Embed presentation

Download to read offline

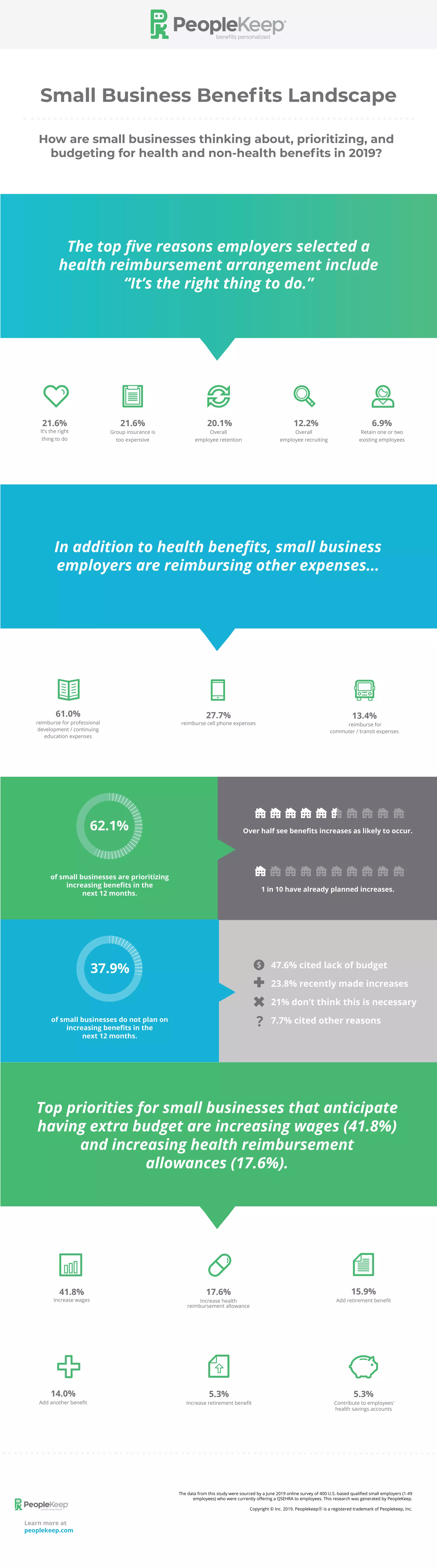

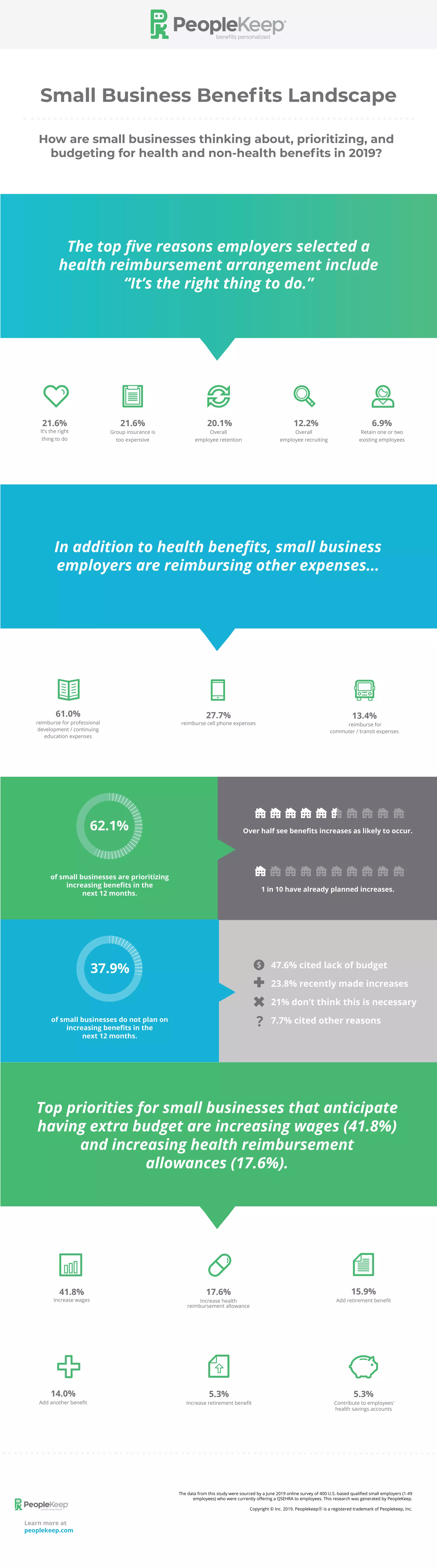

The document discusses a survey of small employers (1-49 employees) regarding their use of health reimbursement arrangements (QSEHRA) and benefits budgeting. Key findings indicate that the top reasons for selecting QSEHRA include ethical considerations and the high cost of group insurance, while employers prioritize increasing wages and health reimbursement allowances. Additionally, many small businesses plan to increase benefits, although a significant portion do not plan any increases due to budget constraints.