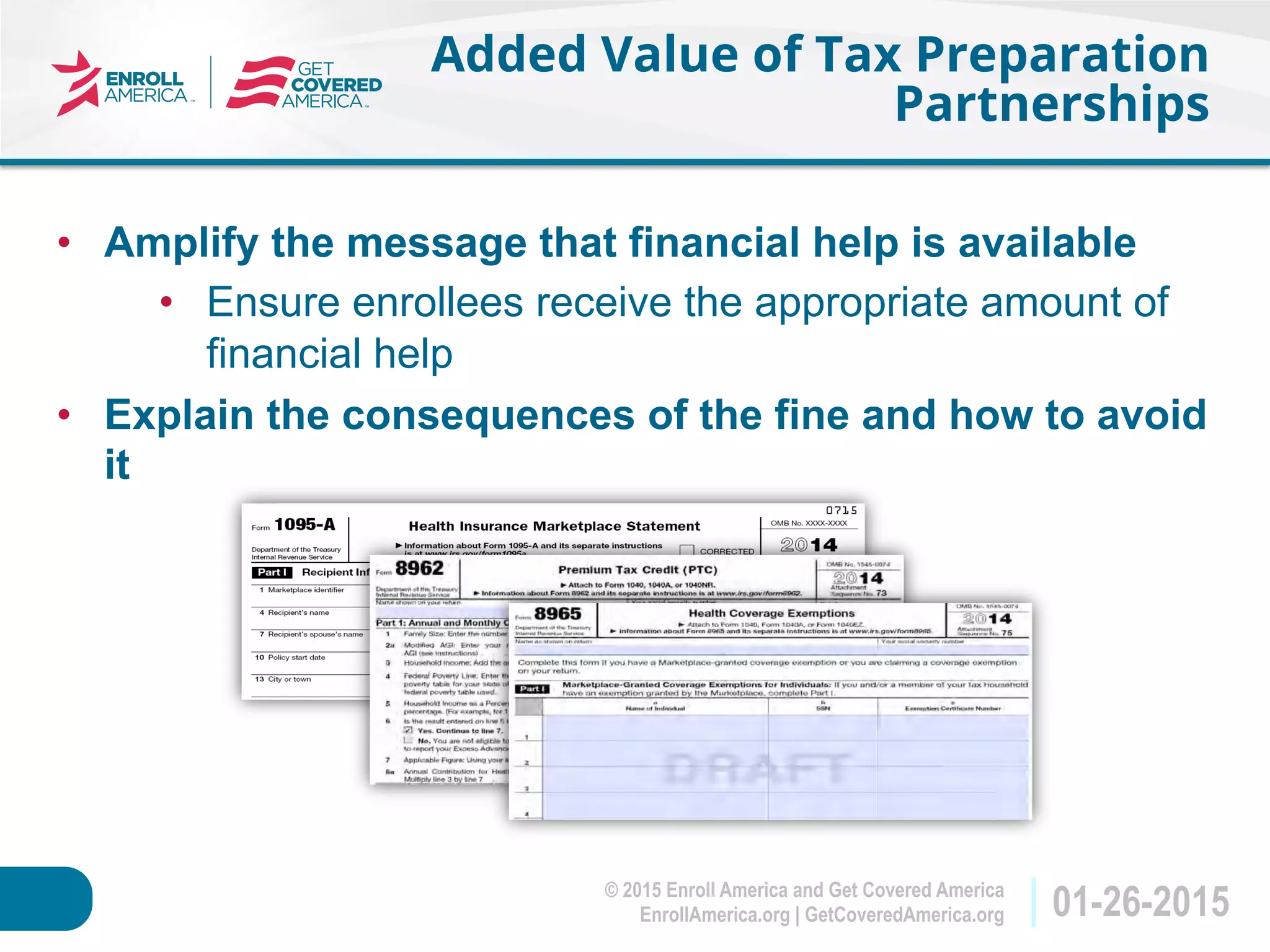

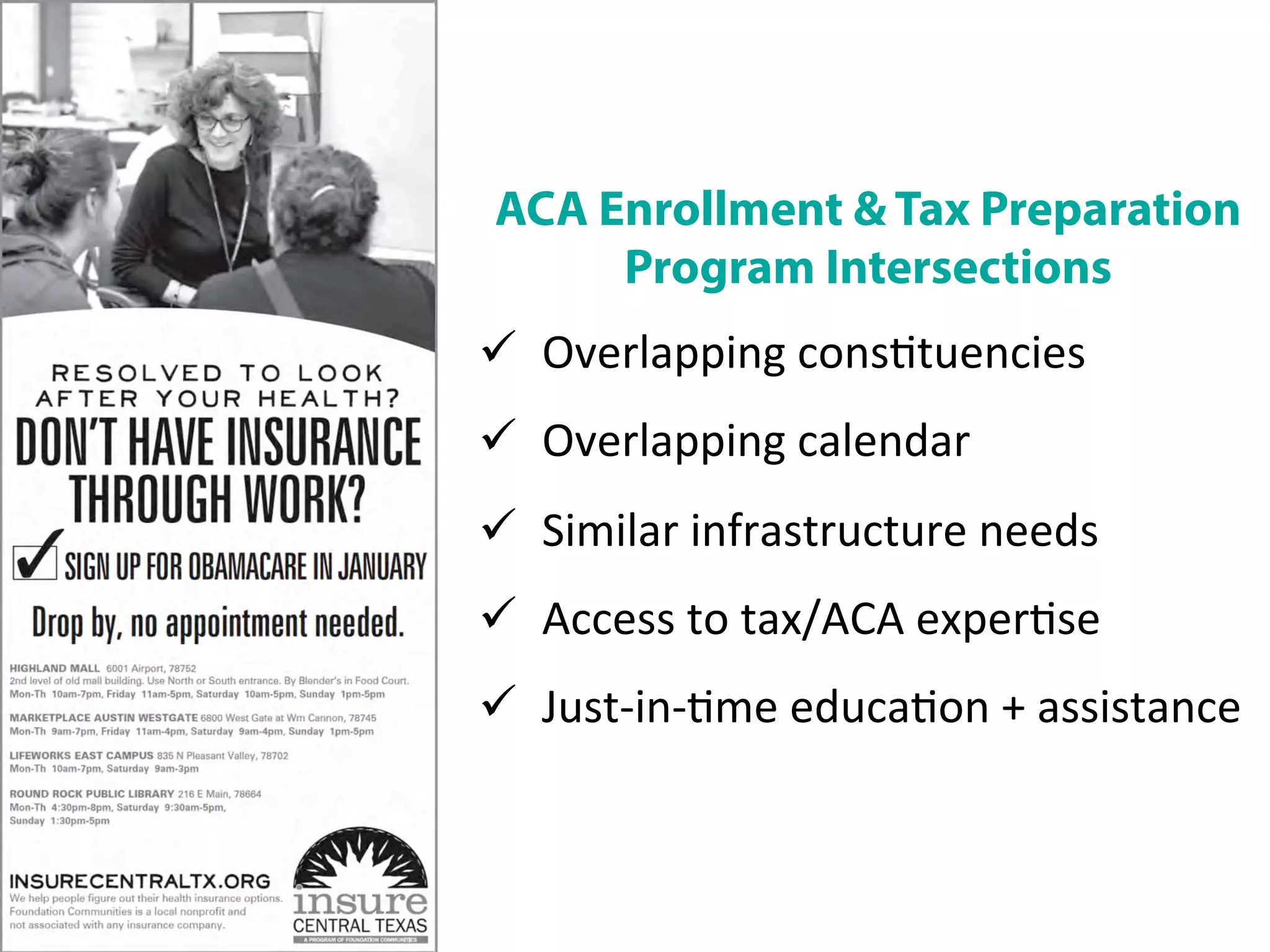

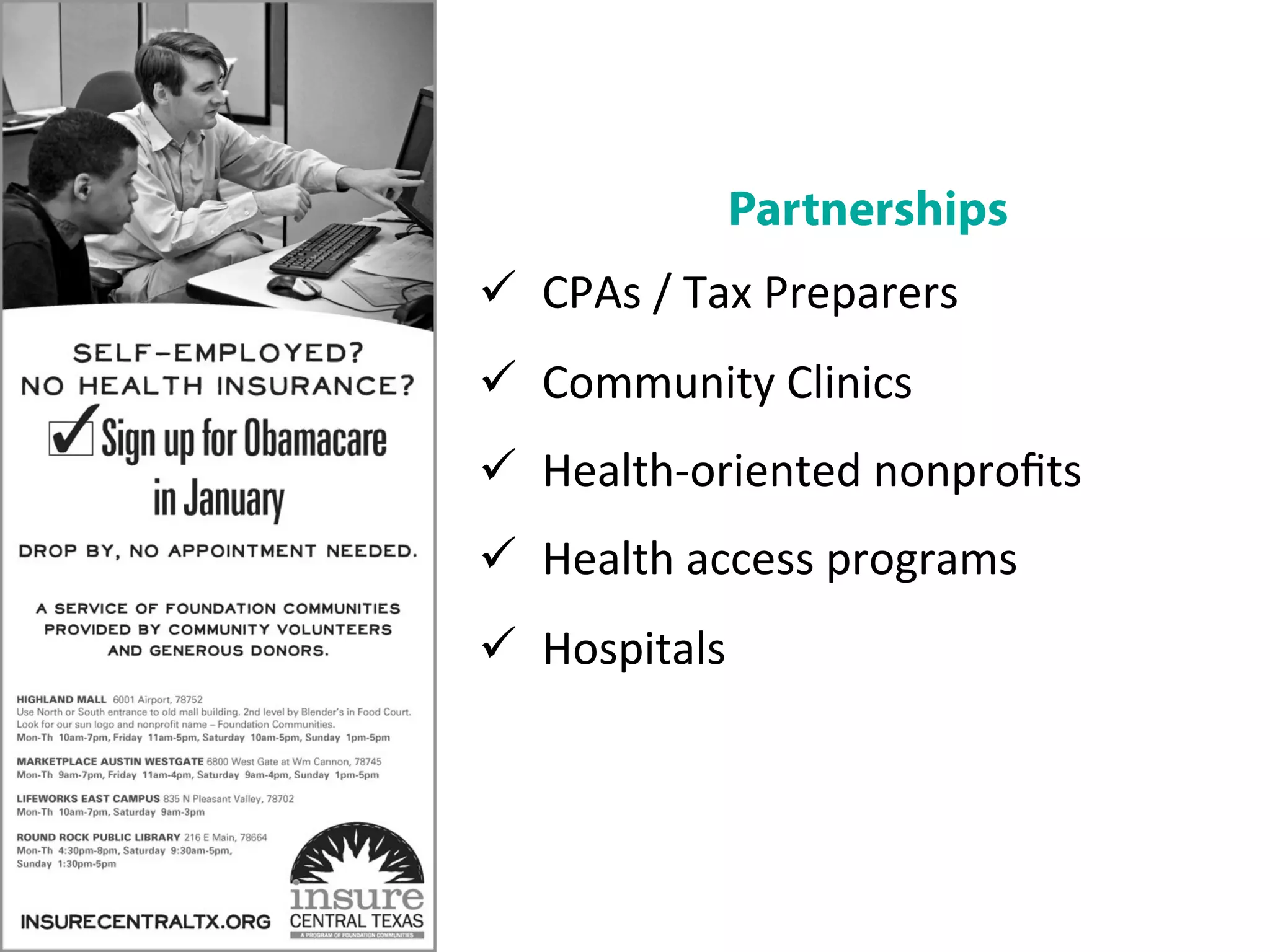

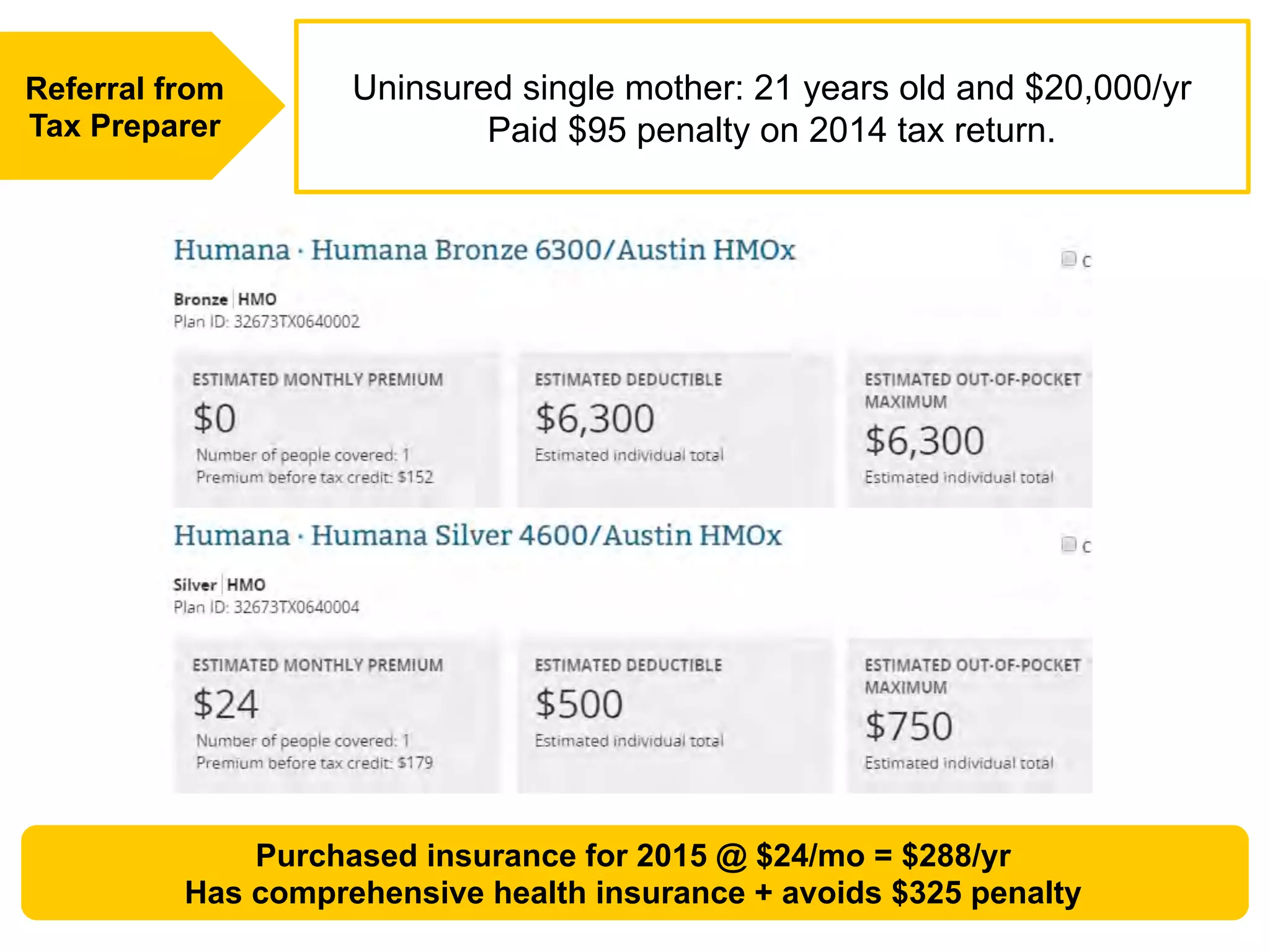

The document discusses the challenges and opportunities related to tax filing for individuals affected by the Affordable Care Act (ACA). It highlights the importance of raising awareness about health coverage during the tax season, especially concerning penalties for being uninsured. The text includes practical advice for tax preparation partnerships and successful models from states like Texas that integrate tax assistance with health insurance enrollment efforts.