Strategies to Minimize Taxes

•

0 likes•173 views

Timothy Bock outlines the techniques he emplys to help clien\'ts achieve total return and minimize their tax exposure.

Report

Share

Report

Share

Download to read offline

Recommended

Profitability and equity

This document discusses profitability and equity. It defines profitability as activities that generate financial gain and lists various styles including encapsulated systems, methods, elements, technology, digitalization, and e-mobilization. Modernization profit refers to developing new technology for profit associated with suitable income. Elements include income/profit literacy, industrialization, urbanization, and digitalization. Equity is defined as the value of assets remaining after debts are subtracted and types include stockholders' equity, owner's equity, common stocks, preferred stocks, treasury stocks, and retained earnings.

Capital Structure

This document discusses capital structure and leverage. It defines capital structure as the composition of a company's long-term capital sources including loans, reserves, shares and bonds. The optimal capital structure maximizes firm value by balancing the use of debt and equity. Leverage refers to a company's use of fixed-cost funds, like debt, to increase returns to shareholders. Both financial leverage and operating leverage can magnify the impact of changes in revenues and earnings but also increase business risk.

POB finance lecture 1

This document provides an introduction to finance concepts for a business principles course. It discusses key topics like the importance of cash over profit, debt versus equity sources of funding, and the working capital cycle. The learning outcomes are to explain the difference between cash and profit, compare debt and equity, evaluate financing options, and understand the importance of cash flow to a business. The document also outlines different sources of funding like loans, leasing, overdrafts, and shares, and how their costs vary based on risk level.

Pre-Series A Funding Vehicles ( Convertible Notes, SAFE, KISS, etc.)

Obtaining funding for early stage startups can be challenging. The array of funding options available to entrepreneurs can be confusing and fraught with pitfalls.

This presentation covers:

1) convertible notes

2) SAFE documents

3) KISS documents

and more!

Chap 1

Accounting provides comparable, reliable financial information to both internal and external users through identifying, recording, and communicating a company's transactions and financial position. It uses standards like GAAP and IFRS and principles such as historical cost and fair value. The basic accounting equation is Assets = Liabilities + Shareholders' Equity, and every transaction has a dual effect. Financial statements like the balance sheet, income statement, and statement of cash flows are produced and there are career opportunities in fields like public, private, and governmental accounting.

IND AS 39 Financial Instrument (hedge accounting)

Hedge accounting allows entities to reduce accounting mismatches between the income statement effects of hedged items and hedging instruments. It can be applied to fair value hedges, cash flow hedges, and hedges of net investments in foreign operations. Hedge accounting aims to provide a better representation of the entity's risk management strategy in the financial statements.

IFRS (Financial Management)

Presentation on "IFRS" by Shabbir Akhtar (PGPM 10, Globsyn Business School - Global Campus) for the subject "Financial Management"

VIRIMAYI CHINYAMA -Managing cash capital fianancing supply chain

This document discusses managing cash and capital as well as financing the supply chain. It covers monitoring key aspects of working capital like inventory, accounts receivable, accounts payable and cash flow. Supply chain transactions can be financed through bank credit lines, supplier credit terms and various loan options. The capital structure, or sources of funding from owners versus lenders, is also addressed. Having too much debt poses risks but low-cost borrowing can boost profits if managed effectively.

Recommended

Profitability and equity

This document discusses profitability and equity. It defines profitability as activities that generate financial gain and lists various styles including encapsulated systems, methods, elements, technology, digitalization, and e-mobilization. Modernization profit refers to developing new technology for profit associated with suitable income. Elements include income/profit literacy, industrialization, urbanization, and digitalization. Equity is defined as the value of assets remaining after debts are subtracted and types include stockholders' equity, owner's equity, common stocks, preferred stocks, treasury stocks, and retained earnings.

Capital Structure

This document discusses capital structure and leverage. It defines capital structure as the composition of a company's long-term capital sources including loans, reserves, shares and bonds. The optimal capital structure maximizes firm value by balancing the use of debt and equity. Leverage refers to a company's use of fixed-cost funds, like debt, to increase returns to shareholders. Both financial leverage and operating leverage can magnify the impact of changes in revenues and earnings but also increase business risk.

POB finance lecture 1

This document provides an introduction to finance concepts for a business principles course. It discusses key topics like the importance of cash over profit, debt versus equity sources of funding, and the working capital cycle. The learning outcomes are to explain the difference between cash and profit, compare debt and equity, evaluate financing options, and understand the importance of cash flow to a business. The document also outlines different sources of funding like loans, leasing, overdrafts, and shares, and how their costs vary based on risk level.

Pre-Series A Funding Vehicles ( Convertible Notes, SAFE, KISS, etc.)

Obtaining funding for early stage startups can be challenging. The array of funding options available to entrepreneurs can be confusing and fraught with pitfalls.

This presentation covers:

1) convertible notes

2) SAFE documents

3) KISS documents

and more!

Chap 1

Accounting provides comparable, reliable financial information to both internal and external users through identifying, recording, and communicating a company's transactions and financial position. It uses standards like GAAP and IFRS and principles such as historical cost and fair value. The basic accounting equation is Assets = Liabilities + Shareholders' Equity, and every transaction has a dual effect. Financial statements like the balance sheet, income statement, and statement of cash flows are produced and there are career opportunities in fields like public, private, and governmental accounting.

IND AS 39 Financial Instrument (hedge accounting)

Hedge accounting allows entities to reduce accounting mismatches between the income statement effects of hedged items and hedging instruments. It can be applied to fair value hedges, cash flow hedges, and hedges of net investments in foreign operations. Hedge accounting aims to provide a better representation of the entity's risk management strategy in the financial statements.

IFRS (Financial Management)

Presentation on "IFRS" by Shabbir Akhtar (PGPM 10, Globsyn Business School - Global Campus) for the subject "Financial Management"

VIRIMAYI CHINYAMA -Managing cash capital fianancing supply chain

This document discusses managing cash and capital as well as financing the supply chain. It covers monitoring key aspects of working capital like inventory, accounts receivable, accounts payable and cash flow. Supply chain transactions can be financed through bank credit lines, supplier credit terms and various loan options. The capital structure, or sources of funding from owners versus lenders, is also addressed. Having too much debt poses risks but low-cost borrowing can boost profits if managed effectively.

Cash Management Strategies During Economic Turmoil Aicpa

The document summarizes a presentation on cash management strategies during economic turmoil. It discusses building financial models, prior period analysis, cash requirements vs expenses, risk mitigation strategies, unforeseen events, and restructuring. Key points covered include rolling forecasts, financial statement analysis, identifying business drivers, covenant compliance, and developing 13-week cash flow projections during workouts.

How Do Convertible Notes Work For Early-stage Financing

What is the definition of convertible debt and how to use it in early-stage startup financing. You can also see the calculations we made using our Convertible Note Calculator.

To read more take a look at this article: https://www.equidam.com/practical-advice-pricing-convertible-note/

Compute your company valuation for free at https://www.equidam.com/

Sources of Finance

This document discusses different sources of finance for capital expenditures and working capital. Internal sources include retaining profits, controlling working capital through reducing costs and speeding up cash flows, and selling assets. External sources involve increasing trade credit, factoring accounts receivable, obtaining an overdraft from the bank, receiving grants, venture capital investments, and issuing new shares.

Acc0904 issue of debentures

There are several types of debentures that companies can issue based on different criteria such as security, convertibility, permanence, negotiability, and priority. The underwriting commission for debentures cannot exceed 2.5% of the issue price. Debenture holders are treated as creditors and do not receive dividends or ownership interests. Any loss from issuing debentures must be written off over the redemption period according to the revenue matching concept.

Money and finance management chapter 4

This document outlines various sources of finance for businesses, including internal and external sources for both long-term and short-term needs. Internally, businesses can utilize retained profits, sell assets, improve working capital management, and recognize depreciation. Externally, long-term sources include share capital, loan capital, and venture capital, while short-term sources are bank overdrafts, trade credit, factoring, and leasing. Each source is described along with its advantages and disadvantages.

Strategies and Structure to Get the Most out of the Deal

The document discusses strategies for structuring an exit from selling a company. It covers the different forms of consideration (cash, stock in a public or private company), as well as factors to consider such as liquidity, valuation, and tax implications. The document also outlines the differences between tax-free and taxable transactions, and how the transaction structure (stock deal vs. asset deal) impacts what the sellers take home and are taxed on. The key takeaway is that the form of consideration and transaction structure can significantly alter the after-tax proceeds, so sellers should plan ahead with advisors.

Legal Landmines for Startups: How to Manage Risks and Avoid Pitfalls

This document outlines some of the most common and costly legal mistakes made by startups. It discusses choosing the appropriate legal entity, properly issuing founder equity and stock options, protecting intellectual property, properly classifying employees versus contractors, and effectively raising capital. Key areas that can cause problems include misclassifying workers, failing to properly assign intellectual property, not vesting founder shares, and misunderstanding securities regulations around fundraising. The document provides advice on navigating these issues and avoiding legal landmines during the early stages of a new company.

Pricing A Business Detail

The document discusses methods for pricing a business for sale, including determining the sellers discretionary earnings (SDE) by adding back non-operating expenses to the profit and loss statement. Other factors that can affect the selling price include assets like equipment and inventory, goodwill, leases, and franchise agreements. When determining a selling multiple, brokers consider market comparisons and other factors about the business such as years in operation, capital needs, competition level, financials, and dependencies. The goal is to arrive at a fair price that will sell the business quickly.

Chap021

This document discusses various types of mergers and reasons for mergers. It covers horizontal mergers between competitors, vertical mergers between companies in different production stages, and conglomerate mergers between unrelated companies. Sensible reasons for mergers include achieving economies of scale, combining complementary resources, and using surplus funds. Dubious reasons include diversification and the "bootstrap game" where a high P/E company acquires a low P/E company to temporarily boost earnings per share. The document also examines evaluating mergers based on whether there is an overall economic gain.

Lessons learned corporate finance - s5

1) The document outlines key lessons learned from a corporate finance course, including that companies should choose projects and capital structures that maximize shareholder value.

2) Capital budgeting involves finding and analyzing long-term investment projects using techniques like payback period, NPV, and IRR to select projects that maximize shareholder value.

3) When raising external equity or debt, companies should consider the various financing options and terms to minimize their overall cost of capital.

Cash flow

Cash flow refers to the amount of cash generated or used in a business over a period of time. There are several types of cash flow, including cash from operating activities (generated from core business operations), cash from investing activities (available after reinvesting into the business), and cash from financing activities (assuming no leverage or debt). Cash flow is important for liquidity, funding operations and growth, paying dividends, and is a key metric used in financial analysis and valuation. Businesses aim to manage cash flow carefully and implement strategies like revenue growth, improving operating margins, and capital efficiency to increase the flow of cash.

Introduction To Business Finance - Mauneel Desai

In this PPT, you will learn about how you can value your money and relation between, risk and return.

Reeba ict powerpoint

Financial planning involves deciding in advance how to allocate financial resources to achieve business objectives such as ensuring adequate funding, minimizing costs, protecting owner control, and maintaining flexibility. It integrates different business functions, eliminates waste, ensures diverse funding sources, reduces uncertainty, and balances cash inflows and outflows while serving as a basis for financial control and lowering financing costs.

How Convertible Notes Work

Convertible notes are one of the most common ways investors invest in early-stage startups. And yet, even with their popularity, they are still quite confusing to many founders.

If you've looking for a greater understanding of convertible notes, check out this presentation from Kevin Smith from SEEDCHANGE (www.seedchange.com) and Gadiel Morantes from Early Growth Financial Services (www.egfs.co).

This presentation explores how convertible notes really work, including:

- Why convertible notes vs. shares of common or preferred stock

- Convertible note terms - and the terms that REALLY matter

- Conversion mechanics

- Valuation cap

- Safe alternatives to convertible notes

- and more....!

Convertible Notes: What Founders Need to Know

This document discusses convertible notes, which are a hybrid of debt and equity used for early-stage startup funding. Convertible notes allow startups to receive funding in exchange for a note that can later convert to equity shares. The document outlines key terms of convertible notes like interest rates, maturity dates, discounts, and note caps. It provides examples of how notes would convert under different valuation scenarios. While convertible notes provide flexibility, the document notes that investors ultimately want equity and alternatives like SAFEs were created that act more like stock.

COLLABORATE 18 Presentation: Manage Cash Management, Treasury & Payments Glob...

SESSION ABSTRACT: Companies are moving to global presence and there are many ways in which they are hoping to manage in an efficient manner, and this creates problems because - processes need to change - and systems need to follow to support these process changes. The tools available today may not entirely support all that is needed - but what is available and what can be done ? This is what you will get from this session and open a conversation on how other people resolve these challenges.

Chapter 01

The document discusses different forms of business organization including proprietorships, partnerships, and corporations. It notes advantages and disadvantages of each. Corporations have unlimited life, easy transfer of ownership, and limited liability but are double taxed. The primary goal of corporations is shareholder wealth maximization through stock price appreciation. Stock prices are influenced by projected cash flows, timing, and risk. Managers do not always act in shareholders' best interests so compensation plans, shareholder intervention, firing threats, and takeovers aim to align goals.

Unit 3

The document discusses cash management, receivables management, and inventory management. It outlines the objectives, strategies, and factors to consider for cash management including holding cash, cash budgeting, and cash flow. It also discusses credit policies, credit analysis, credit terms, and collection policies for receivables management. Finally, it mentions the objectives and costs/benefits considerations for inventory management.

Improving Cash Flow

This document discusses various ways that businesses can improve their cash flow to avoid or address cash flow problems. It identifies key causes of cash flow issues such as low profits, too much inventory, allowing too much customer credit, and overtrading. It then provides recommendations for improving cash flow through better cash flow forecasting, managing accounts receivable and payable more effectively, using different sources of financing, and reducing inventory levels.

Mutual Fund Taxation – How Mutual Funds Are Taxed

Divadhvik explains Mutual Fund Taxation clearly: Equity funds held over a year are taxed at 10% for gains over ₹1 lakh, while short-term gains are taxed at 15%. Debt funds held over three years are taxed at 20% post-indexation. Short-term gains are taxed as per your income slab.

Corporate class explained

Corporate class mutual funds provide tax benefits compared to traditional mutual funds. Investments within a corporate class structure are treated as a single entity for tax purposes, allowing investors to rebalance portfolios without immediate tax consequences. Distributions from corporate class funds are more tax-efficient, consisting primarily of capital gains and Canadian dividends taxed at a lower rate than regular income. This tax treatment leaves more money growing in the investor's account compared to traditional mutual funds. Corporate class is suitable for individual investors with non-registered funds who seek tax-efficient rebalancing and cash flow in retirement.

Short-Term Capital Gains - Mutual Funds - Divadhvik

💰📈 Understanding Short-Term Capital Gains! Short-term capital gains occur when you sell an asset held for less than a year, and they are taxed at your ordinary income tax rate. Stay informed to make smarter investment decisions! 💡✨

More Related Content

What's hot

Cash Management Strategies During Economic Turmoil Aicpa

The document summarizes a presentation on cash management strategies during economic turmoil. It discusses building financial models, prior period analysis, cash requirements vs expenses, risk mitigation strategies, unforeseen events, and restructuring. Key points covered include rolling forecasts, financial statement analysis, identifying business drivers, covenant compliance, and developing 13-week cash flow projections during workouts.

How Do Convertible Notes Work For Early-stage Financing

What is the definition of convertible debt and how to use it in early-stage startup financing. You can also see the calculations we made using our Convertible Note Calculator.

To read more take a look at this article: https://www.equidam.com/practical-advice-pricing-convertible-note/

Compute your company valuation for free at https://www.equidam.com/

Sources of Finance

This document discusses different sources of finance for capital expenditures and working capital. Internal sources include retaining profits, controlling working capital through reducing costs and speeding up cash flows, and selling assets. External sources involve increasing trade credit, factoring accounts receivable, obtaining an overdraft from the bank, receiving grants, venture capital investments, and issuing new shares.

Acc0904 issue of debentures

There are several types of debentures that companies can issue based on different criteria such as security, convertibility, permanence, negotiability, and priority. The underwriting commission for debentures cannot exceed 2.5% of the issue price. Debenture holders are treated as creditors and do not receive dividends or ownership interests. Any loss from issuing debentures must be written off over the redemption period according to the revenue matching concept.

Money and finance management chapter 4

This document outlines various sources of finance for businesses, including internal and external sources for both long-term and short-term needs. Internally, businesses can utilize retained profits, sell assets, improve working capital management, and recognize depreciation. Externally, long-term sources include share capital, loan capital, and venture capital, while short-term sources are bank overdrafts, trade credit, factoring, and leasing. Each source is described along with its advantages and disadvantages.

Strategies and Structure to Get the Most out of the Deal

The document discusses strategies for structuring an exit from selling a company. It covers the different forms of consideration (cash, stock in a public or private company), as well as factors to consider such as liquidity, valuation, and tax implications. The document also outlines the differences between tax-free and taxable transactions, and how the transaction structure (stock deal vs. asset deal) impacts what the sellers take home and are taxed on. The key takeaway is that the form of consideration and transaction structure can significantly alter the after-tax proceeds, so sellers should plan ahead with advisors.

Legal Landmines for Startups: How to Manage Risks and Avoid Pitfalls

This document outlines some of the most common and costly legal mistakes made by startups. It discusses choosing the appropriate legal entity, properly issuing founder equity and stock options, protecting intellectual property, properly classifying employees versus contractors, and effectively raising capital. Key areas that can cause problems include misclassifying workers, failing to properly assign intellectual property, not vesting founder shares, and misunderstanding securities regulations around fundraising. The document provides advice on navigating these issues and avoiding legal landmines during the early stages of a new company.

Pricing A Business Detail

The document discusses methods for pricing a business for sale, including determining the sellers discretionary earnings (SDE) by adding back non-operating expenses to the profit and loss statement. Other factors that can affect the selling price include assets like equipment and inventory, goodwill, leases, and franchise agreements. When determining a selling multiple, brokers consider market comparisons and other factors about the business such as years in operation, capital needs, competition level, financials, and dependencies. The goal is to arrive at a fair price that will sell the business quickly.

Chap021

This document discusses various types of mergers and reasons for mergers. It covers horizontal mergers between competitors, vertical mergers between companies in different production stages, and conglomerate mergers between unrelated companies. Sensible reasons for mergers include achieving economies of scale, combining complementary resources, and using surplus funds. Dubious reasons include diversification and the "bootstrap game" where a high P/E company acquires a low P/E company to temporarily boost earnings per share. The document also examines evaluating mergers based on whether there is an overall economic gain.

Lessons learned corporate finance - s5

1) The document outlines key lessons learned from a corporate finance course, including that companies should choose projects and capital structures that maximize shareholder value.

2) Capital budgeting involves finding and analyzing long-term investment projects using techniques like payback period, NPV, and IRR to select projects that maximize shareholder value.

3) When raising external equity or debt, companies should consider the various financing options and terms to minimize their overall cost of capital.

Cash flow

Cash flow refers to the amount of cash generated or used in a business over a period of time. There are several types of cash flow, including cash from operating activities (generated from core business operations), cash from investing activities (available after reinvesting into the business), and cash from financing activities (assuming no leverage or debt). Cash flow is important for liquidity, funding operations and growth, paying dividends, and is a key metric used in financial analysis and valuation. Businesses aim to manage cash flow carefully and implement strategies like revenue growth, improving operating margins, and capital efficiency to increase the flow of cash.

Introduction To Business Finance - Mauneel Desai

In this PPT, you will learn about how you can value your money and relation between, risk and return.

Reeba ict powerpoint

Financial planning involves deciding in advance how to allocate financial resources to achieve business objectives such as ensuring adequate funding, minimizing costs, protecting owner control, and maintaining flexibility. It integrates different business functions, eliminates waste, ensures diverse funding sources, reduces uncertainty, and balances cash inflows and outflows while serving as a basis for financial control and lowering financing costs.

How Convertible Notes Work

Convertible notes are one of the most common ways investors invest in early-stage startups. And yet, even with their popularity, they are still quite confusing to many founders.

If you've looking for a greater understanding of convertible notes, check out this presentation from Kevin Smith from SEEDCHANGE (www.seedchange.com) and Gadiel Morantes from Early Growth Financial Services (www.egfs.co).

This presentation explores how convertible notes really work, including:

- Why convertible notes vs. shares of common or preferred stock

- Convertible note terms - and the terms that REALLY matter

- Conversion mechanics

- Valuation cap

- Safe alternatives to convertible notes

- and more....!

Convertible Notes: What Founders Need to Know

This document discusses convertible notes, which are a hybrid of debt and equity used for early-stage startup funding. Convertible notes allow startups to receive funding in exchange for a note that can later convert to equity shares. The document outlines key terms of convertible notes like interest rates, maturity dates, discounts, and note caps. It provides examples of how notes would convert under different valuation scenarios. While convertible notes provide flexibility, the document notes that investors ultimately want equity and alternatives like SAFEs were created that act more like stock.

COLLABORATE 18 Presentation: Manage Cash Management, Treasury & Payments Glob...

SESSION ABSTRACT: Companies are moving to global presence and there are many ways in which they are hoping to manage in an efficient manner, and this creates problems because - processes need to change - and systems need to follow to support these process changes. The tools available today may not entirely support all that is needed - but what is available and what can be done ? This is what you will get from this session and open a conversation on how other people resolve these challenges.

Chapter 01

The document discusses different forms of business organization including proprietorships, partnerships, and corporations. It notes advantages and disadvantages of each. Corporations have unlimited life, easy transfer of ownership, and limited liability but are double taxed. The primary goal of corporations is shareholder wealth maximization through stock price appreciation. Stock prices are influenced by projected cash flows, timing, and risk. Managers do not always act in shareholders' best interests so compensation plans, shareholder intervention, firing threats, and takeovers aim to align goals.

Unit 3

The document discusses cash management, receivables management, and inventory management. It outlines the objectives, strategies, and factors to consider for cash management including holding cash, cash budgeting, and cash flow. It also discusses credit policies, credit analysis, credit terms, and collection policies for receivables management. Finally, it mentions the objectives and costs/benefits considerations for inventory management.

Improving Cash Flow

This document discusses various ways that businesses can improve their cash flow to avoid or address cash flow problems. It identifies key causes of cash flow issues such as low profits, too much inventory, allowing too much customer credit, and overtrading. It then provides recommendations for improving cash flow through better cash flow forecasting, managing accounts receivable and payable more effectively, using different sources of financing, and reducing inventory levels.

What's hot (19)

Cash Management Strategies During Economic Turmoil Aicpa

Cash Management Strategies During Economic Turmoil Aicpa

How Do Convertible Notes Work For Early-stage Financing

How Do Convertible Notes Work For Early-stage Financing

Strategies and Structure to Get the Most out of the Deal

Strategies and Structure to Get the Most out of the Deal

Legal Landmines for Startups: How to Manage Risks and Avoid Pitfalls

Legal Landmines for Startups: How to Manage Risks and Avoid Pitfalls

COLLABORATE 18 Presentation: Manage Cash Management, Treasury & Payments Glob...

COLLABORATE 18 Presentation: Manage Cash Management, Treasury & Payments Glob...

Similar to Strategies to Minimize Taxes

Mutual Fund Taxation – How Mutual Funds Are Taxed

Divadhvik explains Mutual Fund Taxation clearly: Equity funds held over a year are taxed at 10% for gains over ₹1 lakh, while short-term gains are taxed at 15%. Debt funds held over three years are taxed at 20% post-indexation. Short-term gains are taxed as per your income slab.

Corporate class explained

Corporate class mutual funds provide tax benefits compared to traditional mutual funds. Investments within a corporate class structure are treated as a single entity for tax purposes, allowing investors to rebalance portfolios without immediate tax consequences. Distributions from corporate class funds are more tax-efficient, consisting primarily of capital gains and Canadian dividends taxed at a lower rate than regular income. This tax treatment leaves more money growing in the investor's account compared to traditional mutual funds. Corporate class is suitable for individual investors with non-registered funds who seek tax-efficient rebalancing and cash flow in retirement.

Short-Term Capital Gains - Mutual Funds - Divadhvik

💰📈 Understanding Short-Term Capital Gains! Short-term capital gains occur when you sell an asset held for less than a year, and they are taxed at your ordinary income tax rate. Stay informed to make smarter investment decisions! 💡✨

Tbl December 08 P16

The document discusses investing outside of registered retirement savings plans (RRSPs) and strategies to minimize taxes on investment income earned outside an RRSP. It recommends investing in corporate class mutual funds or T-Series mutual funds, which allow you to defer capital gains taxes when switching between funds and provide monthly income payments that are partially treated as a return of capital and not immediately taxed. When combined with an overall asset allocation and tax management plan, these non-registered investment options can help maximize wealth over the long run.

__Unlocking the Benefits of the VAT Flat Rate Scheme for Small Businesses_.pdf

You will find here

"Unlocking the Benefits of the VAT Flat Rate Scheme for Small Businesses". Also VAT flat rate scheme criteria for small businesses , Difference between flat rate scheme vat and main scheme?

Ten tax tips march 2011

This document provides a summary of 10 tax tips to lower taxes and grow wealth, presented by Sucré-Vail Wealth Advisors. The tips include: choosing an advisor over a broker for tax deductible fees; using tax managed investing strategies; maximizing retirement plan contributions; utilizing available deductions and credits; education planning options like 529 plans and Coverdell ESAs; insurance options; charitable foundations; efficient estate planning; annuities pros and cons; and gifting strategies. Sucré-Vail is an experienced RIA firm that provides wealth management and fiduciary retirement plan services.

Key SEIS Booklet

What is Seed EIS?

Seed Enterprise Investment Scheme (SEIS) is the most

generous, tax-advantaged venture capital scheme ever

introduced that offers investors enhanced income tax

and Capital Gains Tax (CGT) reliefs.

Higher rate tax payers and profitable business owners now have a low hurdle threshold to recover up to £50,000 income tax annually.

The 2014 Budget has made this a permanent feature of UK tax savings schemes and this Guide highlights the main conditions that need to be satisfied, but the conditions are complex and you should take professional advice before making an investment.

Funding your energy saving projects

The document discusses how payment over time (leasing) can allow customers to implement energy projects more quickly and efficiently by enjoying the benefits of the investment immediately rather than having to wait years to break even. Leasing provides tax advantages where customers can receive 100% tax allowances on payments, and it allows customers to spread costs over monthly payments while retaining liquidity. The benefits of leasing include faster returns, positive cash flow, tax savings, preserving credit lines, flexibility to take on additional projects, and lower approval levels for decisions.

Retaining Wealth in a Rising Tax Environment

Tax rates are expected to rise in 2011 as Bush-era tax cuts expire. This will negatively impact high-income taxpayers through higher income, capital gains, and dividend tax rates. The document discusses three strategies for improving tax efficiency despite rising rates: 1) minimizing short-term capital gains distributions through manager incentives and technology; 2) investing in dividend-paying stocks for qualified dividends taxed at a lower rate; and 3) municipal bonds which provide tax-exempt income but require credit research expertise. It emphasizes the benefits of tax-efficient strategies, especially for accumulation and distribution phases of investing.

Corporate Class Funds

1) The document discusses Quadrus corporate class funds, which offer a collection of multi-manager and single-manager funds from leading investment managers.

2) Each multi-manager equity fund is designed to minimize risk through rigorous selection criteria and extensive portfolio testing to ensure minimal volatility for the expected return.

3) The single-manager funds complement the other corporate class funds by providing a unique, tax-efficient portfolio that is diversified across investment styles, asset classes, and geographic regions.

Risk Analysis , Operating Performance and Value Ratios

The document discusses various ratios used for risk analysis and valuation of companies. It defines ratios that measure asset coverage, capital structure, profitability, debt levels, cash flows, earnings, market values and preferred share quality. Specific ratios covered include asset coverage, debt-to-equity, interest coverage, preferred dividend coverage, return on equity, price-earnings and book value per share. The purpose, calculation and interpretation of these ratios are explained.

Risk analysis , operating performance and value ratios

The document discusses various ratios used for risk analysis and valuation of companies. It defines ratios that measure asset coverage, capital structure, profitability, debt levels, cash flows, earnings, market values and preferred share quality. Specific ratios covered include asset coverage, debt-to-equity, interest coverage, preferred dividend coverage, return on equity, price-earnings and book value per share. The purpose, calculation and interpretation of these ratios are explained.

Finance 340

The document discusses the new revenue recognition standard under GAAP which provides guidance for recognizing revenue from contracts with customers. The new standard aims to clarify and converge revenue recognition principles globally to reduce inconsistencies in practice. It establishes a principle that revenue should be recognized when control of goods or services transfers to a customer in an amount that reflects the consideration to which the entity expects to be entitled.

Measuring And Controlling Assets employed

This document discusses methods for measuring and controlling assets employed in business units. It describes two main methods - return on investment (ROI) and economic value added (EVA). ROI is a ratio that compares income to assets employed, while EVA is a dollar amount that subtracts a capital charge from net operating profit. The document explores how different types of assets like cash, receivables, inventories, property/equipment should be treated in the calculation. It also addresses topics like how to treat leased assets, idle assets, intangible assets, and noncurrent liabilities. The goal of accurately measuring assets employed is to motivate managers and provide useful information for decision making.

Improving profitability for small business

In this comprehensive presentation, we will explore strategies and practical tips for enhancing profitability in small businesses. Tailored to meet the unique challenges faced by small enterprises, this session covers various aspects that directly impact the bottom line. Attendees will learn how to optimize operational efficiency, manage expenses, and increase revenue through innovative marketing and customer engagement techniques.

Donts of personal_finance

The document provides financial advice for high-net-worth individuals (HNIs) to avoid certain transactions that may increase their tax burden or result in negative cash flow. Specifically, it recommends avoiding mutual funds held for less than one year, stock and commodity trading as an amateur, car or personal loans unless as a consultant, and fixed deposits except for retired senior citizens, as the interests from these can increase taxes and some provide low returns or depreciating assets.

Supercharge your Investments with Tax-Loss Harvesting

Tax-loss harvesting, or "tax selling," is a technique used to lower your taxes while maintaining the expected risk and return profile of your portfolio. It harvests previously unrecognized investment losses to offset taxes due on your other gains and income. You can reinvest these tax savings to significantly grow the value of your portfolio.

Wealthfront has two different strategies available for Tax-Loss Harvesting on client portfolios:

1. Daily Tax-Loss Harvesting

2. The Tax-Optimized US Index Portfolio

Both of Wealthfront’s Tax-Loss Harvesting strategies run every day, selling underperforming assets and replacing them with similar but not identical ones as opportunities arise.

Learn more about Daily Tax-Loss Harvesting and Stock level Tax-Loss Harvesting with the Wealthfront Tax-Optimized US Index Portfolio here.

IRS' Best Kept Secrets for Real Estate Investors

Taxable income can be reduced through various tax planning strategies like spreading income over time, spreading income to different entities, and grouping income and expenses. Spreading income over time can be done through installment sales or tax-deferred exchanges of real estate. Income can also be spread to different entities like corporations, partnerships, trusts, or relatives. Grouping income and expenses allows offsetting gains with losses and timing deductions to maximize tax savings. Consulting a tax advisor can help identify strategies to significantly reduce tax liability through lowering taxable income.

An introduction to financial management for MBA graduates

1. Financial management involves acquiring, managing, and distributing assets to achieve business goals. It focuses on maximizing shareholder wealth through investment, financing, and dividend decisions.

2. The objective of financial management is to maximize the current value of the company's stock by investing in projects with returns greater than the minimum hurdle rate and using an optimal debt-equity mix to fund operations.

3. Working capital management involves determining the appropriate level of current assets like cash, receivables, and inventory to meet short-term obligations while pursuing an efficient yet effective current assets policy.

Destination: Achieve

This document discusses separately managed accounts as an effective approach for investors with complex financial needs requiring flexibility. It summarizes that separately managed accounts provide customized, diversified portfolios through specialist money managers while safeguarding the investment strategy. They allow for tax-efficient trading to help investors keep more of their earnings. The document provides an example portfolio allocation and highlights benefits like access to institutional money managers, flexibility, and tax awareness.

Similar to Strategies to Minimize Taxes (20)

Short-Term Capital Gains - Mutual Funds - Divadhvik

Short-Term Capital Gains - Mutual Funds - Divadhvik

__Unlocking the Benefits of the VAT Flat Rate Scheme for Small Businesses_.pdf

__Unlocking the Benefits of the VAT Flat Rate Scheme for Small Businesses_.pdf

Risk Analysis , Operating Performance and Value Ratios

Risk Analysis , Operating Performance and Value Ratios

Risk analysis , operating performance and value ratios

Risk analysis , operating performance and value ratios

Supercharge your Investments with Tax-Loss Harvesting

Supercharge your Investments with Tax-Loss Harvesting

An introduction to financial management for MBA graduates

An introduction to financial management for MBA graduates

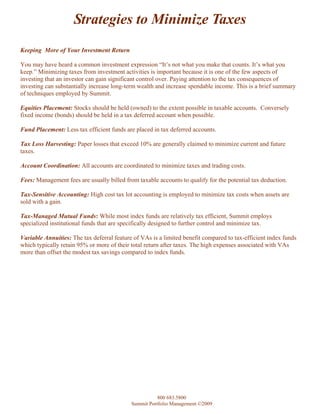

Strategies to Minimize Taxes

- 1. Strategies to Minimize Taxes Keeping More of Your Investment Return You may have heard a common investment expression “It’s not what you make that counts. It’s what you keep.” Minimizing taxes from investment activities is important because it is one of the few aspects of investing that an investor can gain significant control over. Paying attention to the tax consequences of investing can substantially increase long-term wealth and increase spendable income. This is a brief summary of techniques employed by Summit. Equities Placement: Stocks should be held (owned) to the extent possible in taxable accounts. Conversely fixed income (bonds) should be held in a tax deferred account when possible. Fund Placement: Less tax efficient funds are placed in tax deferred accounts. Tax Loss Harvesting: Paper losses that exceed 10% are generally claimed to minimize current and future taxes. Account Coordination: All accounts are coordinated to minimize taxes and trading costs. Fees: Management fees are usually billed from taxable accounts to qualify for the potential tax deduction. Tax-Sensitive Accounting: High cost tax lot accounting is employed to minimize tax costs when assets are sold with a gain. Tax-Managed Mutual Funds: While most index funds are relatively tax efficient, Summit employs specialized institutional funds that are specifically designed to further control and minimize tax. Variable Annuities: The tax deferral feature of VAs is a limited benefit compared to tax-efficient index funds which typically retain 95% or more of their total return after taxes. The high expenses associated with VAs more than offset the modest tax savings compared to index funds. 800 683.5800 Summit Portfolio Management ©2009