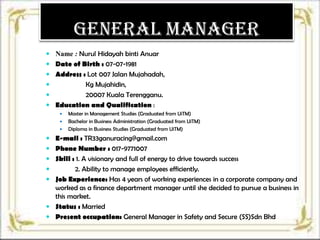

The document provides details about Safety & Secure Sdn Bhd, a partnership company that produces safety products. It includes information on the company background, managers and their roles, organizational structure, marketing, operation and financial plans. The general objectives are to produce affordable safety airbag jackets and compete effectively in the market.