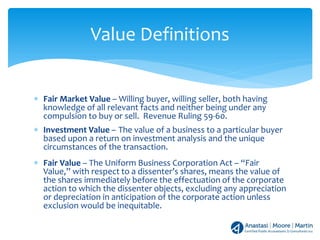

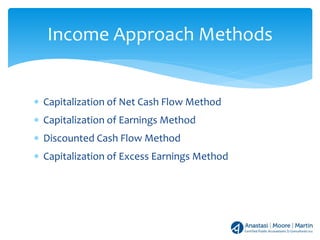

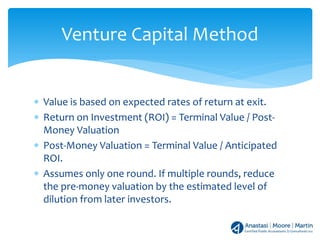

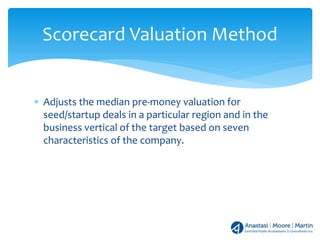

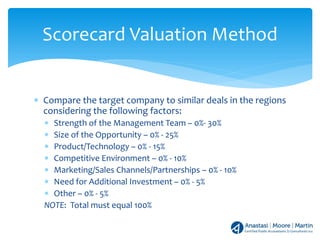

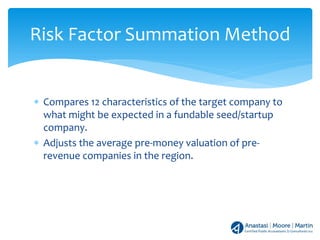

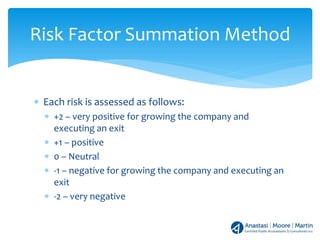

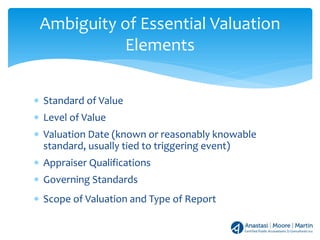

The document discusses methods for valuing early-stage companies, outlining approaches such as asset, income, and market methods, along with specific valuation techniques like the Berkus and scoring systems. It emphasizes the importance of understanding market conditions and investor expectations when determining fair value. Additionally, it covers essential agreements and triggers for buy-sell agreements, including purchase price determination and conditions for share transfers.