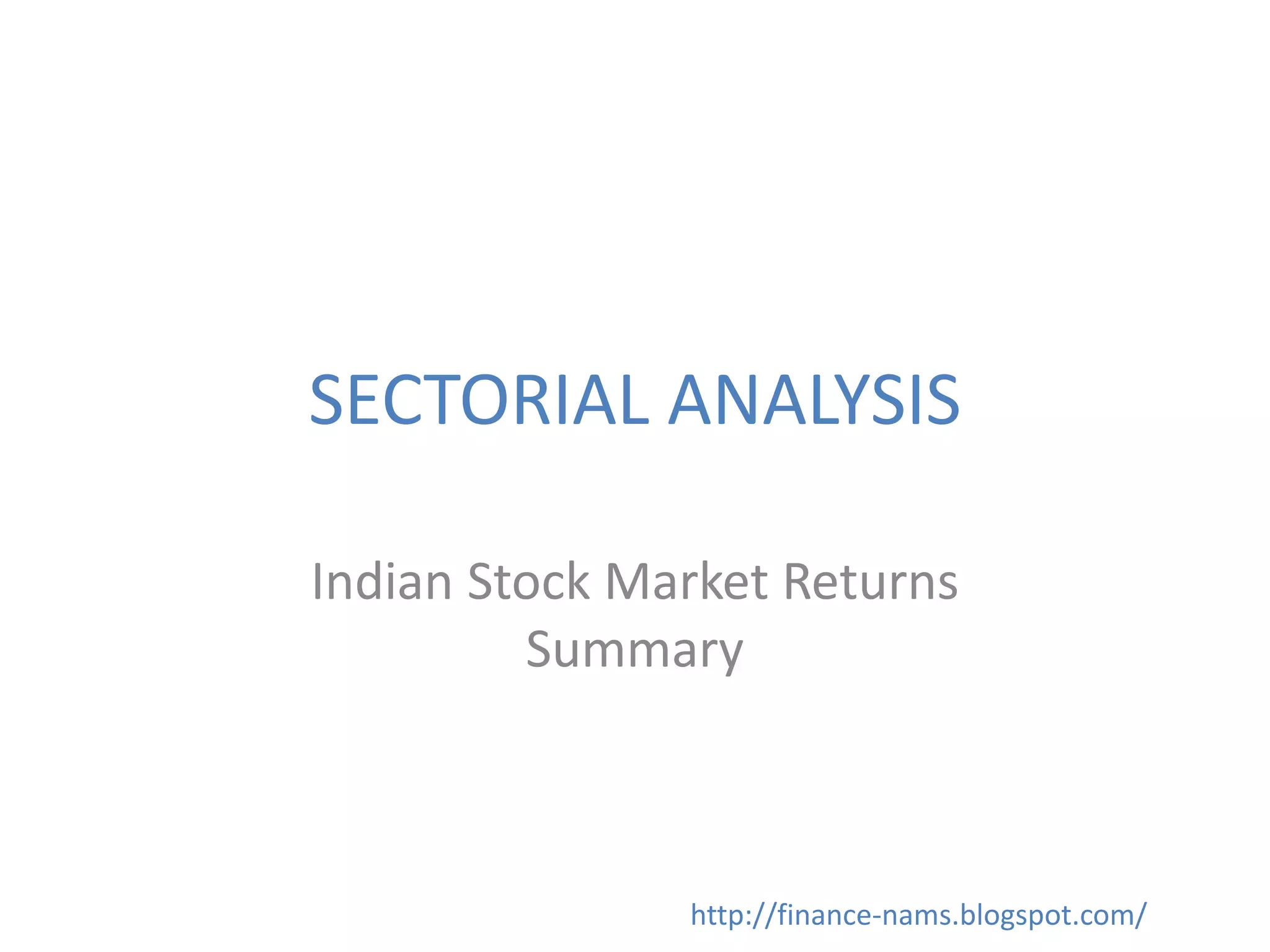

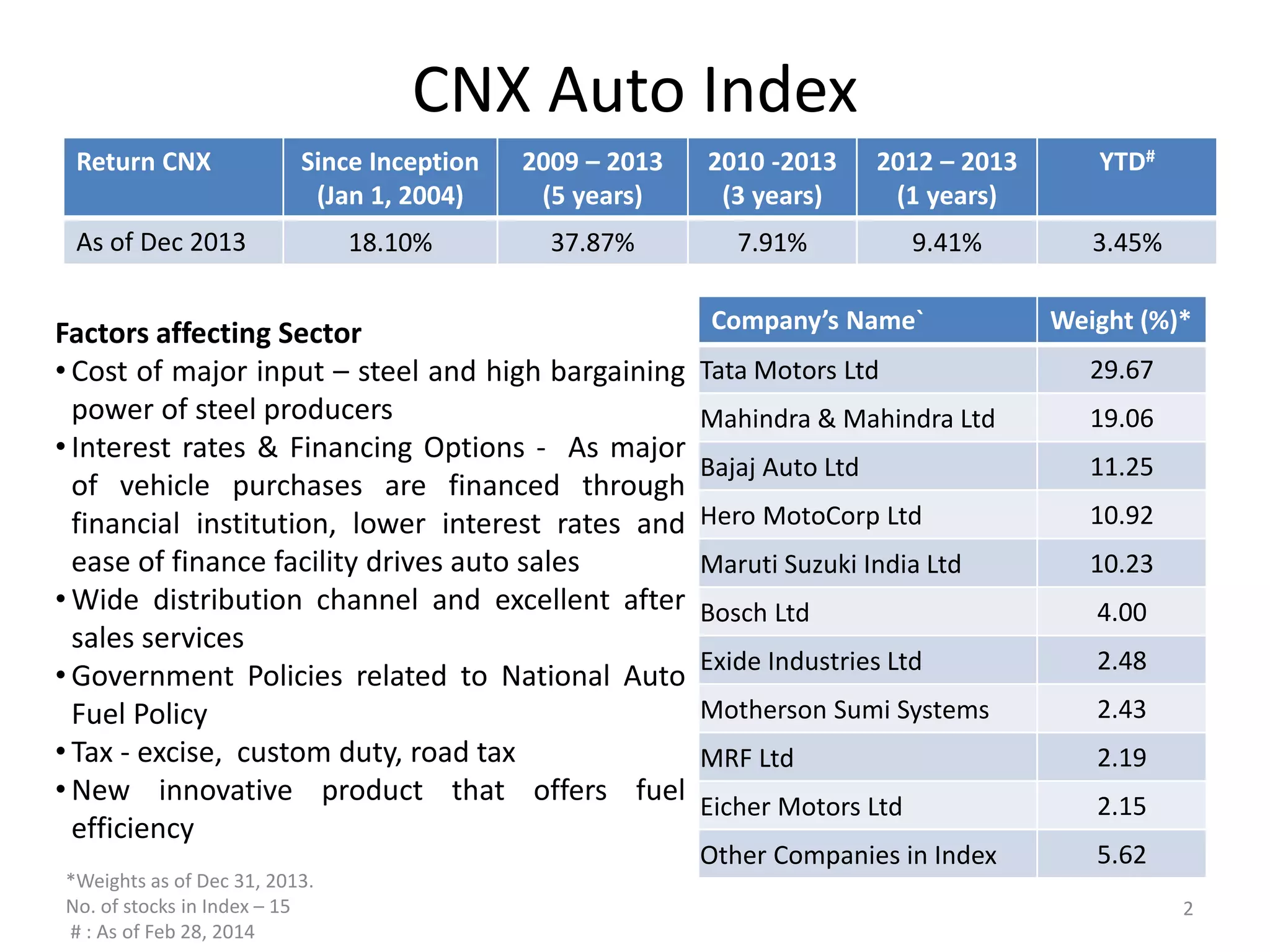

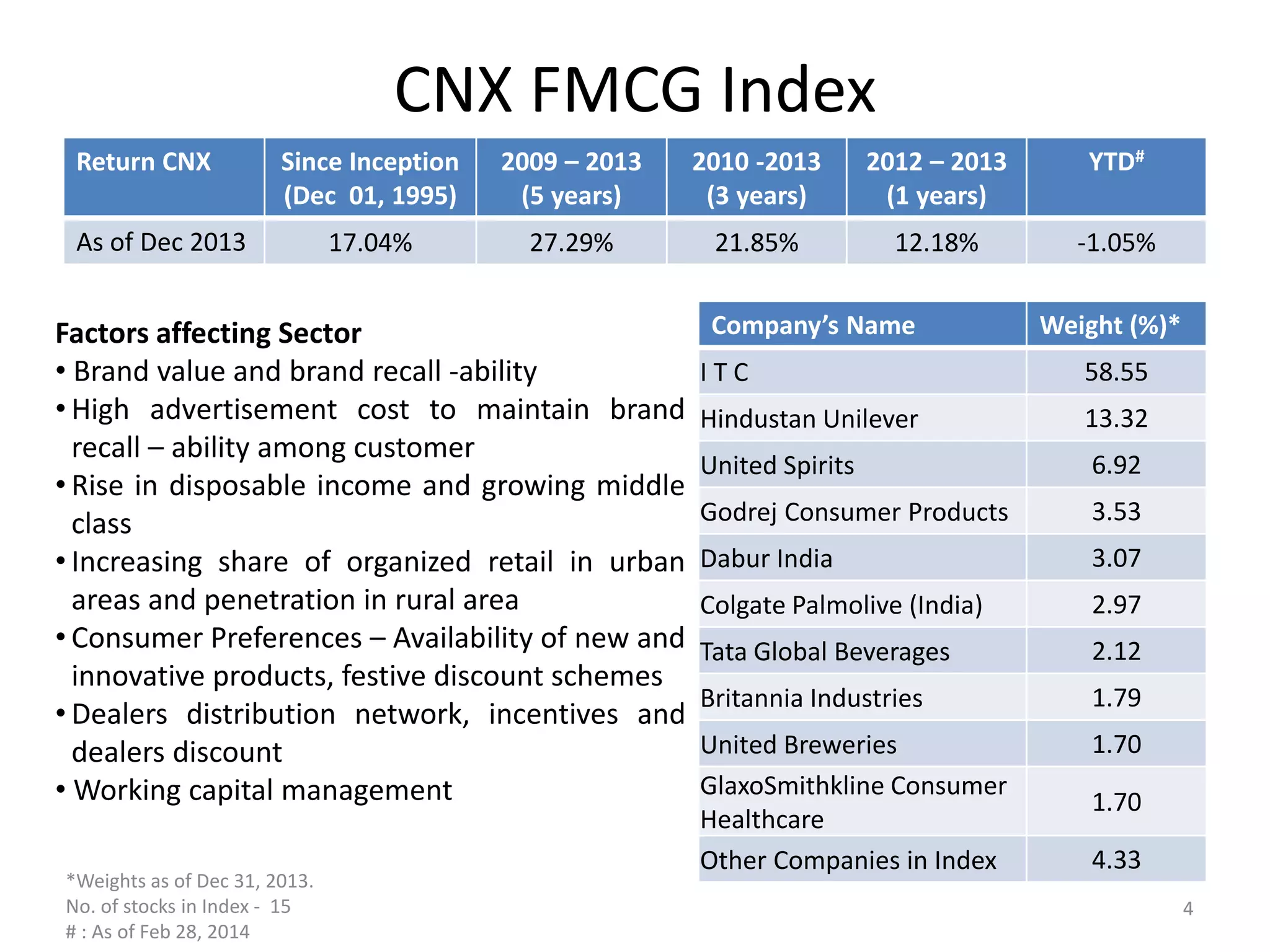

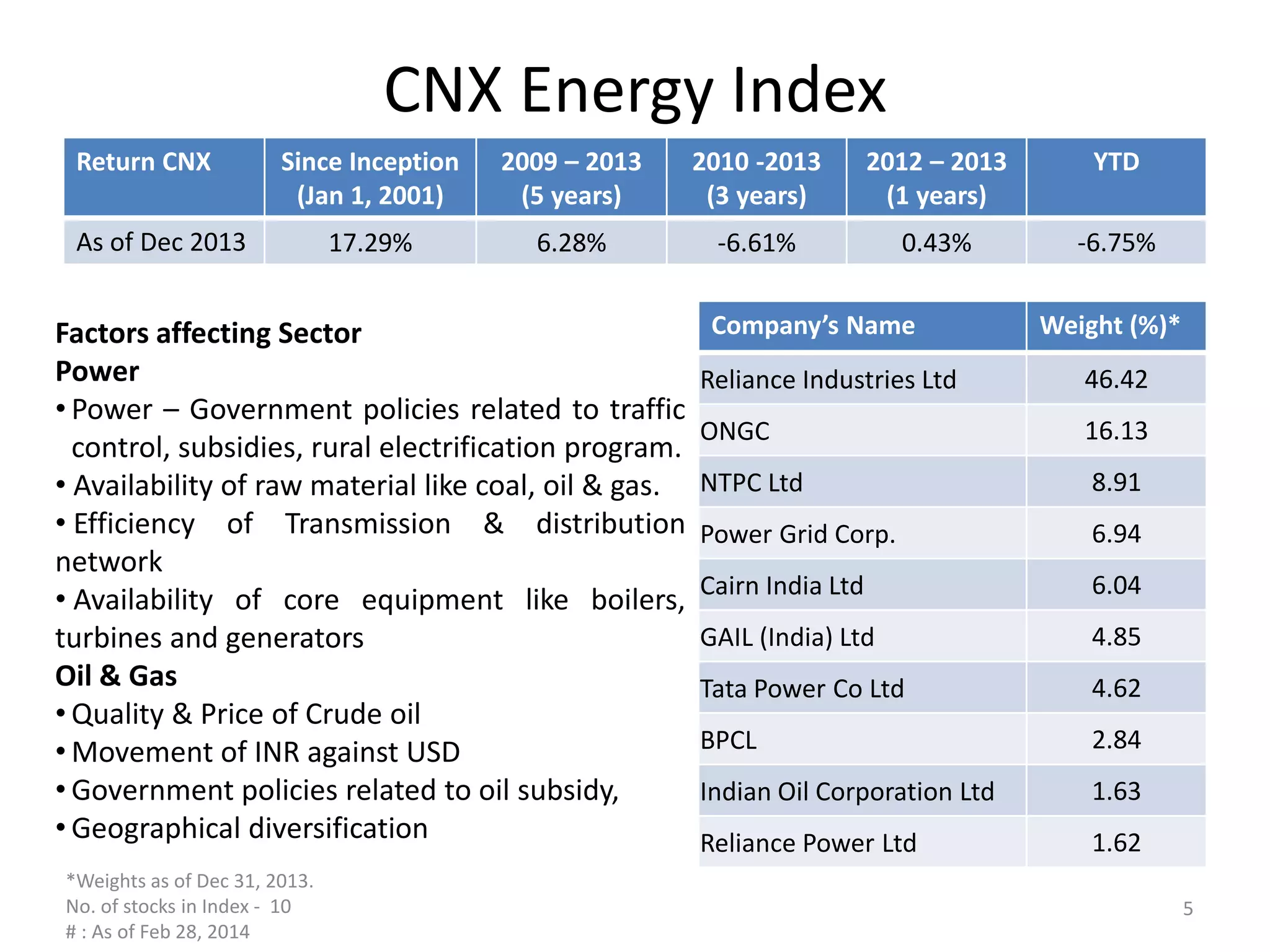

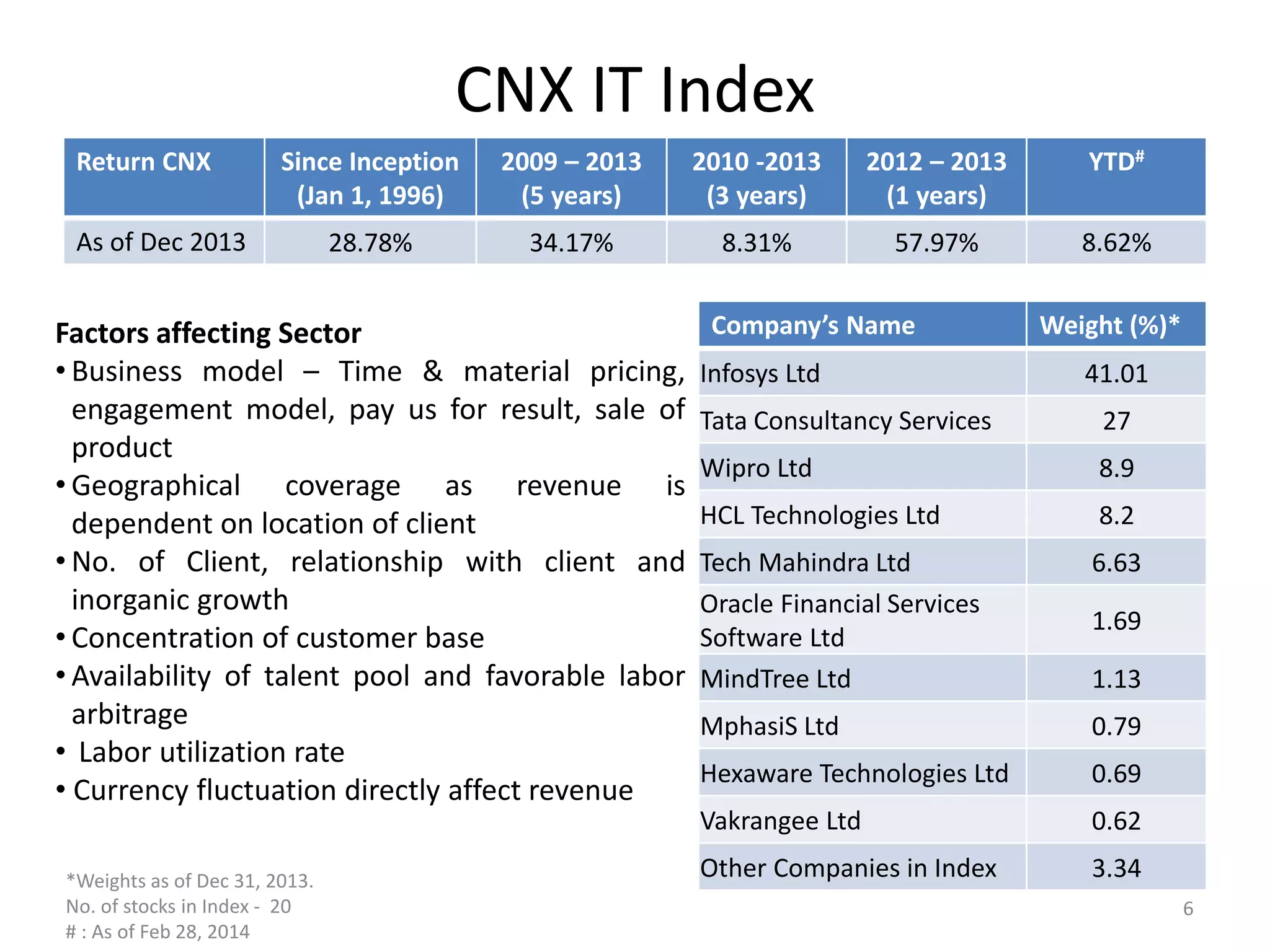

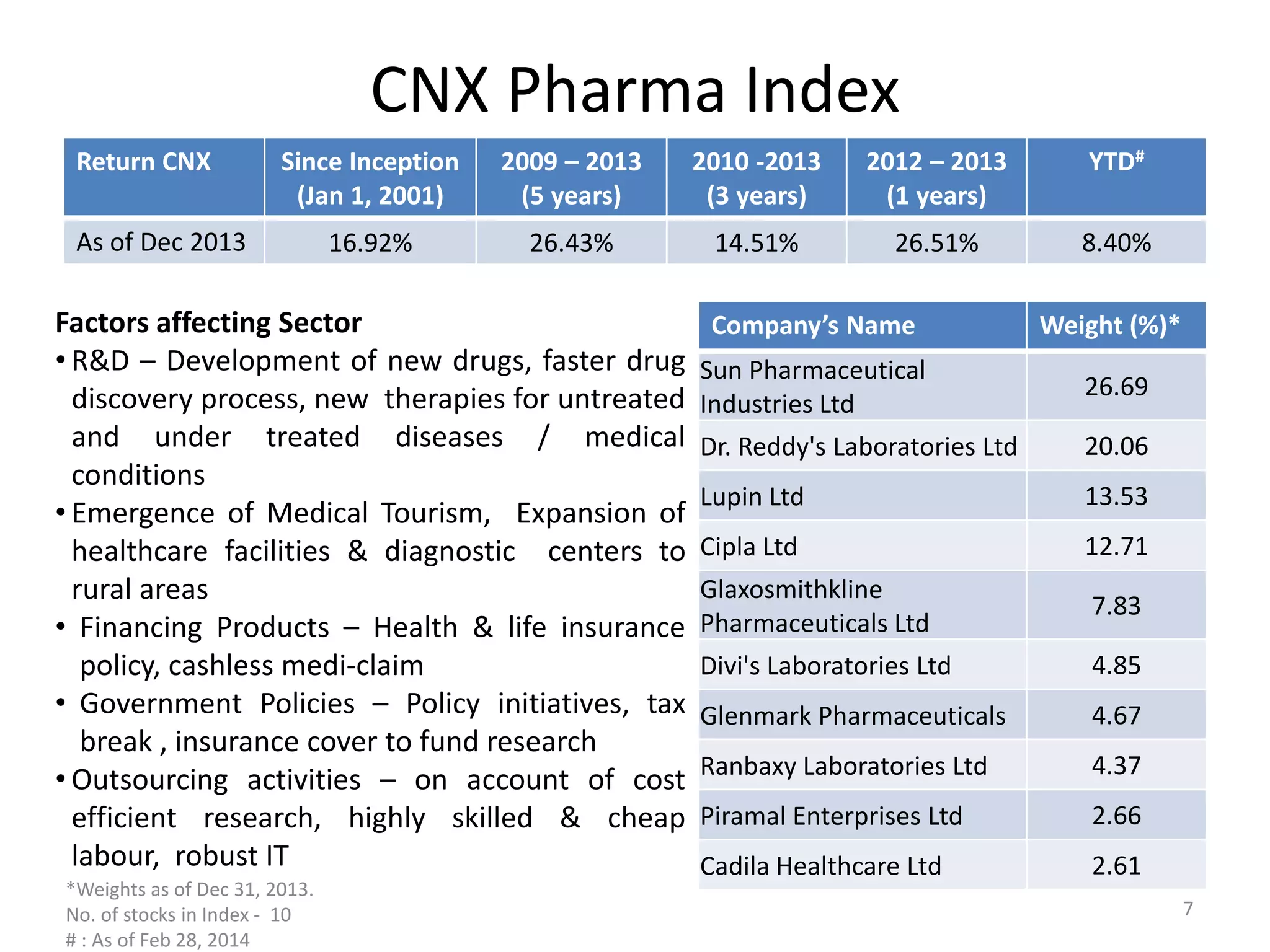

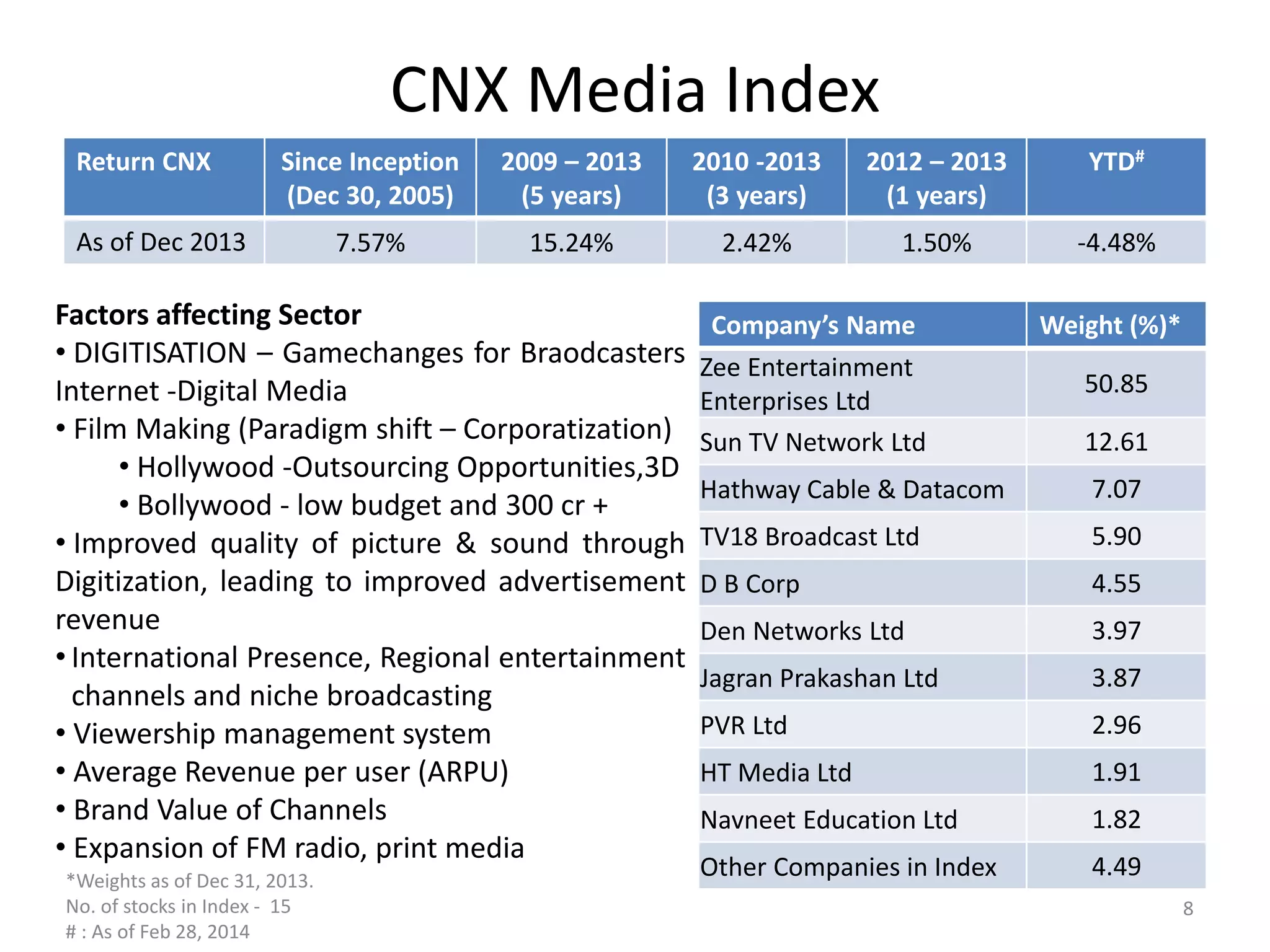

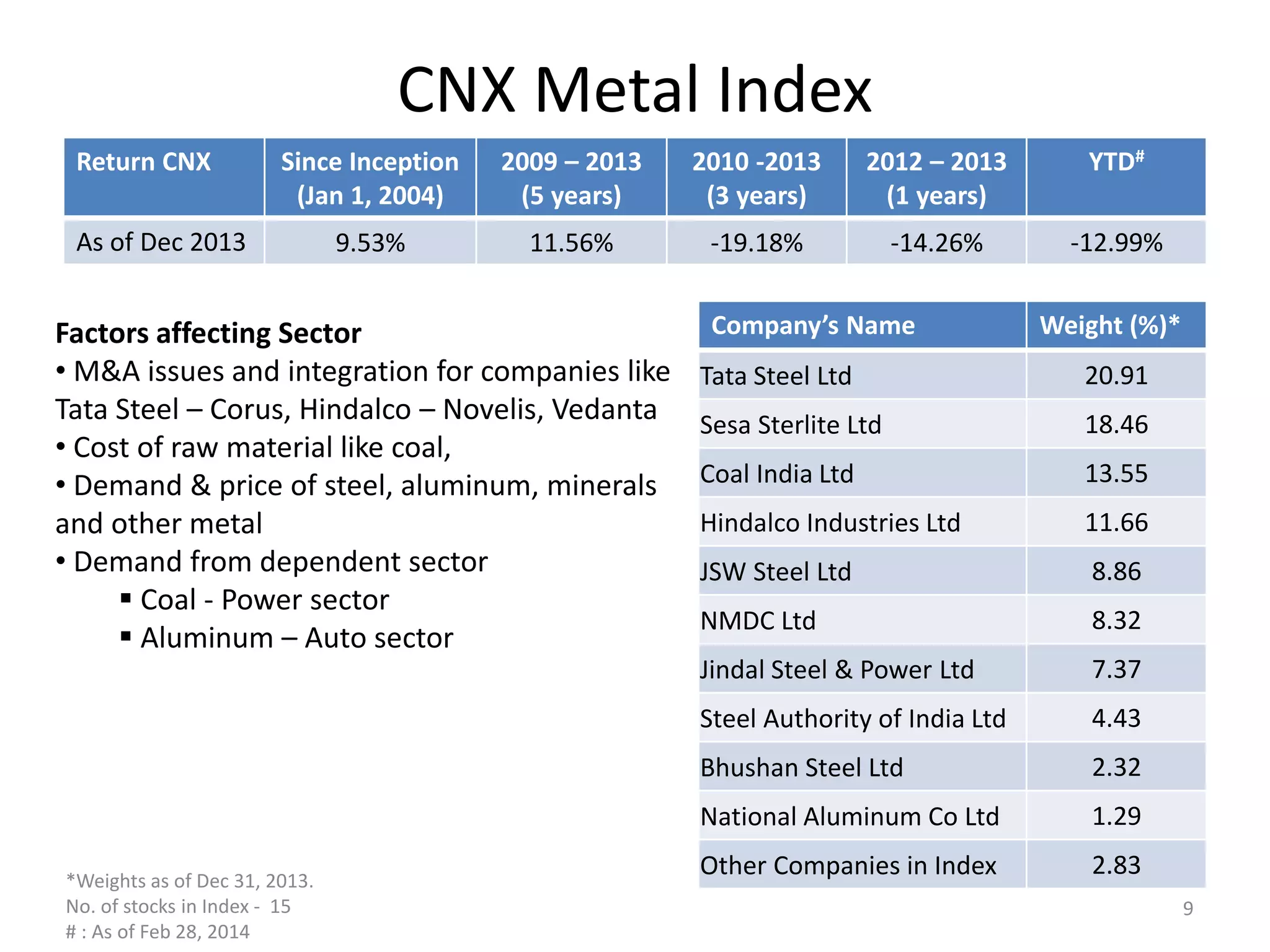

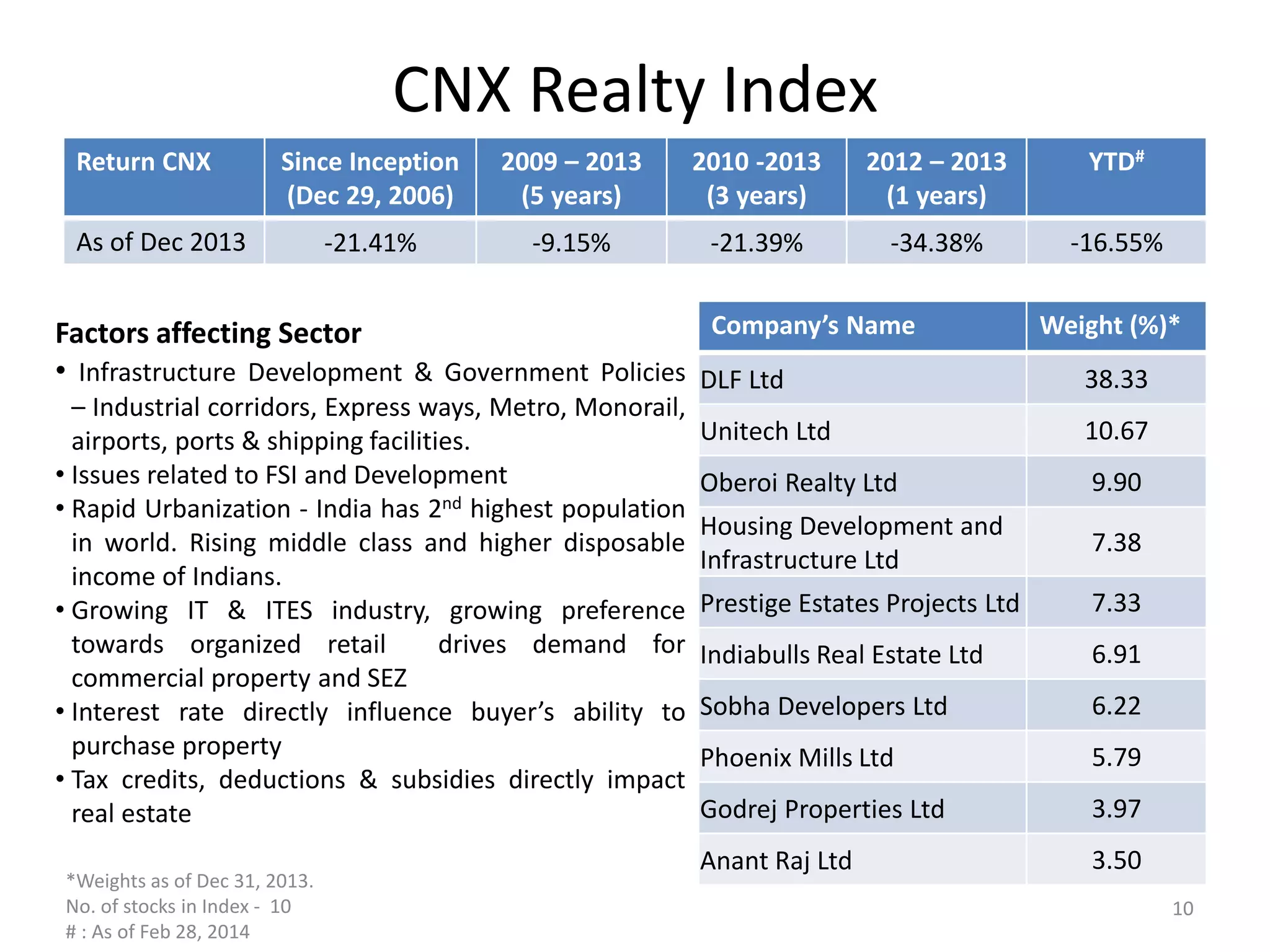

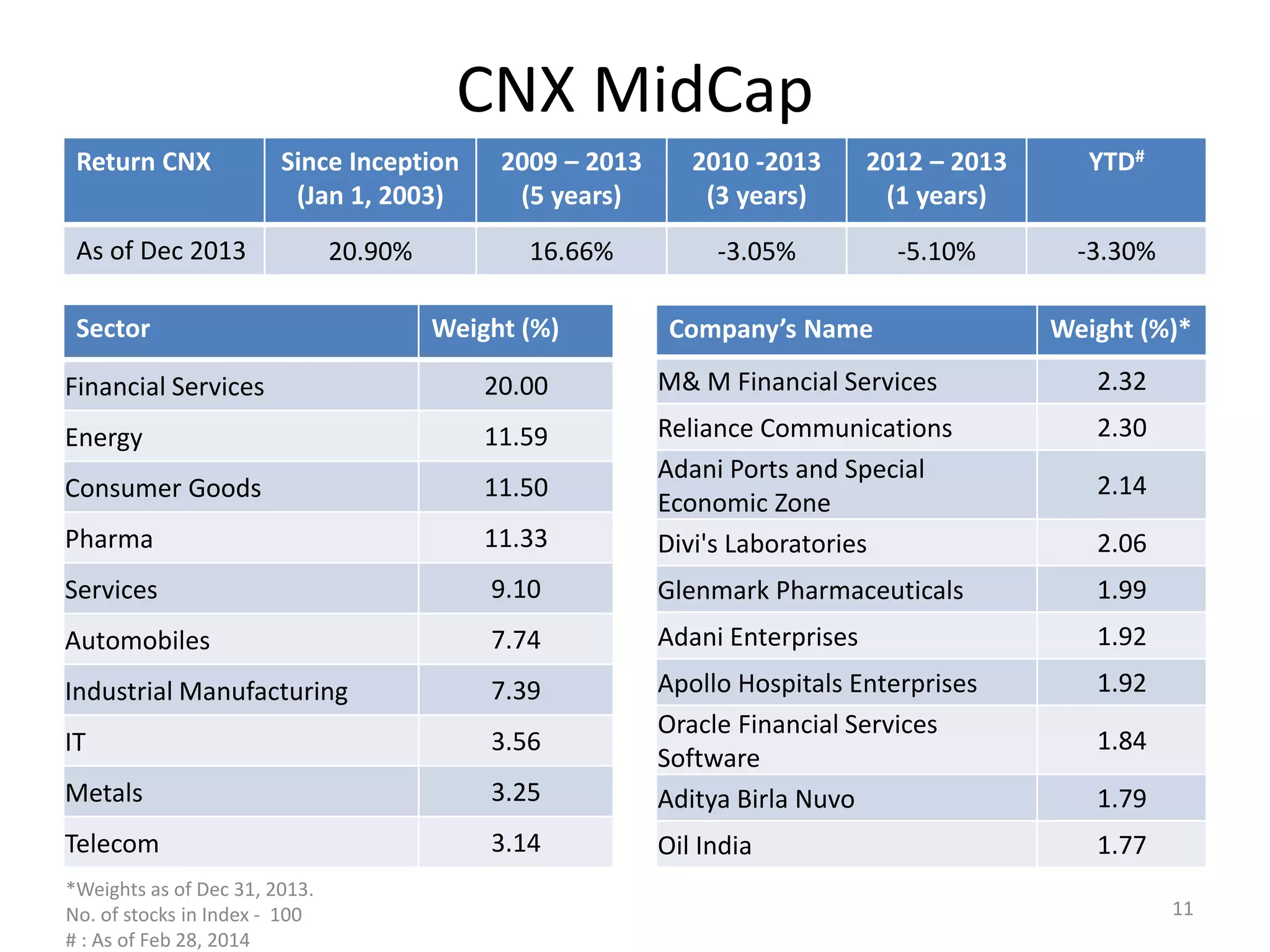

The document provides an analysis of sectorial returns for various Indian stock market indices between 2009-2013 and discusses key factors affecting each sector. It summarizes returns and composition for 11 indices: CNX Auto, CNX Finance, CNX FMCG, CNX Energy, CNX IT, CNX Pharma, CNX Media, CNX Metal, CNX Realty, CNX MidCap. For each sector, it lists the top 10 companies, their weights, and macroeconomic and regulatory factors influencing industry performance.