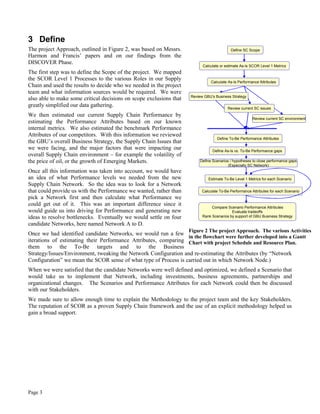

The document summarizes HP's use of the SCOR framework to evaluate potential supply chain network configurations for its Notebook GBU. Key points:

- SCOR provided a standardized way to systematically analyze the supply chain and compare performance attributes of different network options.

- They identified critical processes, metrics, and KPIs to estimate how 4 potential network scenarios would impact goals like costs, reliability, and responsiveness.

- Visual comparisons using spider charts effectively conveyed tradeoffs to stakeholders and stimulated discussions to refine network designs.

- The SCOR analysis supported selecting and transitioning to a new network configuration within months of an opportunity arising.