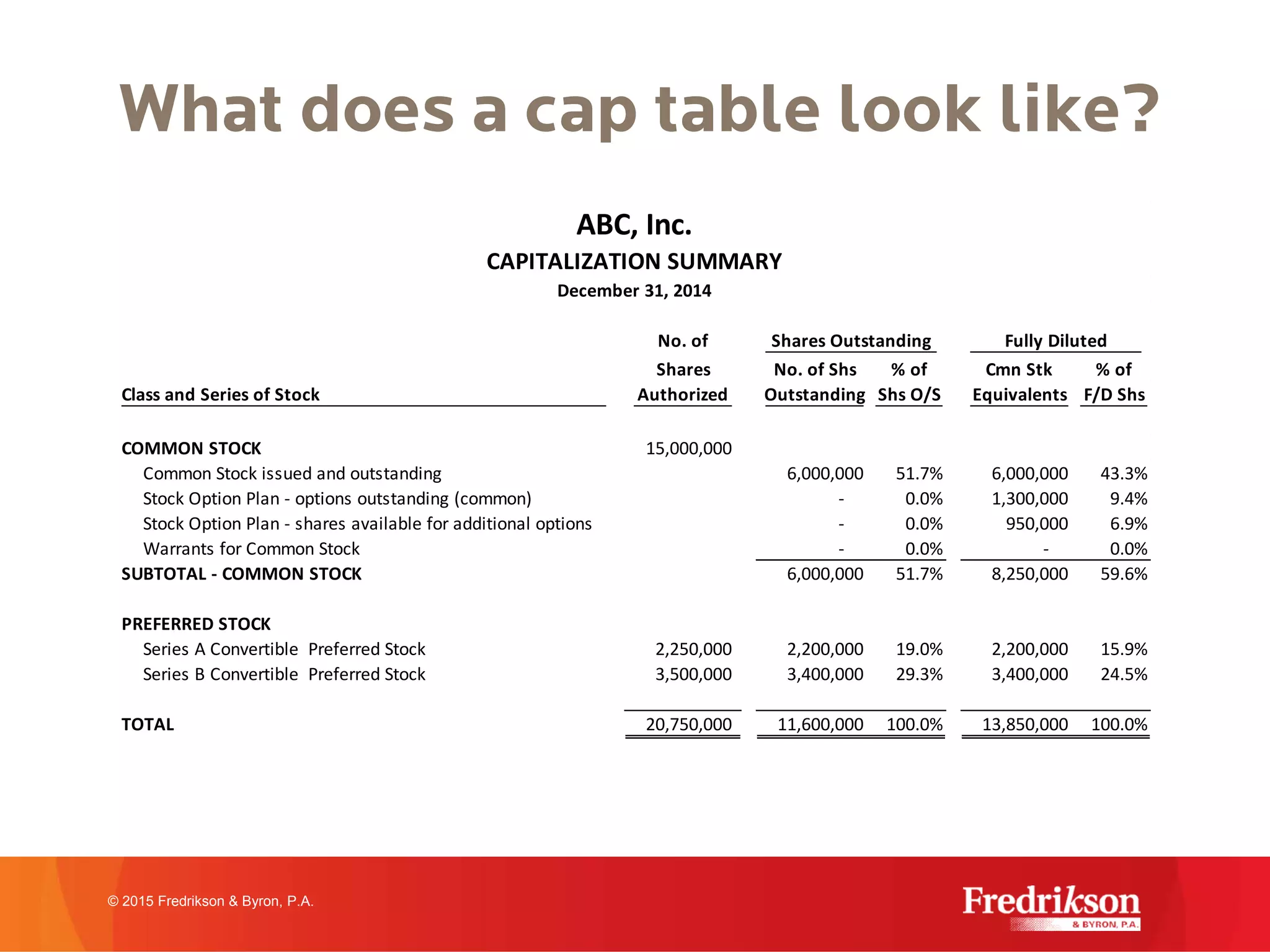

This document provides an overview of capitalization structures for corporations. It discusses common stock and preferred stock, how shares are authorized and created, vesting of founders' shares, option pools, and maintaining accurate stock records like a capitalization table. Maintaining good records of shares authorized, issued, outstanding and stock options is important for transactions and inquiries about ownership. A capitalization table example is provided to illustrate how shares are tracked on a fully diluted basis.