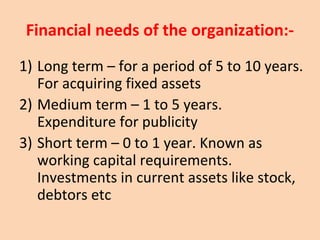

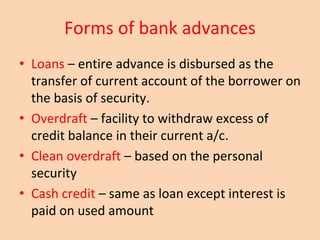

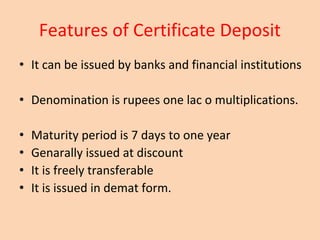

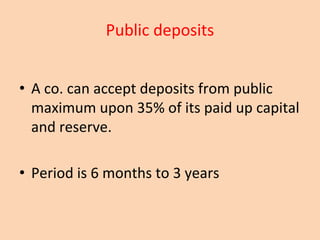

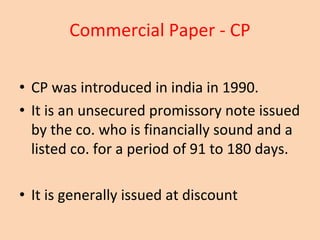

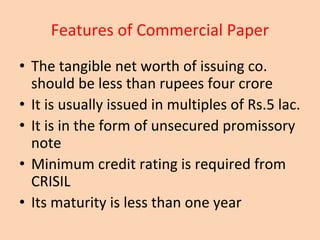

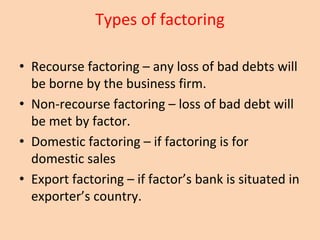

Short-term finance, or working capital financing, is typically for needs lasting less than a year, often due to cash flow inconsistencies or seasonal operations. Various sources include trade credit, bank advances, commercial papers, and factoring, each with specific terms and features. These financing options are crucial for managing current assets and ensuring business liquidity.