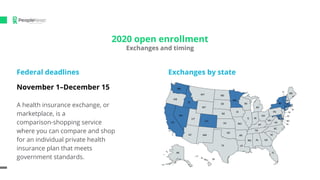

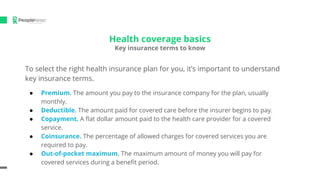

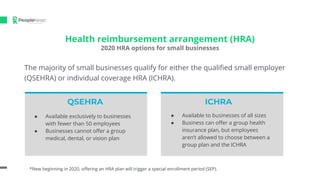

The document provides an overview of open enrollment for health insurance in 2020, explaining its significance and timing for individual and employer-sponsored plans. It outlines key concepts like premiums, deductibles, and health reimbursement arrangements (HRAs), emphasizing the advantages for small businesses. The presentation also highlights the importance of understanding health insurance options and funding mechanisms to better support employees' health benefits.