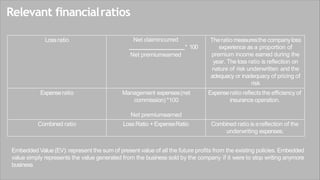

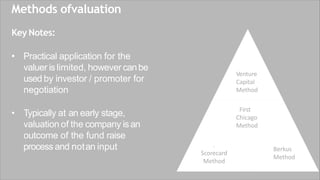

This document discusses various valuation methods that can be used for start-up companies. It describes 4 main methods:

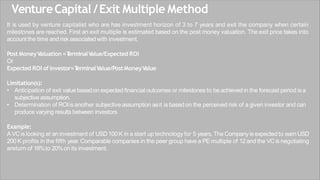

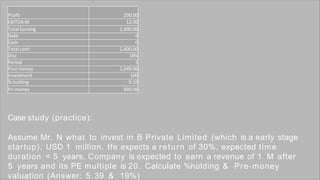

1) Venture capital method which estimates expected return on investment and exit value to determine post-money valuation.

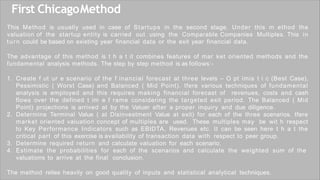

2) First Chicago method which creates financial projections under different scenarios and applies comparable company multiples to estimate valuation.

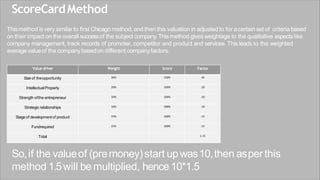

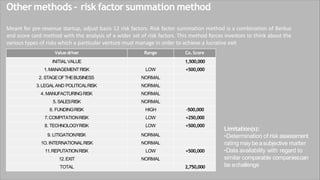

3) Scorecard method which applies weightings to qualitative and quantitative factors to calculate a weighted average valuation.

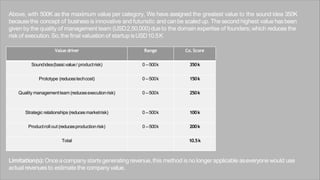

4) Berkus method which assigns valuation ranges based on progress in 5 elements: idea, prototype, management team, strategic relationships, and sales. The document provides examples and limitations of these start-up valuation methods.

![Valuation methodologies

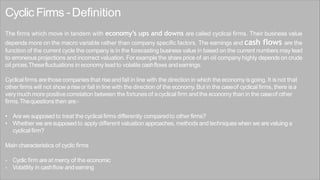

Step 1:

• Normal cyclescenarioDCFvalue[using pastdata]

• Terminal value should be based on normalized

level of profit and not peak or trough

Step 2:

Anew trend line scenario DCFvalue[focus on long

term trendline]

Step 3:

Develop economicrationale

Demand growth

Competition

T

echnology change

Step4:

Assign probability and get weighted value

[Takeweighted DCFbasedon the probabilities of

occurrence differentscenario]

Exampleof cyclic firms:Automobile, oil companies, steel, entertainment companies, airlines, electronics](https://image.slidesharecdn.com/9b-230525090806-6287f006/85/9-B-Specific-valaution-converted-converted-1-1-pptx-29-320.jpg)