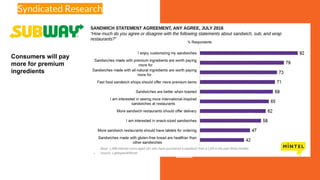

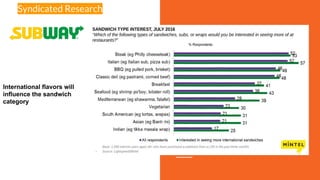

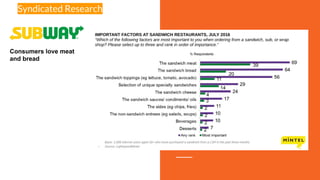

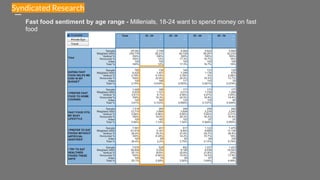

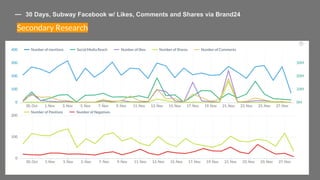

Subway has experienced declining sales since 2014 and closed more franchises in 2016 than ever before, facing increasing competition from fast casual dining chains. The brand's image as health-conscious is attracting older women, but younger consumers favor fresher alternatives and improved dining experiences. Recommendations for Subway include focusing on premium ingredients, enhancing store designs, implementing a loyalty program, and addressing customer perceptions to combat declining consumer sentiment.