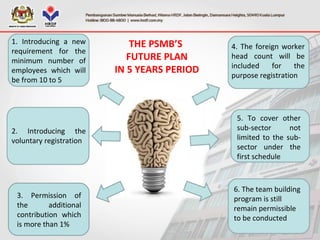

The document provides an overview of the Human Resources Development Fund (HRDF) in Malaysia and discusses its enforcement of the PSMB Act 2001. It covers the following key points:

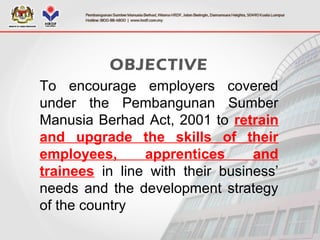

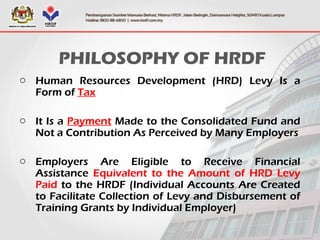

- An introduction to HRDF, its vision, mission and objectives in encouraging workforce training.

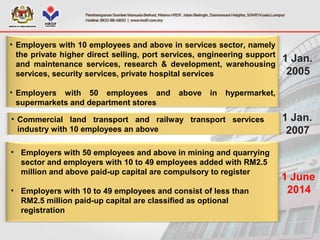

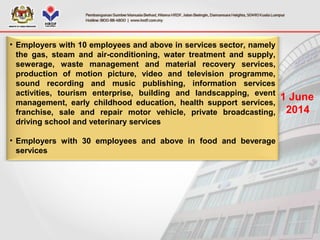

- The current sectors covered under the Act and HRDF's plan to expand to 19 new sub-sectors.

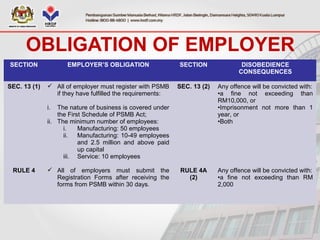

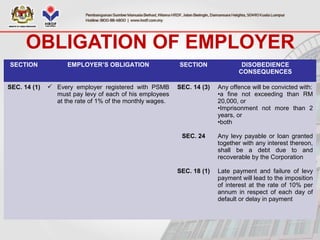

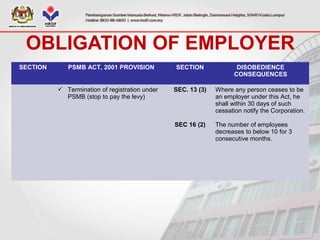

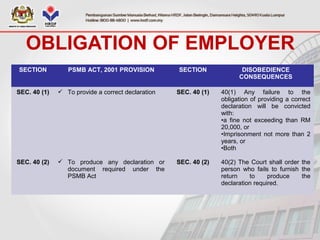

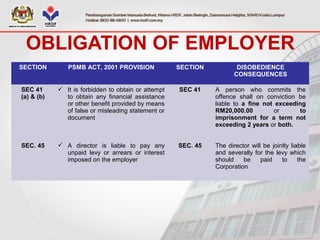

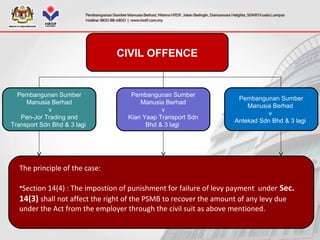

- The liabilities, offenses and penalties outlined in the Act for non-compliance by employers including failure to register or pay levies.

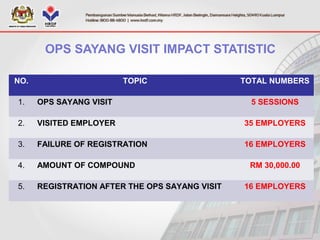

- HRDF's enforcement plan which includes premises visits, collaboration with other agencies, and an "Ops Sayang" visit program that issued compounds to non-compliant employers.

![Employer Information Statement

FORM 1A

A requirement stipulated under

[Pembangunan Sumber Manusia

Berhad (Registration of Employers and

Payment of Levy) Regulation 2001] in

gathering employers' information

before determining the liability of the

employers](https://image.slidesharecdn.com/slide-150508023241-lva1-app6891/85/HRDF-31-320.jpg)