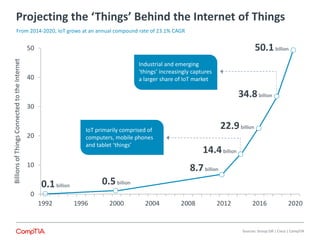

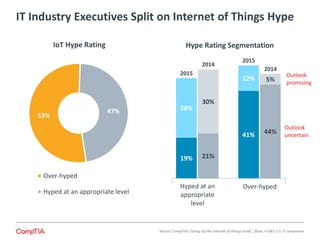

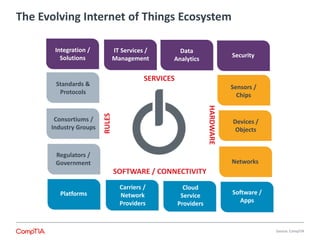

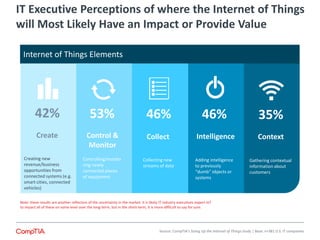

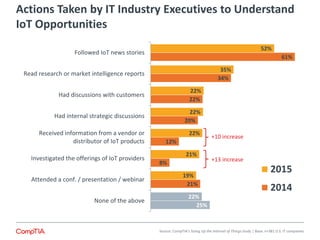

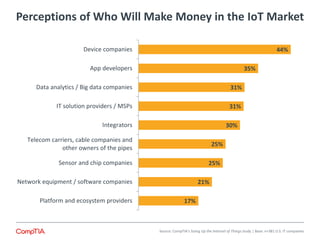

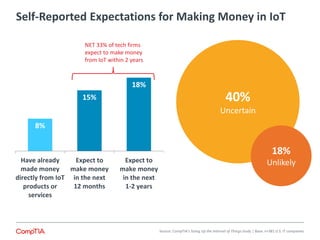

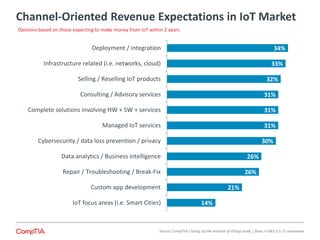

The CompTIA report from September 2015 outlines the growth and potential of the Internet of Things (IoT), projecting a compound annual growth rate of 23.1% from 2014 to 2020 with an anticipated 50.1 billion connected devices by 2020. It highlights the mixed perceptions among IT executives regarding IoT hype, with varying expectations on its market impact and profitability, suggesting uncertainty in how companies will monetize IoT opportunities. Key focus areas identified include smart cities, data analytics, and integrated solutions, reflecting both immediate challenges and long-term revenue potential in the IoT landscape.