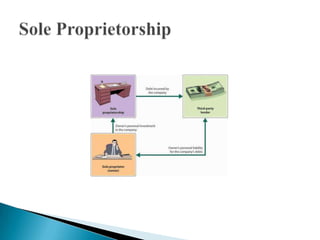

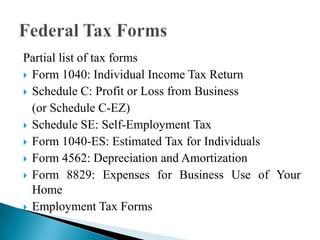

A sole proprietorship is a business owned and operated by a single individual. It is the simplest form of business ownership to establish, requiring no formal registration with government agencies. As the sole proprietor, the individual has total control over the business and assumes all profits and liabilities. They report business income and expenses on their personal tax return and pay self-employment taxes.