The document provides an investment analysis on Starwood Hotels & Resorts (NYSE: HOT) conducted by Nick Ennis, Bill Geist, Allen Miller, Mike Mongiardini, Tom Walker & Ryan Williams. Key points include:

- The analysts conducted a discounted cash flow valuation that derived an equity value of $15.1 billion for HOT, implying a slight downside to the current share price.

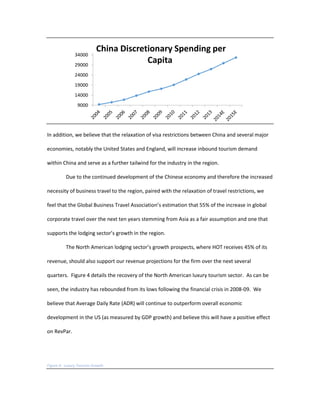

- Growth in the lodging industry, particularly in China and North America, is expected to support increased revenues and profits for HOT.

- HOT's transition to an asset-light business model is expected to improve returns and reduce debt, supporting a higher valuation multiple.