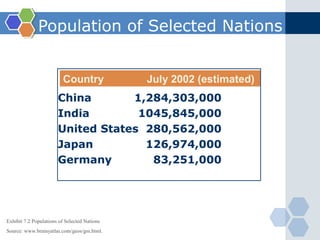

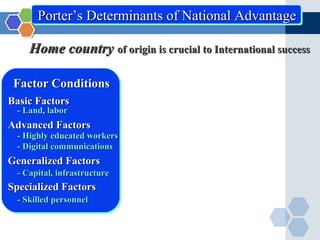

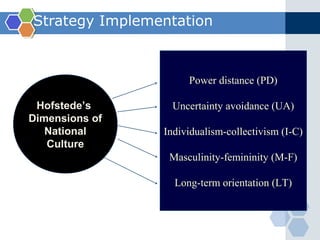

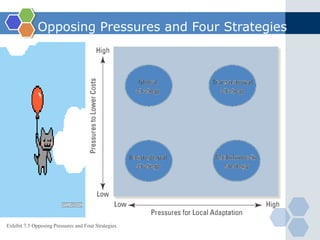

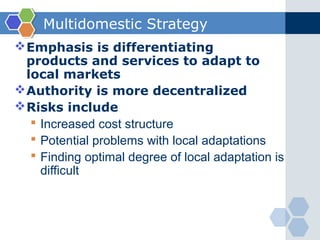

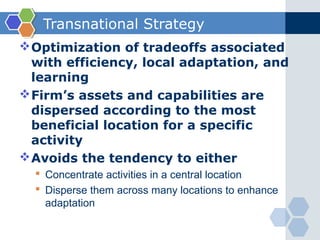

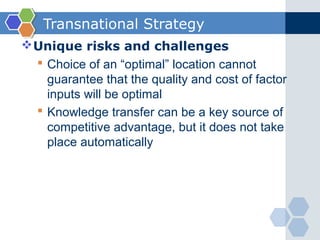

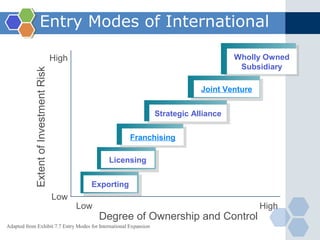

The document discusses various international strategies that firms can employ, including global, multidomestic, and transnational strategies. It also examines factors that motivate firms to expand globally as well as risks they may face. Different entry modes such as exporting, licensing, joint ventures, and wholly owned subsidiaries are analyzed in terms of the control and risk involved.