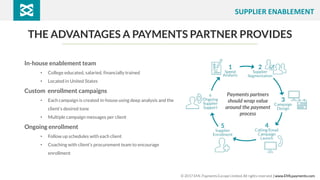

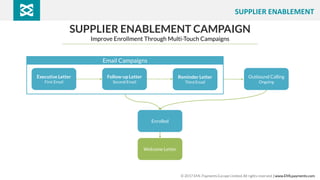

EML offers payment optimization solutions to large corporations, processing billions of dollars in payments annually. Payment optimization involves creating a holistic payment strategy to generate revenue, reduce costs, and improve controls. Key aspects include supplier enablement through customized enrollment campaigns, ongoing support, and reporting to clients on enrollment and payment activity. The presentation encourages attendees to contact EML to discuss how payment optimization could benefit their organization.