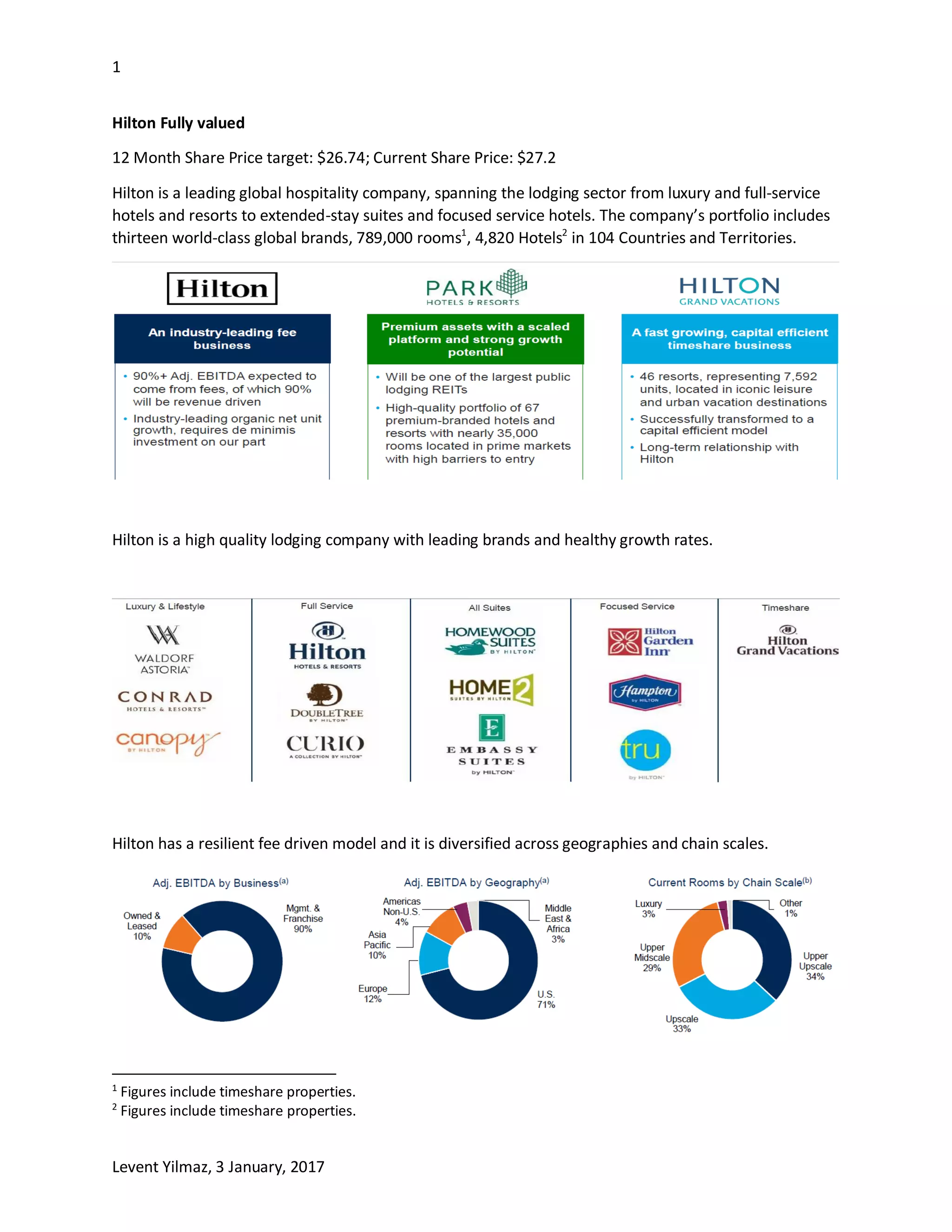

Hilton has a stable share price of $27.2 with a projected target of $26.74, reflecting a strong global hospitality presence across diverse segments. The company is anticipating challenges from economic slowdowns and security threats, but is optimistic about growth potential from new brands and higher franchise fees, with expected annual EBITDA growth of 5% to 8%. Hilton is planning significant capital returns of $3 to $4.5 billion over the next three years, alongside strategic spin-offs of its real estate and timeshare businesses.