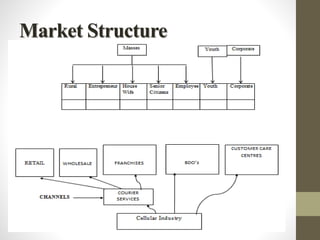

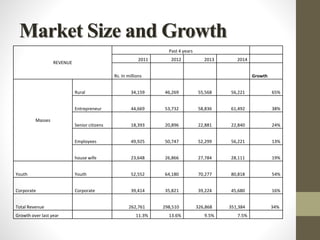

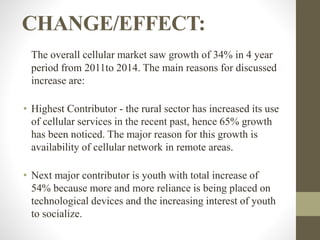

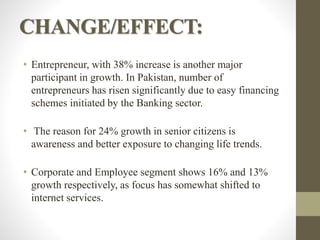

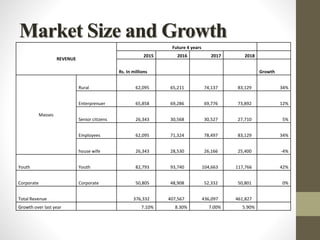

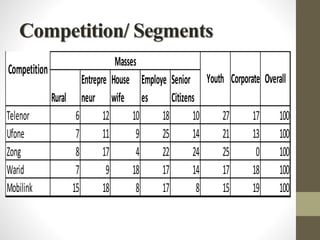

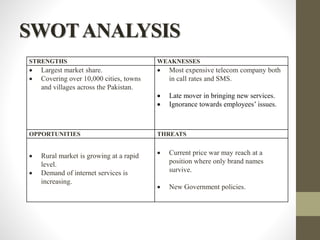

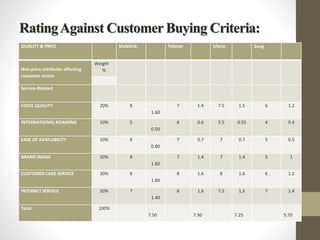

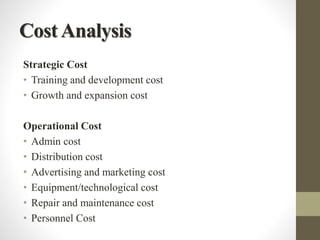

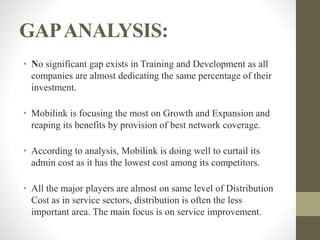

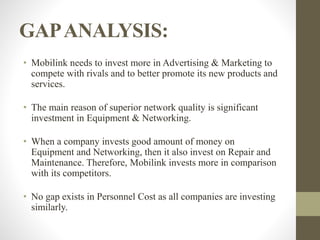

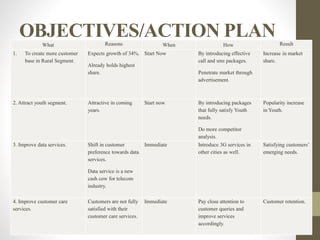

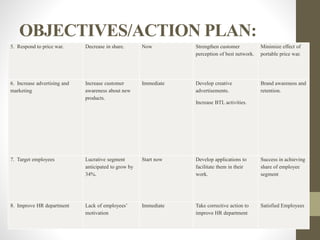

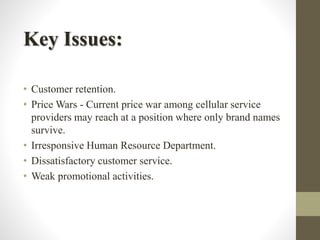

The report presents an analysis of Mobilink's strategic management in the telecom sector of Pakistan, highlighting its customer segments, market growth, and competition. It shows a significant growth of 34% in the overall cellular market from 2011 to 2014, with a focus on rural and youth segments as key drivers. Additionally, the report outlines Mobilink's strengths, weaknesses, and objectives to enhance customer retention and improve its service offerings.