party name entered in the party details did not appear in the drill-down report of GSTR-1 and GSTR-3B. This issue has been solved.

- 8. GST Reports ● Zero-valued transactions have now been captured in GSTR-1 , GSTR-3B ,and GST-4 returns. ● In GST-3B, the value of 3 (1) (d) did not match its drill-down report, when there were two journal vouchers, one for purchase of capital goods and another capable of reverse charging in vouchers Was able to purchase. This issue has been solved ● In the GST-1 and GST-3B report, the sale of the current month was not visible in the drill-down report of sales against the previous period. This happened when the sales voucher was adjusted against advance receipts filed two or two months prior to the date of sale. This issue has been solved. ● URD - Details were not correctly aligned in the stock item view of purchase from reverse charge obligation. This issue has been solved. ● The tax value changed in the HSN / SAC summary when the voucher was grouped by the HSN details and HSN / SAC, and did not match the tax values of the GST-1 report. This issue has been solved.

- 9. ●Payments made against purchases under reverse charge will now appear in GST-1 document summary. ● Debit notes and credit notes will now appear in the GSTR-1 document summary, and you can export them in MS Excel format. ● A memory access violation error was shown when the e-way bill details were exported in the JSON format from the Invoice Export screen. This issue has been solved. ● In the drill-down report of GST-1 and GST-3B, the bank account holder appeared in the multi-payment mode instead of the name of the party in the POS invoice recorded with the bank details. This happened when the name of the consumer was manually entered in the party details, and the bank account holder was selected as one of the methods of payment. This issue has been solved. ●In the GST-4 report, the cash was shown under both the sales returns and is not relevant for the returns. This issue has been solved. ●In GSTR-1, GST-2, and GSTR-3B reports, you can now open list and accounting reports using F9 and F10 respectively. ● In the incoming supply from the ISD report of GST-3B, the name of the party chosen in the magazine vouchers and GSTIN / UIN did not appear. This issue has been solved.

- 10. ●In the GST-1 report, the export notes of the credit were shown under the incomplete / non-matching (to resolve) information. This happened when credit notes were filed by selecting the original sales invoice reference. This issue has been solved. ● In the GST-1 document summary, the number of canceled vouchers did not appear in the number of vouchers column canceled. This issue has been solved. ● For transactions registered with the bank's leaders, the bank's GSTIN / UIN GST-2B2B invoice did not appear in the drill-down report. This issue has been solved. ●In the purchase voucher register of GSTR-3B, the Grand Total displayed negative values when debit notes were filed before the purchases for the return period. This issue has been solved. ●When a sale or purchase register was exported as a pivot table, show the option GST details? The export report did not appear in the screen. This issue has been solved. ● Now you can open GST-3B by exporting GST portal, e-way bills, and e-way bill report by pressing Ctrl + O. ● Appeared in incorrect sections in GST-3B by attracting inappropriate purchases or reverse charge for input tax credit. This happened when the option allows modification of tax details for GST? The voucher was able to. This issue has been solved. ● In the Summary view of GST-1 report, the taxable value of at least advance tax: The previous period advance tax payment did not match the total taxable value in the drill-down report. This issue has been solved.

- 11. ● P : Print On the use of the print, the company was not showing in the printout of GSTIN / UIN GST-1 and GST-3B. This issue has been solved. ● In the summary view of GST-3B, non-GST was not a match for consolidated and detailed amount of local purchase. This issue has been solved. ● Invoice amount column is now generated in the GSTR-1 voucher register based on the supplied space. ●If a dot (.) Was entered in the HSN description of the stock item, then it will now be captured in the JSON and MS Excel file for the e-bill. ●The purchase of unregistered dealers under reverse charge did not appear in the GST-1 document summary. This issue has been solved.

- 12. Accounting Masters ● There was an error in laser alteration when a company's laser masters were copied using F3: Company. This occurred when the data was migrated from the previous release to the current release. This issue has been solved. ● When the data of many people was synchronized, the other was made as new hands. This issue has been solved.

- 13. Accounting Vouchers ●When a sales invoice was duplicated and a receipt was converted into a voucher, the debit and credit amount was not visible. This happened when the sale invoice was entered in voucher mode. This issue has been solved. ●An inconsistency in invoice quantity occurred when many stock items were selected with optional entity. This issue has been solved. ●When exchange rates and batch details were selected, the old exchange rate appeared in the sales transaction. This issue has been solved. ●In the printed purchase invoice, the name of the party appeared instead of the company name. This happened when the purchase account was entered in invoicing mode and then changed into voucher mode. This issue has been solved. ● When the stock item was changed from the invoice, the cost center allocated to the laser was reset to the previously selected cost center. This issue has been solved. ● During the invoice change, the amount in stock item allocation was automatically changed. This happened when the option allows tax inclusive of taxes for stock items? Was enabled with batches and warehouses. This issue has been solved.

- 14. Accounting and Inventory Reports ● The closing price was calculated incorrectly when the stock journal was recorded in negative quantity and the method of stock verification was FIFO. This issue has been solved. ● The Job Work Analysis report displays the date of post-date transactions rather than the date of the last regular voucher. This issue has been solved. ● When a voucher was opened from the De Book, the De Book did not have a matching between the value of the laser value and the drill down voucher laser. This happened when the transaction was registered using TDS, VAT and service tax. This issue has been solved. ● The outstanding outstanding amount in the outstanding laser printed as a reminder letter, including post outstanding transactions, was shown incorrectly. This issue has been solved.

- 15. Bank Reconciliation Report ●Optional payroll vouchers appear in bank statement This issue has been solved. ●When the bank transaction was exported and then imported into the same company, then the imported transaction did not appear in the bank reconciliation statement. This issue has been solved. Inventory Vouchers ● Other reference fields did not appear in the party details in a physical out voucher when the job operation process was enabled. This issue has been solved.

- 16. POS Invoice ●In a POS invoice, if a transaction is recorded using a warehouse, the rate (tax included) field does not capture the MRP settings for the inventory item. This issue has been resolved. ● In a printed POS invoice, option has not occurred when option enables supplemental details? This issue was resolved, this issue has been resolved. ● In POS transactions with zero value, rate and amount was pre-filled. This issue has been solved.

- 17. Call us @ 9988741983 Website:http://cbitss.net