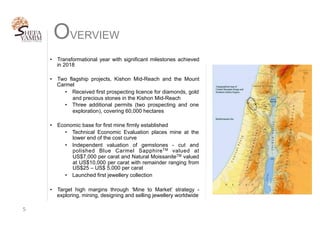

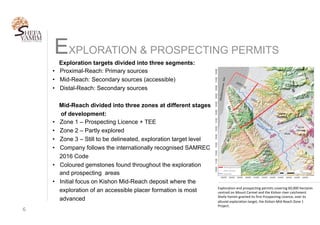

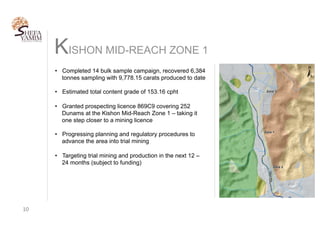

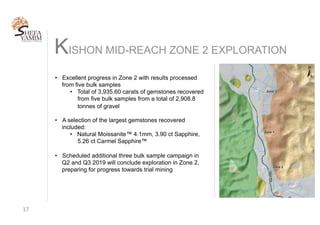

- Shefa Yamim has exploration and prospecting permits covering 60,000 hectares in Israel centered around Mount Carmel and the Kishon River. They have been granted their first prospecting license for their main exploration target, the Kishon Mid-Reach Zone 1 project.

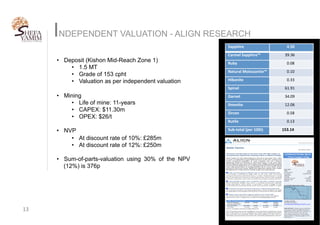

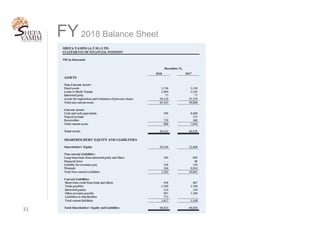

- An independent technical economic evaluation report found that the proposed first mine at Kishon Mid-Reach Zone 1 is economically viable with an estimated capital expenditure of $11.3 million and operating costs of $26-27 per tonne processed.

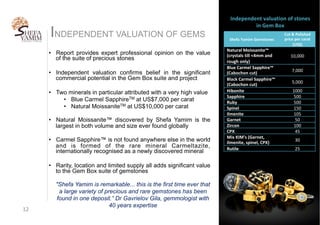

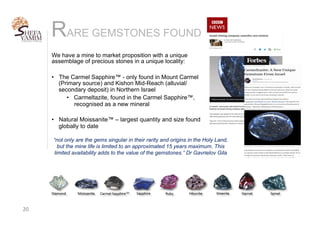

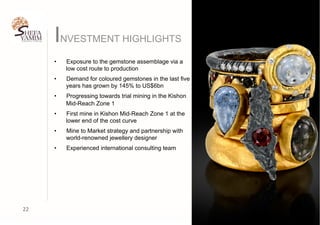

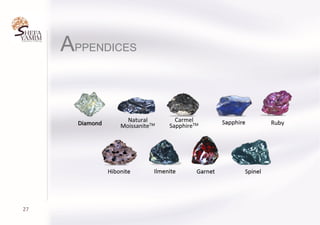

- Independent valuations of Shefa Yamim's gemstones in their "Gem Box" collection found that blue Carmel Sapphire is worth $7,000 per carat