Embed presentation

Download to read offline

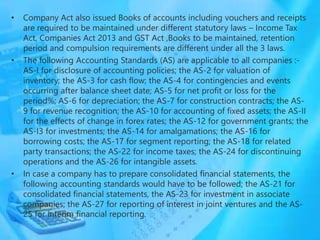

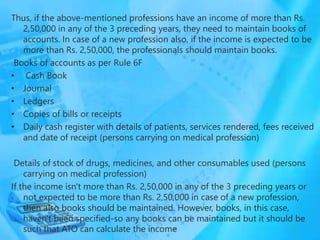

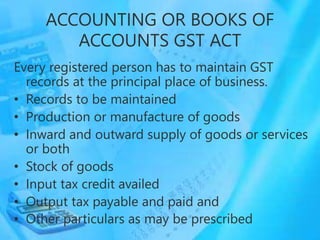

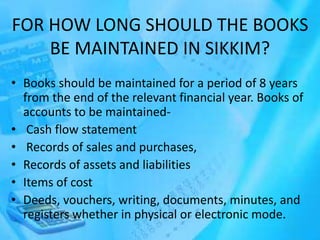

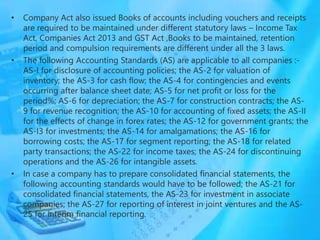

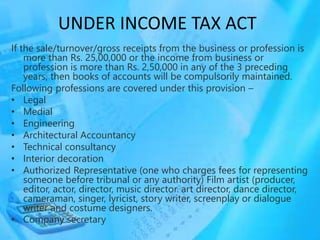

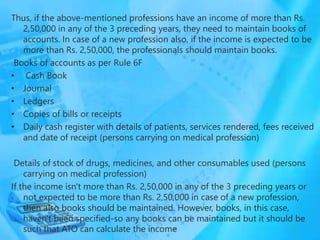

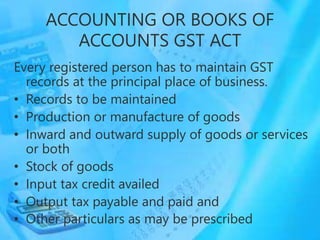

This document provides information about accounting laws and provisions for maintaining books of accounts in Sikkim. It discusses the requirements under the Companies Act 2013, Income Tax Act, and GST Act. The key points are: - Companies must prepare financial statements according to accounting standards issued by the central government and maintain books of accounts for 8 years. - Under the Income Tax Act, certain professions must maintain books if gross receipts or income exceed thresholds. - The GST Act requires maintaining records of production, supply, stock, input tax credit, and output tax. - The document outlines the types of books and accounts that must be kept according to different statutes.