This document is the annual report and accounts for Shefa Yamim for 2017. It provides an overview of the company's operations, including:

- Conducting bulk sampling programs in Zones 1 and 2 of the Kishon Mid-Reach project area, collecting over 4,000 tonnes of gravel.

- Successfully treating nearly 3,000 tonnes of gravel at its operational site, finding over 1,000 carats of gemstones including moissanite, sapphire, ruby, and hibonite.

- Receiving a new exploration permit and publishing an updated project report.

- Going public on the London Stock Exchange in December 2017, raising £4.15 million.

- Appointing

![27

Shefa Yamim | Annual Report & Financial Statements 2017

BUSINESS REVIEW & STRATEGIC REPORT

Introduction

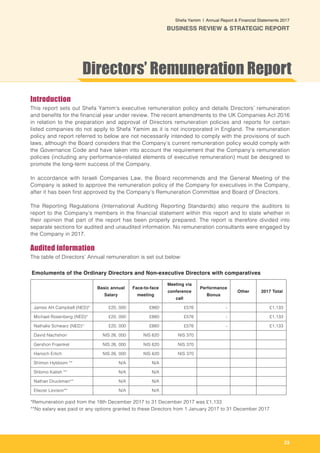

This report sets out Shefa Yamim’s executive

remuneration policy and details Directors’

remuneration and benefits for the financial year

under review. The recent amendments to the UK

Companies Act 2016 in relation to the preparation

and approval of Directors remuneration policies

and reports for certain listed companies do not

apply to Shefa Yamim as it is not incorporated

in England. The remuneration policy and report

referred to below are not necessarily intended to

comply with the provisions of such laws, although

the Board considers that the Company’s current

remuneration policy would comply with the

Governance Code and have taken into account

the requirement that the Company’s remuneration

policies (including any performance-related

elements of executive remuneration) must be

designed to promote the long-term success of the

Company.

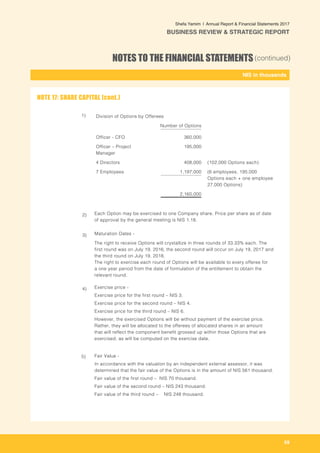

[In accordance with Israeli Companies Law, the

Board recommends and the General Meeting of

the Company is asked to approve the remuneration

policy of the Company for executives in the

Company, after it has been first approved by the

Company’s Remuneration Committee and Board of

Directors.]

The Reporting Regulations (International Auditing

Reporting Standards) also require the auditors to

report to the Company’s members in the financial

statement within this report and to state whether

in their opinion that part of the report has been

properly prepared. The report is therefore divided

into separate sections for audited and unaudited

information. No remuneration consultants were

engaged by the Company in 2017.

Audited information

The table of Directors’ Annual remuneration is set

out below:

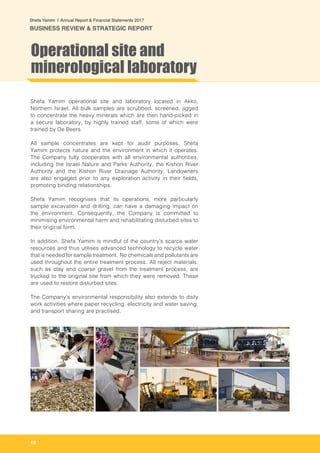

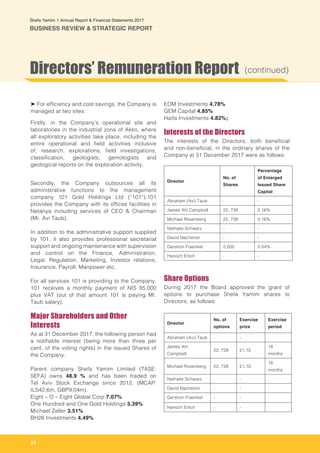

For efficiency and cost savings, the Company is

managed at two sites:

Firstly, in the Company's operational site and

Shefa Yamim (A.T.M.)

Consolidated Financial Statements

for the year ended 31 December 2017](https://image.slidesharecdn.com/shefayamimar2018final-180430153753/85/Shefa-Yamim-Annual-Report-2018-27-320.jpg)