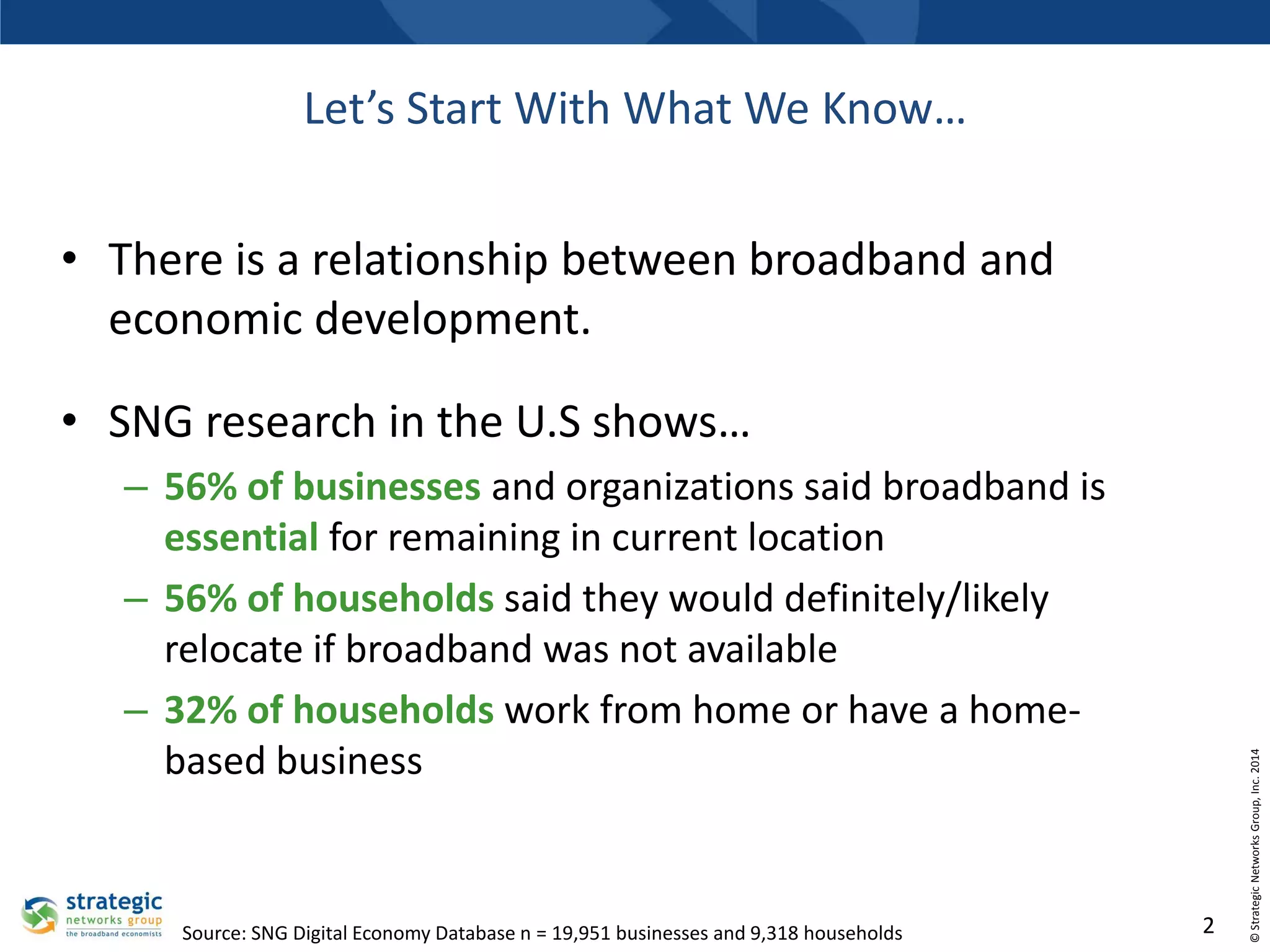

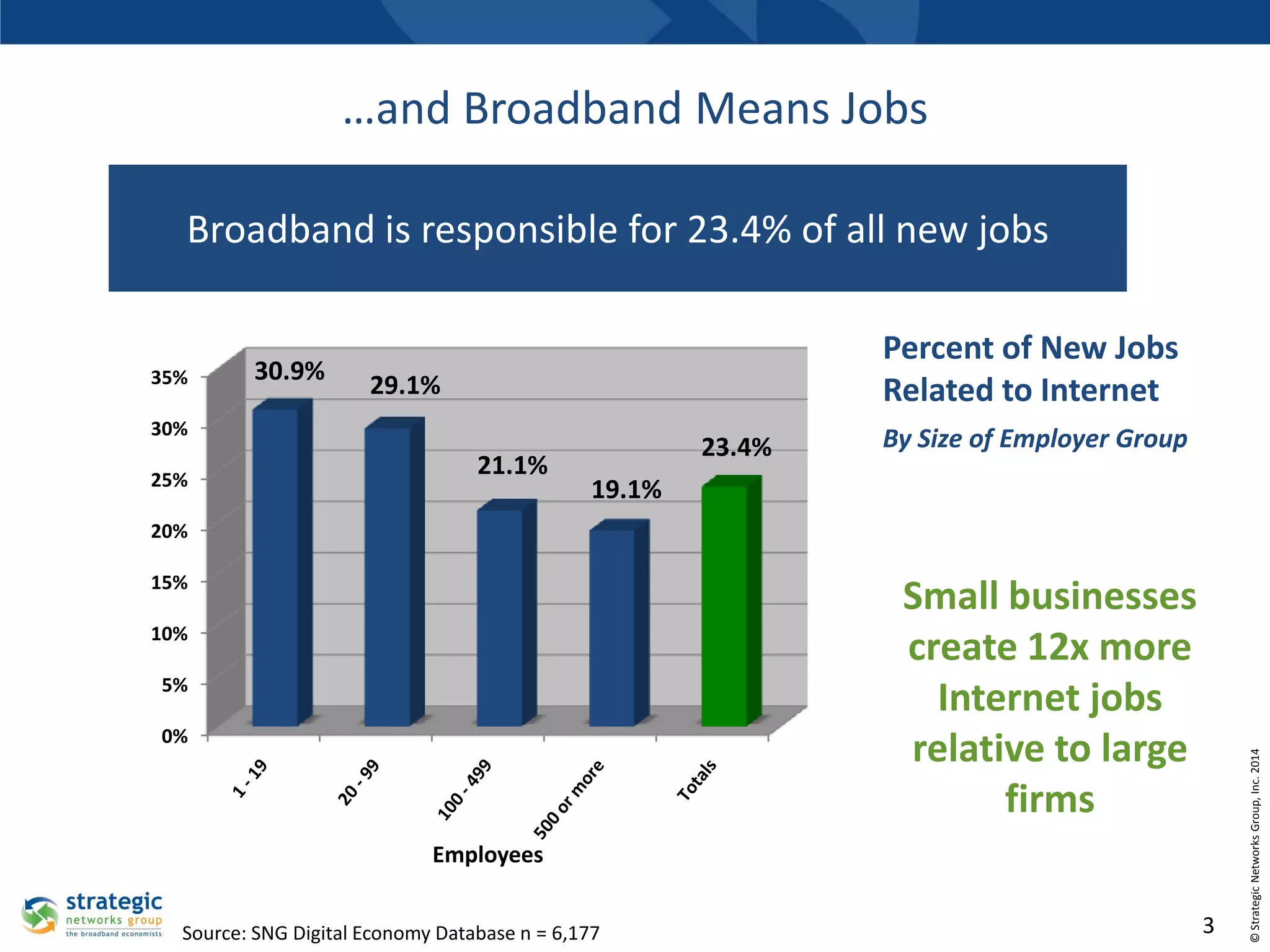

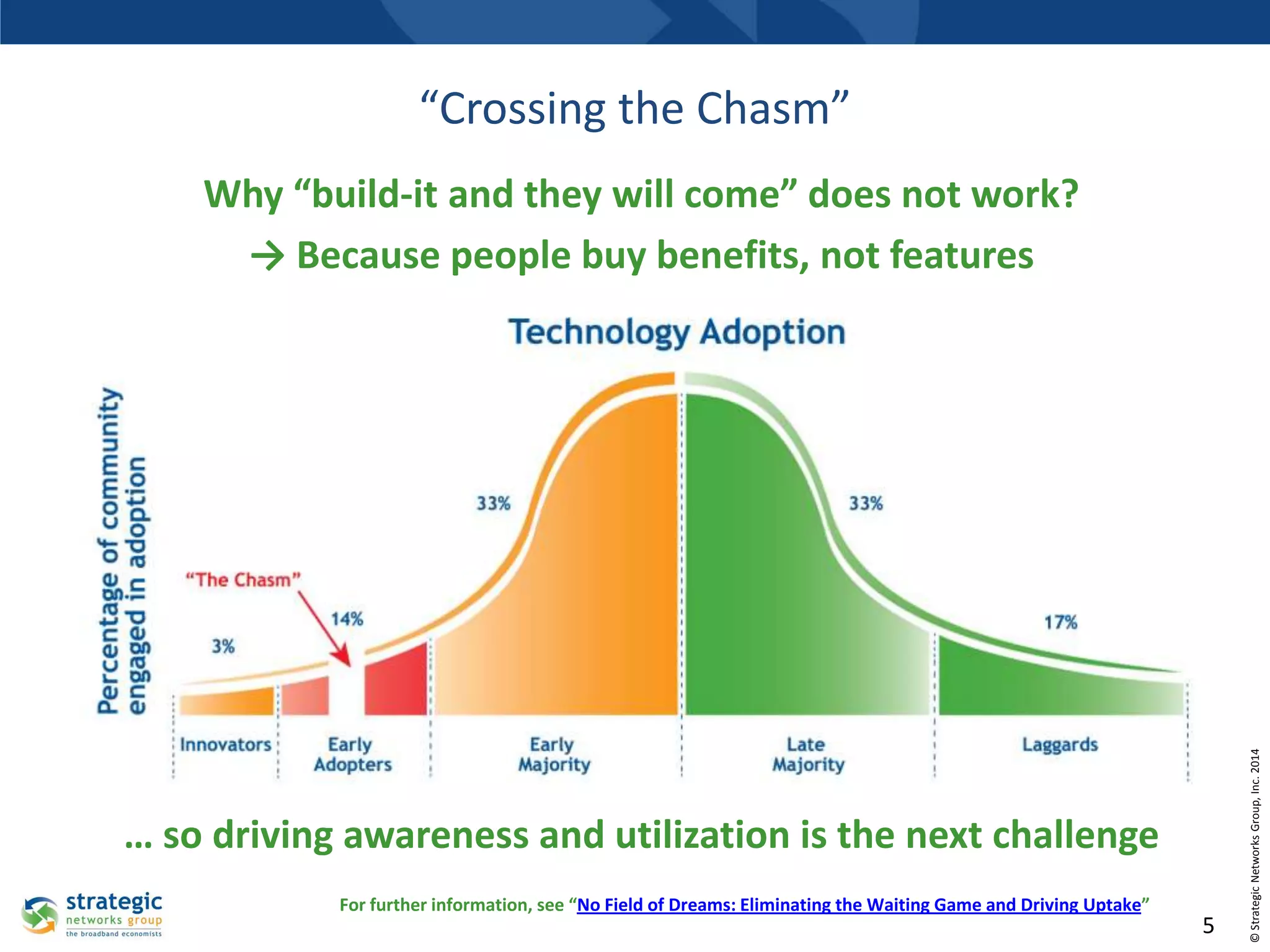

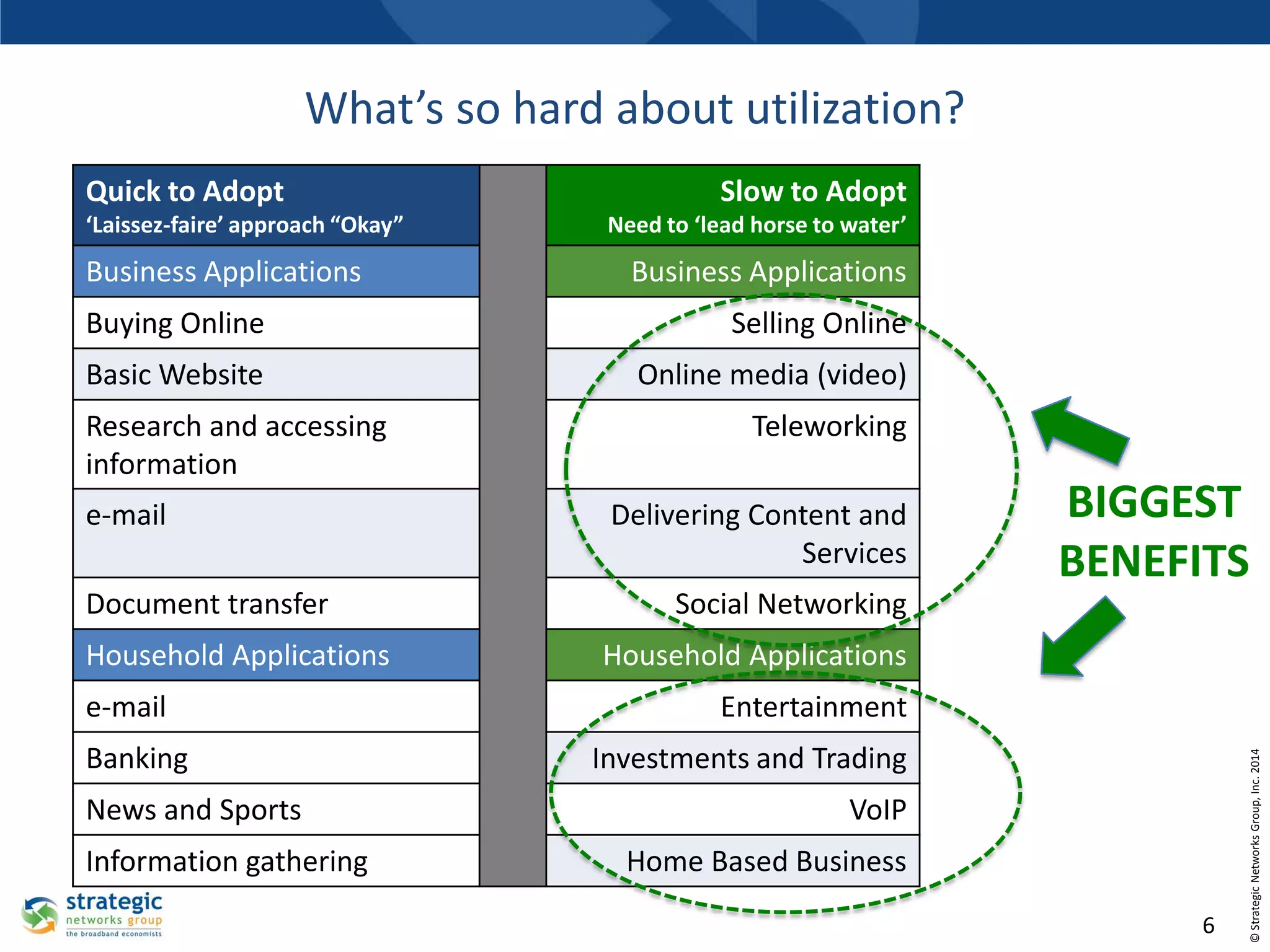

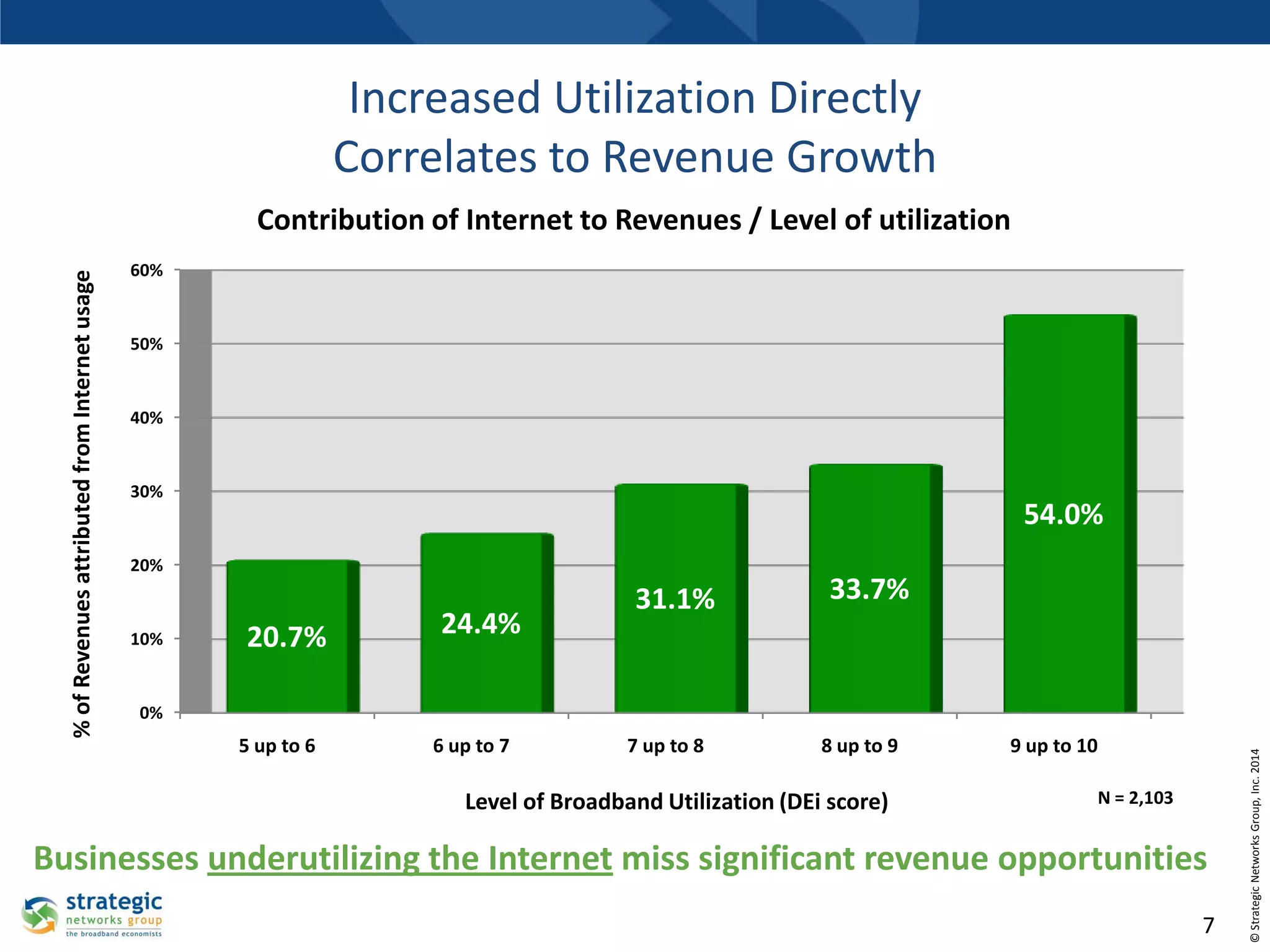

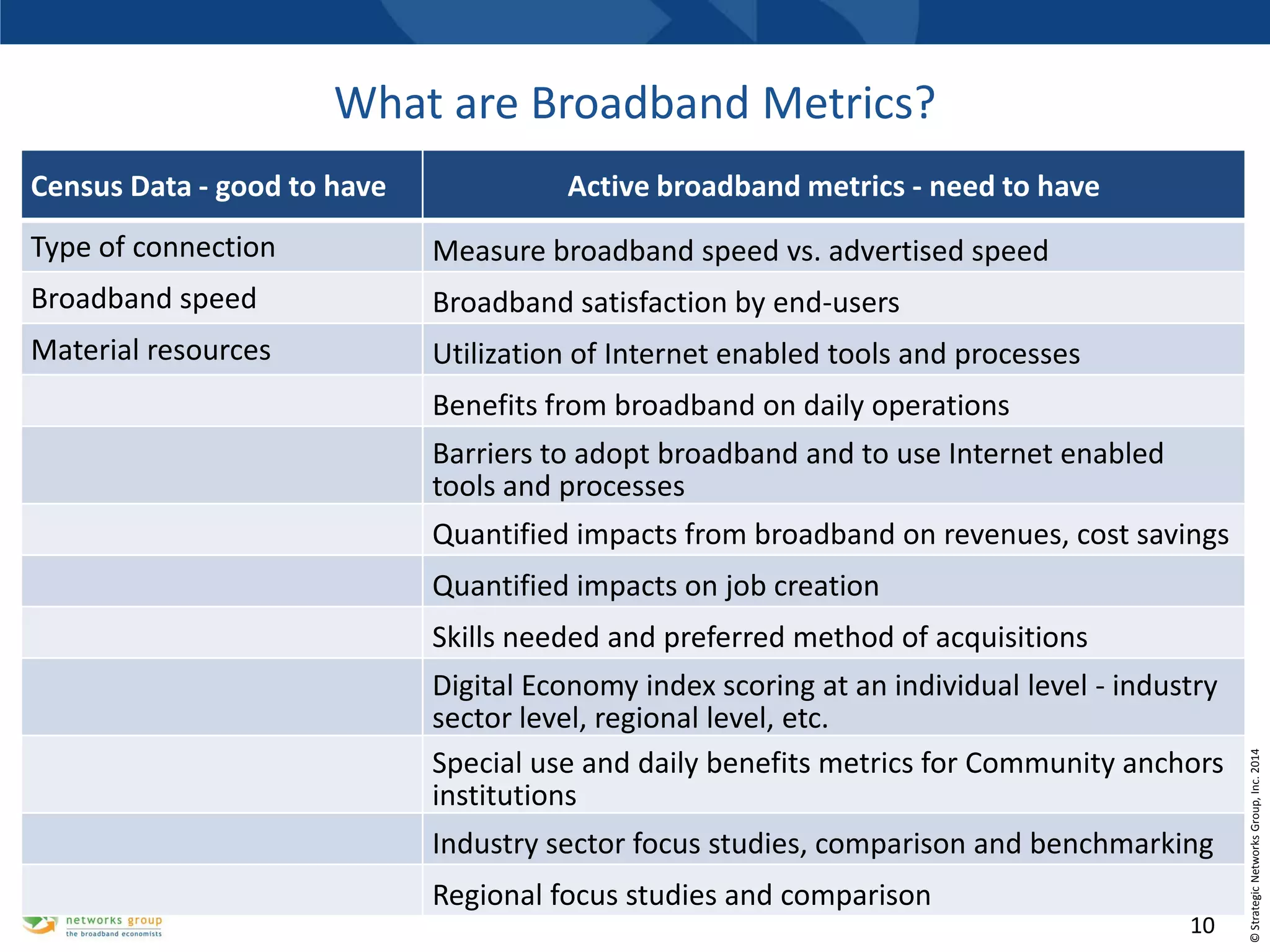

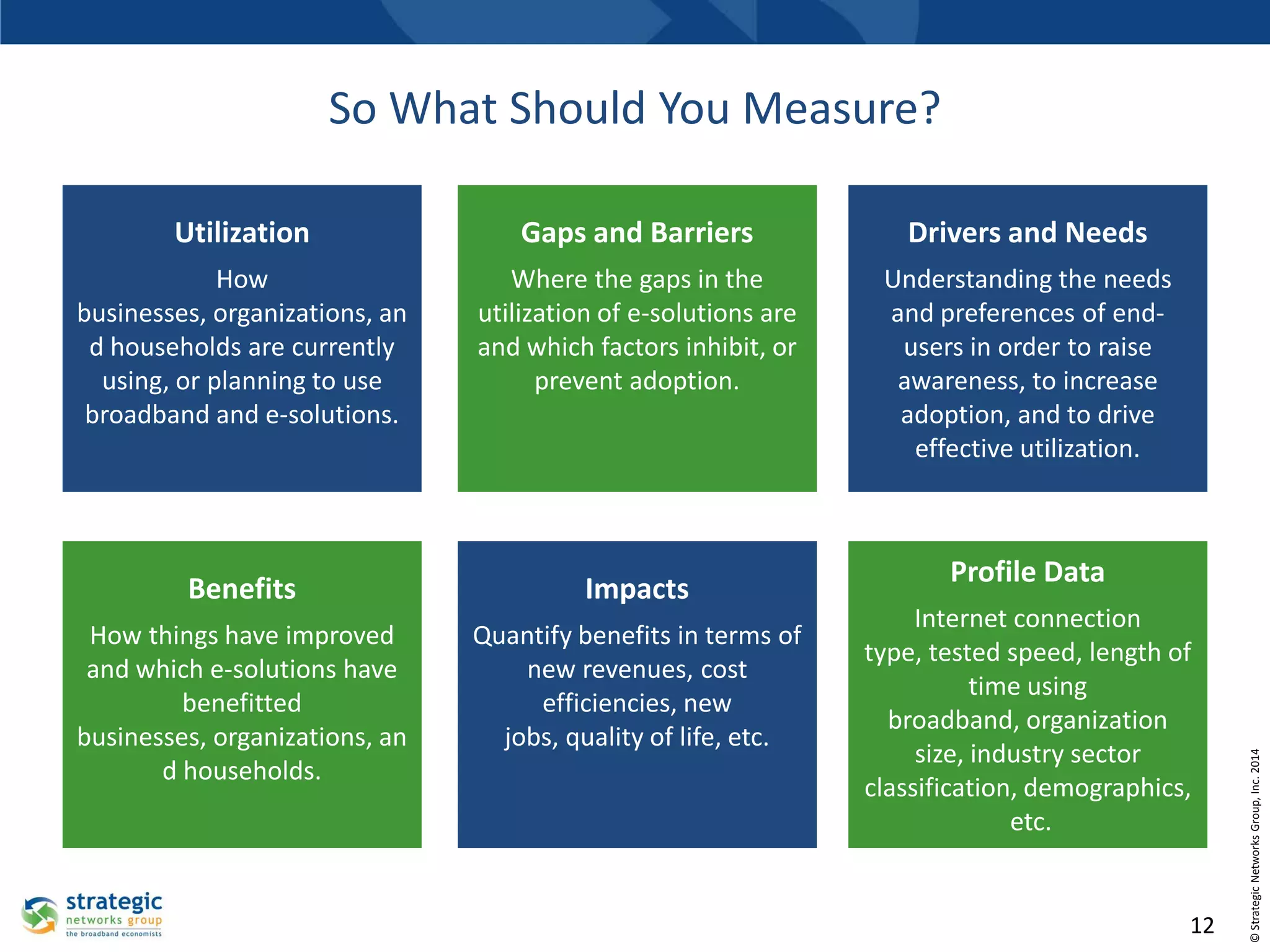

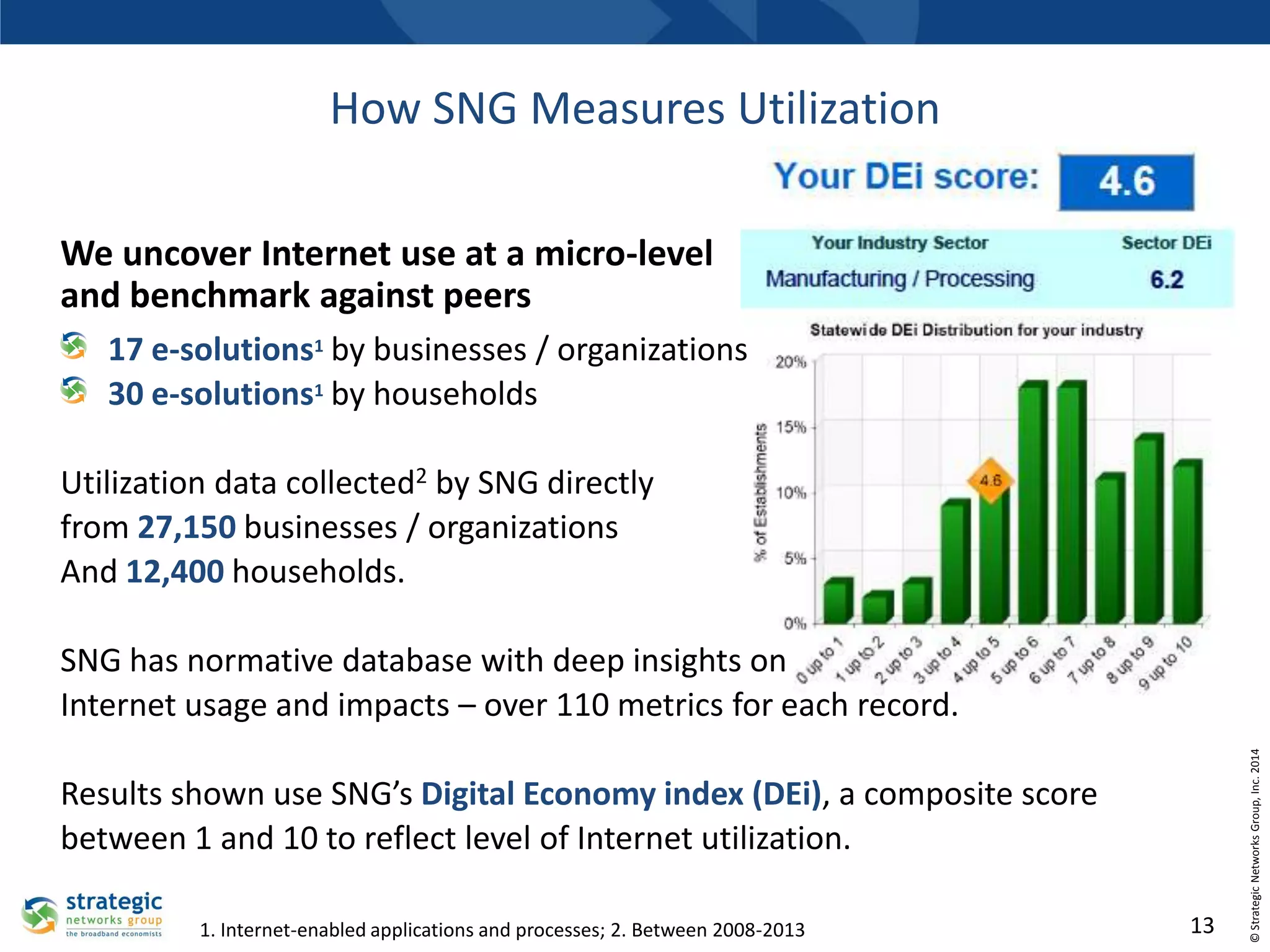

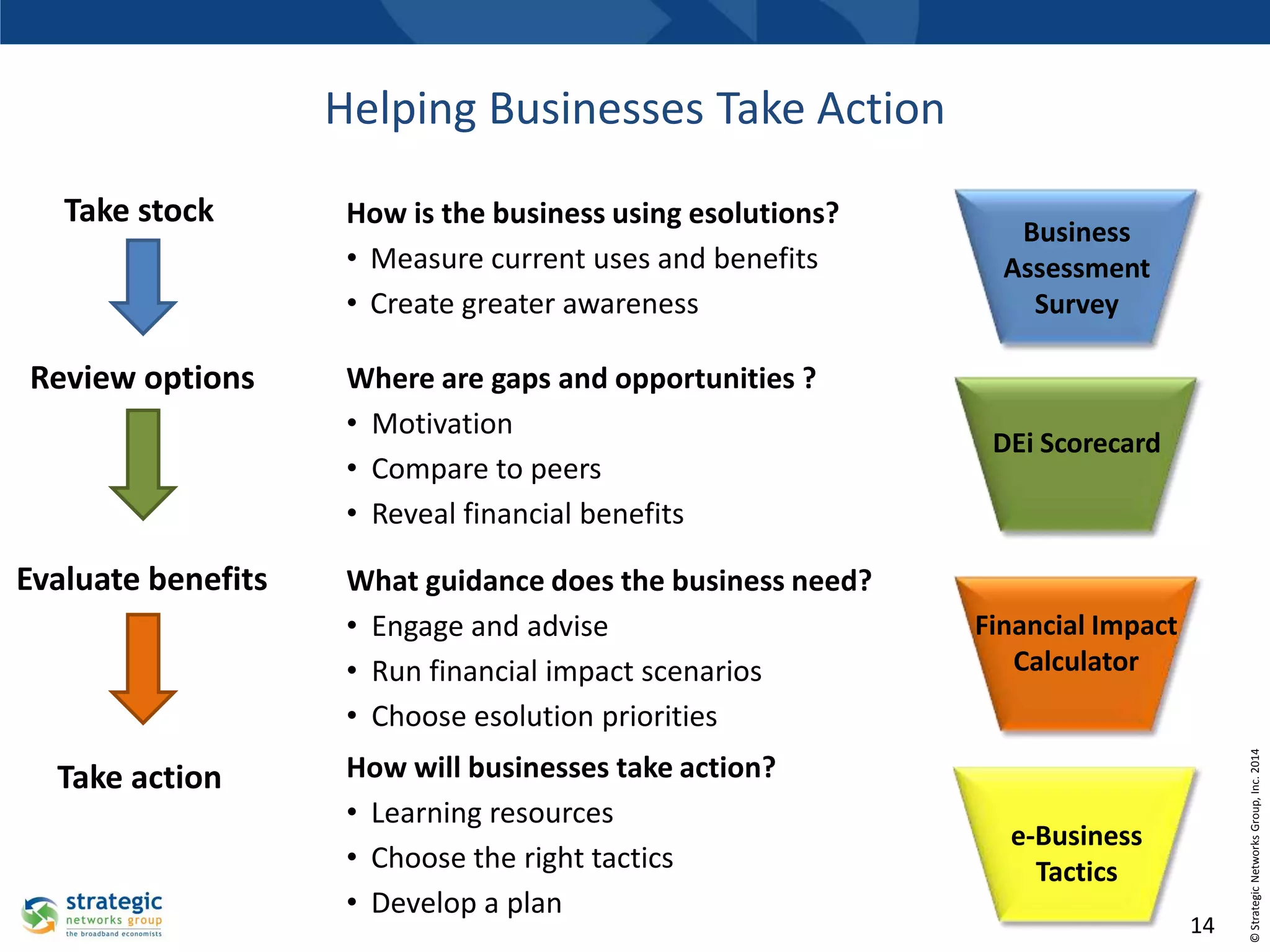

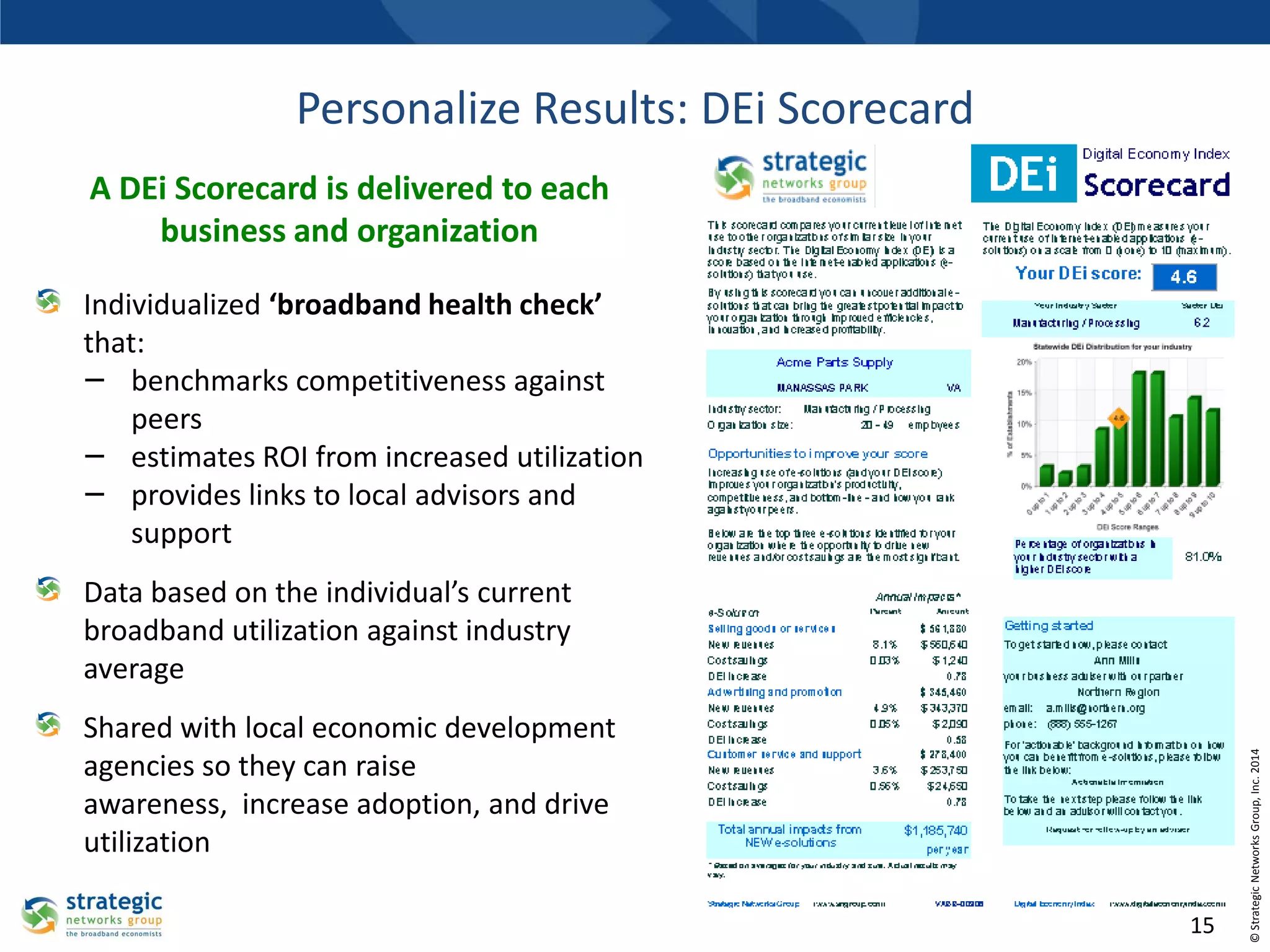

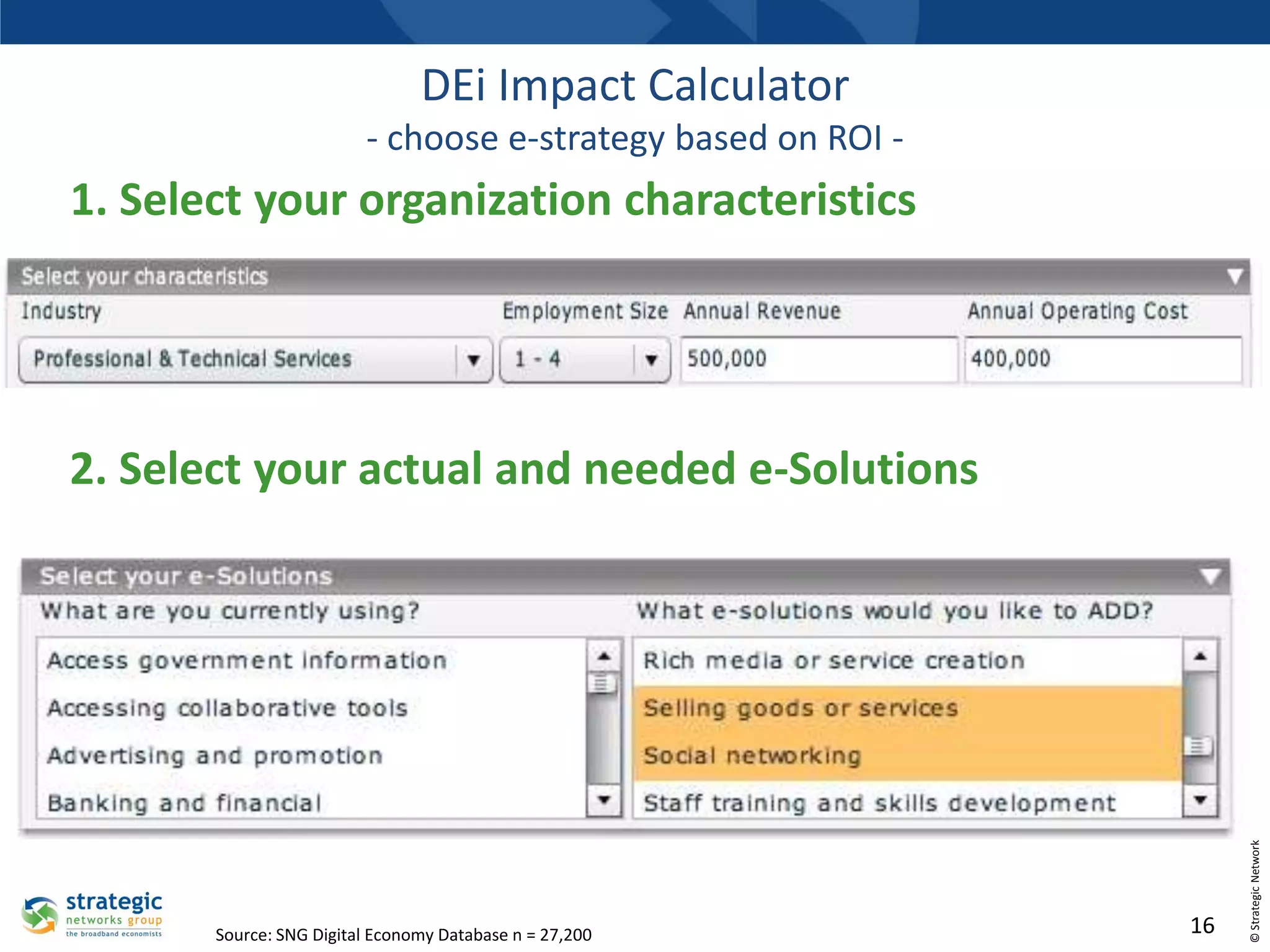

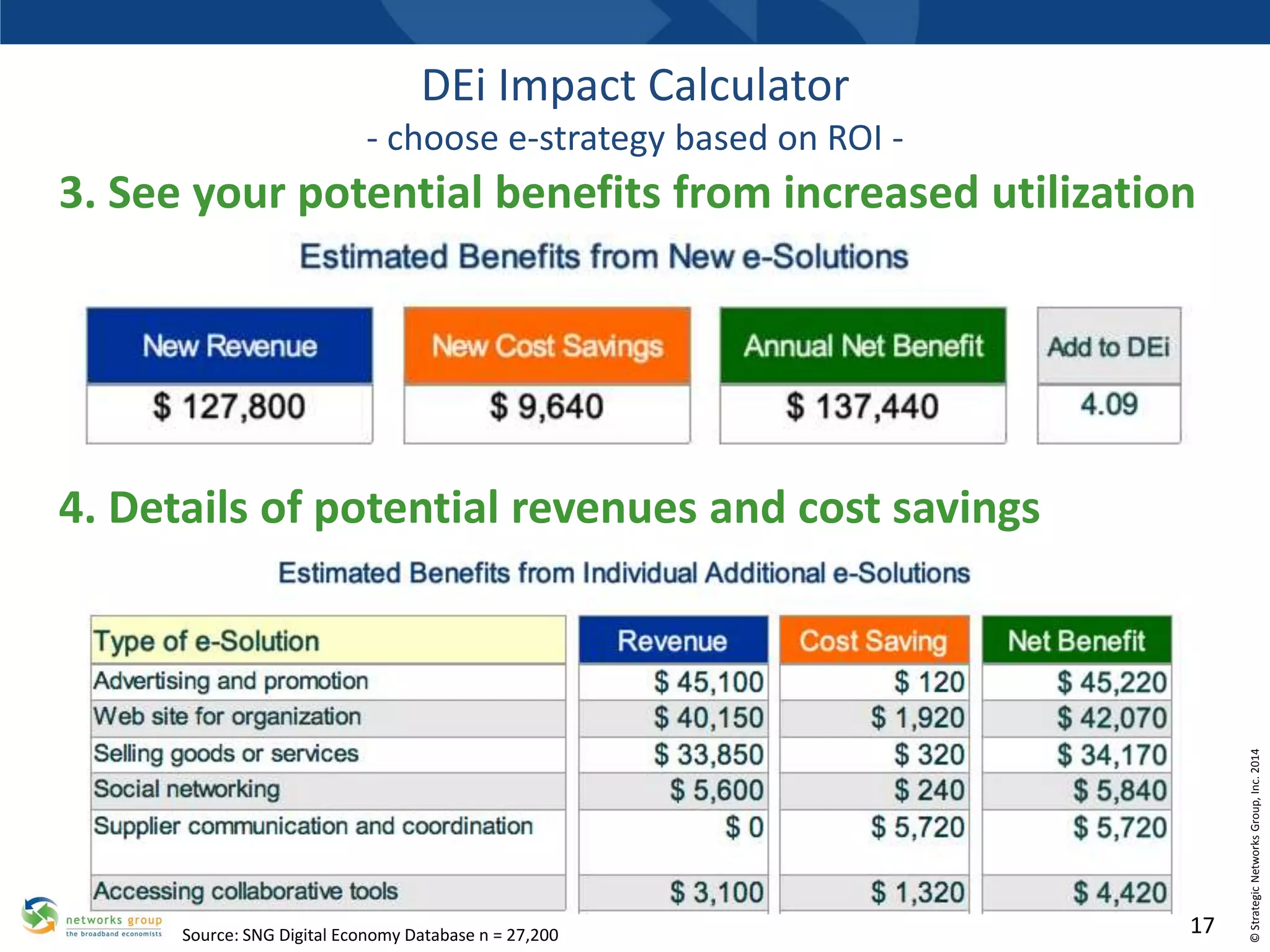

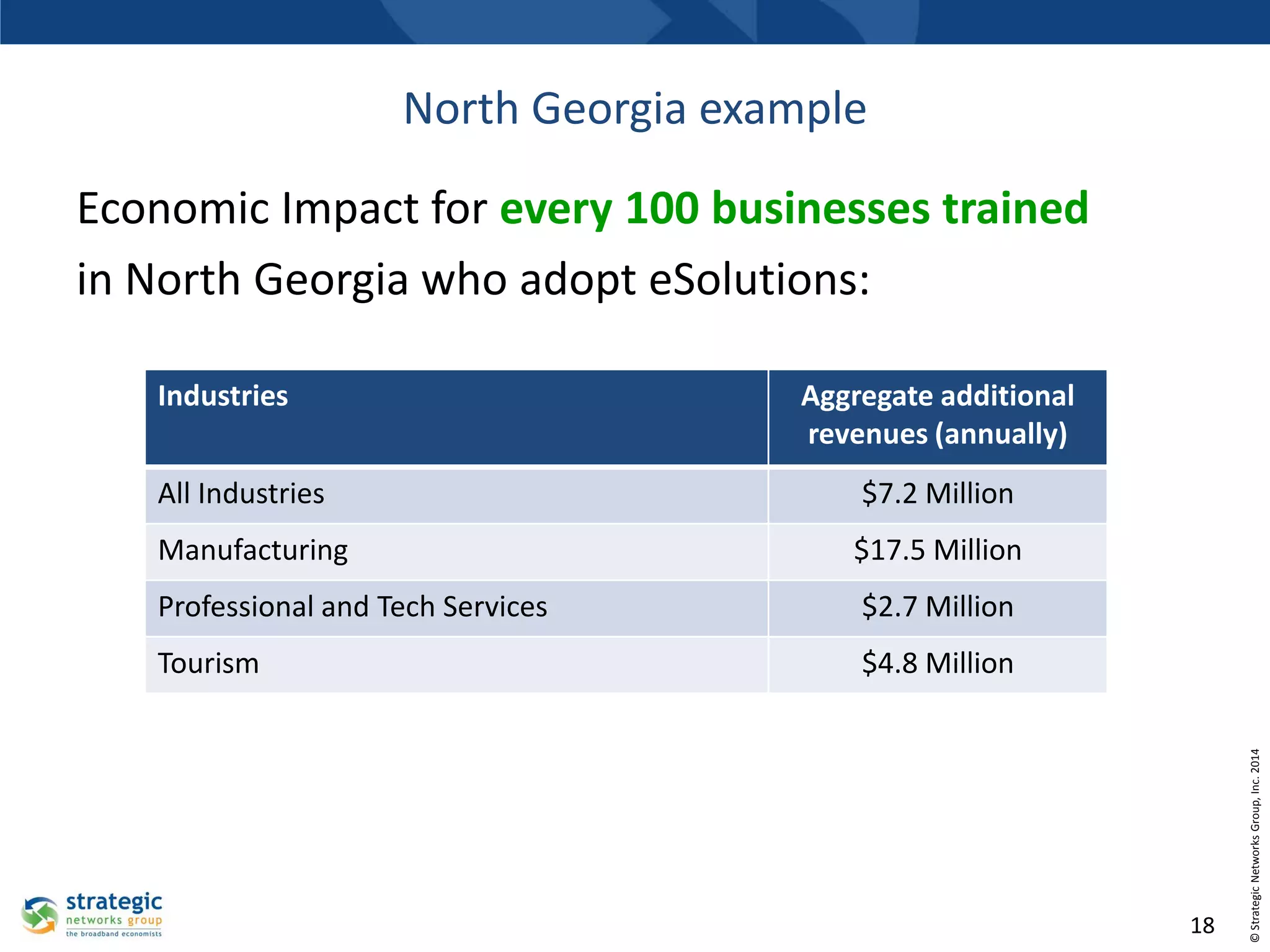

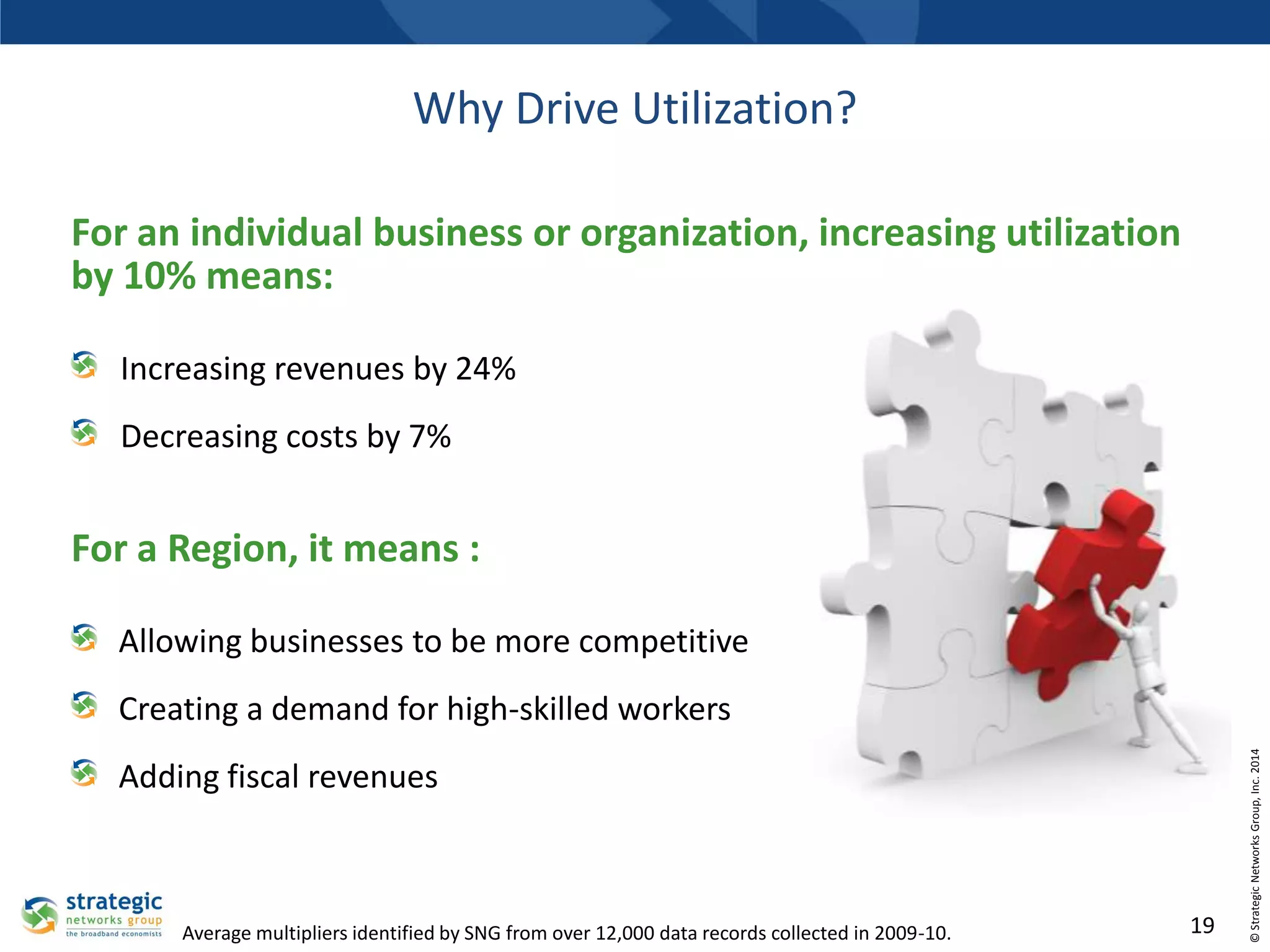

This document discusses the importance of broadband utilization and provides strategies for improving it. It shows that broadband is essential for businesses and economic development, and is responsible for 23.4% of new jobs. While availability and adoption of broadband are important, driving awareness and utilization presents the next key challenge. Metrics for measuring utilization, gaps, impacts, and profiles can help understand markets and guide planning. Tools like utilization scorecards and impact calculators help businesses evaluate opportunities to increase revenues and decrease costs through improved broadband adoption. Regions that boost utilization can expect economic benefits like more competitive businesses, added fiscal revenues, and demand for high-skilled workers.