Session 3: Investors and Donors Panel: Approaches, Challenges and Partnerships for Investing in FLR

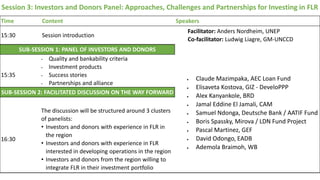

- 1. Session 3: Investors and Donors Panel: Approaches, Challenges and Partnerships for Investing in FLR Time Content Speakers 15:30 Session introduction Facilitator: Anders Nordheim, UNEP Co-facilitator: Ludwig Liagre, GM-UNCCD SUB-SESSION 1: PANEL OF INVESTORS AND DONORS Claude Mazimpaka, AEC Loan Fund Elisaveta Kostova, GIZ - DeveloPPP Alex Kanyankole, BRD Jamal Eddine El Jamali, CAM Samuel Ndonga, Deutsche Bank / AATIF Fund Boris Spassky, Mirova / LDN Fund Project Pascal Martinez, GEF David Odongo, EADB Ademola Braimoh, WB 15:35 • Quality and bankability criteria • Investment products • Success stories • Partnerships and alliance SUB-SESSION 2: FACILITATED DISCUSSION ON THE WAY FORWARD 16:30 The discussion will be structured around 3 clusters of panelists: • Investors and donors with experience in FLR in the region • Investors and donors with experience in FLR interested in developing operations in the region • Investors and donors from the region willing to integrate FLR in their investment portfolio

- 4. • Tailored 1-on-1 support • Formal training Global Mentoring Technical Assistance Access To Capital Capacity Building • Technical & functional expertise • In-country for 1-3 months • Financial management • Accounting systems • Branding/Marketing • Human Resources • Below market rate loans • 10% loan declining balance AEC’s Core Programming

- 5. Critical example of an SME’s bookkeeping

- 6. The financial matrix (Cashflow ) Financial matrix RWA Company: Names: Date: Signature: Currency: Rwf January February March April May June July August September October November December Total …...…. Sales (A) TOTAL (A) Costs for raw materials (B) TOTAL (B) Gross result (C) (Total A - Total B) Operative expenses (D) Employees salaries (total) Entrepreneur's salary Social Security Taxes Rent (premises) Rent (machines) Other rental costs Maintenance and repair Car costs, petrol, etc. Insurance costs Governemental fees & costs Energy (electricity, air cond, etc.) Transportation costs Advertisement costs Legal costs (Law yer, etc.) Telephone costs Other Taxes Reserve Amortisation of fixed assets Loan amortisation BPN Loan Interest BPN Total operative expenses (D) Net result (Total C - Total D) А B D

- 7. I. The bankability criteria for AEC Investment schemes include but not limited to:

- 8. II. AEC Product Profile and conditions African Entrepreneur Collective Rwanda Trustee Ltd (AEC RT) offers financing support through capital leasing and project Finance to entrepreneurs participating in the Inkomoko business acceleration program. The following criteria must be meet by a company in order to be eligible for investment: - Must be registered as a business in Rwanda; - Must be an Inkomoko client; AEC Business accelerator service; - Must have financial information available (actuals cash flow and projections) . The capital lease and project finance offered by AEC RT has the following terms: - Interest Rates 10% declining balance - Tenor: up to 5 years - Flexible repayment plan depend on seasonality e.g.: Monthly, quarterly, Half year, yearly etc. with grace period if required.

- 9. 9 II. Successful FLR investment from AEC portfolio. Constructio n 9% Education 9% Energy 4% Environmen t 7% Agriculture/ Food 40% Manufactur ing 11% Services 20% INDUSTRY BY NUMBER OF BORROWERS Construction 12% Education 7% Energy 4% Environment 3% Agriculture/F ood 59% Manufacturi ng 8% Services 7% INDUSTRY BY AMOUNT INVESTED

- 10. Social Impact Results: • 15 rice cooperatives; 8,000 farmers • Increase in farmer yield: 4x • Created 31 permanent; 30 temp jobs Entrepreneurs Creating Jobs and Improving Lives HPS and B LTD processes rice and impacts thousands of farmers AEC Support: • Business plan • Investor readiness • Analyzed agriculture operations • Built new accounting systems • 2 mentors with expertise in agriculture financing • ~142k USD in direct financing repaid (4 loans); Avg 6% interest as compared to 20% interest at commercial bank Business Growth Results: • From 30% to 80% capacity • Secured $600k in external investments

- 11. Social Impact Results: • Working with over 1,000 farmers; helped launch 200 women farmers • Profit-sharing with farmers • Created 34 permanent; 332 seasonal jobs in remote areas 5 Coffee Washing Stations AEC Support: • Business plans & websites • Built new accounting systems • Partnership with local exporter • Increasing access to local and int’l markets • Provided 240k USD in direct financing Business Growth Results: • 3 of 5 businesses launched; now starting 2nd & 3rd seasons • 2 of 5 businesses grew by 50% since working with AEC Entrepreneurs Creating Jobs and Improving Lives

- 12. Thanks!!

- 13. BRD AGRICULTURE FINANCING AND LAND SCAPPING

- 14. 1. Introduction. The Development Bank of Rwanda (BRD), acts as the Government of Rwanda’s investment arm and through the new strategic plan, its financial development objectives are designed to focus on the key priority sectors of the economy which covered the following: Agriculture (modernization and mechanization primary farming), covering irrigation; Exports (mainly tea and coffee farming); Other key sectors Energy; Housing; Education; Special projects and Infrastructure

- 15. 2. What has BRD done so far in agric financing Portfolio distribution to agriculture Sub-sector The financing is distributed in refinancing (MFIs and SACCOs), Equity, LC and Direct Loans 2010 2011 2012 2013 2014 2015 Amount(RWF) Amount(RWF) Amount(RWF) Amount(RWF) Amount(RWF) Amount(RWF) PrimaryAgriculture 990,532,713 1,478,407,034 2,206,577,663 2,427,235,429 2,669,958,972 2,936,954,869 PrimaryproductioninCoffee 396,077,520 591,160,477 882,329,070 970,561,977 1,067,618,175 1,174,379,992 PrimaryproductioninTea 1,973,487,449 2,945,503,656 4,396,274,113 5,332,105,201 6,447,927,651 7,116,922,928 Livestockandrelatedinvestment 1,378,989,329 2,058,193,029 3,071,929,894 3,221,930,044 3,371,930,202 3,060,820,191 Agro-industries 5,658,895,212 8,446,112,257 12,606,137,697 13,866,751,467 12,367,028,802 15,087,775,138 CoffeeProcessingplants 1,287,402,012 1,921,495,540 2,867,903,791 3,154,694,170 3,312,428,879 3,378,677,456 TeaFactories 2,053,747,490 3,065,294,761 4,575,066,807 4,675,067,008 4,575,066,807 4,575,066,807 CoffeeSeasonalCampaign 970,494,839 1,448,499,760 2,161,939,940 2,378,133,934 2,615,947,327 2,877,542,060 TOTALPORTFOLIOFORAGRIC 14,709,626,564 21,954,666,513 32,768,158,975 36,026,479,230 36,427,906,815 40,208,139,442 Sector

- 16. 3. What has BRD done so far in agric financing 17 cooperatives financed One of the tea Plantations financed by the Bank

- 17. 4. What has BRD done so far in agric financing 24 Coffee Plantations financed so far totaling to 1,020 ha Coffee Plantation

- 18. 5. Forest financed by BRD

- 19. 6. New Outlook and Approach to Agric. Financing Bank Equity Lines of Credits/DFIs Development Agencies and GoR MFIs and SACCOS Coops Individuals and Cos - Agric Mechanization - Risk mitigation - Agro processing BRD Financing Model

- 20. 7. BRD Products/Facilities Development Loans Equity Investments Refinancing (Esp. MFIs) Short term basis Medium term basis Long term basis Trade Finance: Over Invoicing Under Invoicing Multiple Invoicing Short shipping Over shipping Phantom Shipping Etc., TA/Advisory Project Identification and Scoping Feasibility Assessment Development Funding Financial Structuring Management guidance

- 21. 8. Challenges in Agric financing Low capacity to prepare bankable Business plans; Management issues within cooperatives; Poor agricultural techniques; Climate change affecting the agriculture production; High risk perception; Coordination and monitoring of Agriculture related Program Lending schemes; Price volatility for agriculture commodities; High transaction costs;

- 22. 9. Possible solutions Mobilization of concessional credit lines for agriculture projects; Providing support to MFIs, SACCOs at local levels; Infrastructure investment by the Government; Land consolidation scheme Agriculture technical support to farmers; Insurance schemes; Support to organized value chain activities; Support to cooperatives.

- 23. THANK YOU

- 24. Unleashing Business Opportunities for Sustainable Landscapes Forest & Landscape Investment Forum Group CAM, an institution sustainably committed in financing small, medium and large farmers Session3: Investors and Donors Panel Approaches, Challenges and Partnerships for Investing in Forest and Landscape Restoration

- 25. Forest & Landscape Investment Forum GCAM financing approach GCAM’sinvolvementinfinancingtheagriculturalsectoraccordingtothenationalstrategy«Plan MarocVert» Farms characteristics Financing System 20% 40% Farms that are consistent with the banking rules Micro-farms developing off-farm economic activities and that are not consistent with the banking rules 40% Small and medium farms that rely mainly on agriculture but are not consistent with the banking rules Moroccan farms typology 1,5 Million units PILLAR1PILLAR2

- 26. Forest & Landscape Investment Forum GCAM was in charge of managing the Catalyst Fund project emerged from the cooperation between Moroccan Ministry of Agriculture and Millennium Challenge Account. It aimed at accompanying small and medium farmers in olive tree plantation and valorization. This project contributed to conversion from cereal crops to a more resilient and adding value production. 20 EIG 188 cooperatives 6 539 members 61 321 ha GCAM financed investment costs (44 millions US $) of modern units of olive storage, crushing and packaging GCAM allowed overdraft facilities GCAM gave advances on purchase of (raw) goods (olives) GCAM financed operating costs GCAM financed maintenance costs of olive trees planted for free by Ministry of Agriculture & Millennium Challenge Corporation as well as intercrops and small breeding before first harvest An example of Tree Plantation and Landscape Restoration project successfully financed by GCAM – Olive Tree Project

- 27. Forest & Landscape Investment Forum The GCAM, a transformational tool Sources of funding Funded projects Family farms Agro-Industries Agribusiness & Large farms Medium farms GCAM financing mechanism Players of the Moroccan agricultural ecosystem Interprofessional associations Technical, and financial education of farmers IT systems, scoring systems, traceability Distribution network Rural and agricultural expertise ARDI HR strategy, experts network Risk mitigation levers Traditional credit (20%) Meso-credit (40%) Micro-credit (40%) Crédit Agricole Tamwil el Fellah GCAM’s own capital/Savings collection Development Finance Institutions and other donors Incentives, organization and technical education

- 28. Forest & Landscape Investment Forum The GCAM’s current network of African financial partners Senegal AMIFA CNCAS Rwanda BRD Tanzania TADB Madagascar UNICECAM Nigeria BoA NIRSAL Zambia DBZ Ghana ADB Ethiopia DBE Niger BAGRI Ivory Coast Morocco GCAM Mali BNDA

- 29. THANK YOU 29

- 30. LAND DEGRADATION NEUTRALITY FUND An innovative fund project dedicated to sustainable land use and natural capital Kigali, May 2017 Strictly confidential - This commercial document is intended for Professional clients only in accordance with MIFID

- 31. Foreword 31 Parties involved Established in 1994, the United Nations Convention to Combat Desertification (UNCCD) is the sole legally binding international agreement linking the environment, poverty and development to sustainable land management in the drylands. The UNCCD is particularly committed to a bottom-up approach, ensuring the participation of local communities in combating desertification and land degradation. The secretariat of the Convention also facilitates cooperation between developed and developing countries, particularly regarding knowledge and technology transfers for sustainable land management practices. The Global Mechanism (GM) is an organ of the United Nations Convention to Combat Desertification (UNCCD), mandated to support UNCCD country Parties in the mobilization of resources for its implementation. As the operational arm of the Convention, the Global Mechanism supports countries to translate the Convention into action and to achieve Land Degradation Neutrality at the national level. Mirova, the Responsible Investment subsidiary of Natixis Asset Management, develops an engaged approach aiming to combine value creation and sustainable development. Mirova’s philosophy is based on the conviction that integrating sustainable development themes can generate solutions that create value for investors over the long term, not only thanks to a better appreciation of risks, but also by identifying favourable investment opportunities in a changing world. Mirova offers a global responsible investing approach with a single offer revolving around 5 pillars: equities, bonds, infrastructure, Impact investing,(1) voting and engagement. Mirova has €6.7 bn in AuM and €40 bn in voting and engagement. The company brings together 68 multi-disciplinary experts, specialists in thematic investment management, engineers, financial and ESG(2) analysts, specialists and experts in socially conscious finance and project financing. Source: Mirova as of 30/09/2016 (1) Impact Investing: management having a strong social or environmental impact. (2) ESG: Environnemental, Social & Gouvernance Party PresentationRole in the project Co-promoter - Initial Concept - Enabling environment - Institutional coordination Co-promoter - Fund strategy - Business Model - Structuring - Fund management 31

- 32. LAND DEGRADATION 32 A global challenge with severe consequences What is at stake? Poor land management practices, often fueled by exploitation for short-term economic gains instead of favouring long- term sustainability, have led to the loss of more than 25% of the world’s arable land in the last two decades. 2billions hectares of land are degraded worldwide, and we continue to degrade another 12 million hectares of productive land every year “Land and natural capital suffer from over-exploitation and under-investment” Why is it important? As well as the direct economic value of using land and its resources, land-based ecosystems and their management can have substantial consequences: Climate change Poverty Social instability and conflicts MigrationsBiodiversity loss Food security pressure 32 Increasing awareness that the cost of inaction is significantly higher than the cost of action led to the emergence of the Land Degradation Neutrality (LDN) concept, and its inclusion in the SDGs (Target 15.3): Land Degradation Neutrality is a state where the amount and quality of land resources necessary to support ecosystem functions and services and enhance food security, remains stable or increases

- 33. THE LDN FUND PROJECT A mission-driven impact fund project Environmental and Social standards and impact • The Fund will only consider projects that can make a significant contribution to LDN while complying with robust Environmental & Social (E&S) standards and generating positive impact Financial additionality • The LDN Fund will offer financing solutions that are not readily available in the market by providing patient long-term finance and strategic benefits in ways that other investors or banks might not: risk-adjusted interest rates, limited recourse, longer maturity, longer grace periods than local commercial banks, etc. • The Fund intends to initiate or participate to blended finance schemes by (i) actively collaborating with DFIs and MDBs and (ii) on-boarding local and international commercial banks in projects Financial return • The Fund will invest in profitable projects. • Sustainable agriculture and forestry can potentially offer attractive investment opportunities due to the rising global demand • Using improved agronomic practices helps to increase productivity, product quality and generate better returns 33 ‘To be a source of transformative capital bringing together public and private investors to fund triple bottom line projects that contribute to Land Degradation Neutrality’ The LDN Fund project’s mission:

- 34. KEY SECTORS • Sustainable agriculture as a high-impact sector offering the possibility of making a real difference on the ground • Sustainable forestry • Other LDN-related sectors on an opportunistic basis, such as green infrastructure and land reclamation or eco-tourism GEOGRAPHICAL SCOPE • Focus on developing countries where capital mobilisation is crucial • Developed countries on an ancillary basis INVESTMENT TYPES 60% 20% 20% Target capital allocation 80% 20% Target capital allocation LDN FUND PROJECT STRATEGY Producing impact and financial return PROGRAMMATIC APPROACH (well-suited for agriculture and outgrower schemes) INTEGRATED APPROACH (well-suited for forestry and green infrastructure projects) 34 MOU WITH GCAM SIGNED DURING COP22 Joint offer in some African countries combining long-term finance and assistance to local banks to reach smallholders Phase 0 - Kick off LDN FUND Cash (Loan) PROJECT OPERATOR Small holders Small holders Small holders Small holders Small farmers and cooperatives SERVICE PROVIDERS Cash (payment for services) OFF- TAKER Soft Commo Cash (Debt service) LDN FUND PROJECT OPERATOR TECHNICAL PARTNER OFF- TAKER Tree planting, maintenance, harvest Cash Cash (Loan / equity) Cash (Debt service / Dividends) Timber

- 35. Disclaimer This commercial document is intended for Professional clients only in accordance with MIFID. If no and you receive this document sent in error, please destroy it and indicate this breach to MIROVA. MIROVA Regulated by AMF under n°GP 02-014 Limited liability company - Share capital € 7 461 327, 50 RCS Paris n°394 648 216 Registered Office: 21 quai d’Austerlitz – 75 013 Paris Mirova is a subsidiary of Natixis Asset Management - Under Mirova’s social responsibility policy, and in accordance with the treaties signed by the French government, the funds directly managed by Mirova do not invest in any company that manufactures sells or stocks anti-personnel mines and cluster bombs. - The fund project has not been authorized by any supervisory authority. - This Presentation in no way constitutes an offer or a sales promotion to a person regarding whom it would be illegal to make such an offer. This Presentation may not be used as an offer or a sales promotion in countries or in conditions where such offers or promotions have not been authorized by the competent authorities. Each investor must ensure he is authorized to invest in the Fund project. - Investments in the fund are mainly subject to loss of capital risk. - This presentation (the “Presentation”) is being circulated as an information-only document and does not constitute an offer, a proposal, or a solicitation to investors to invest in the funds described in this document and managed by Mirova nor does it form the basis of, or constitute, any contract. These products and services do not take into account any particular investment objectives, financial situation nor specific need. Mirova will not be held liable for any financial loss or decision taken or not taken on the basis of the information disclosed in this document, nor for any use that a third party might make of this information. This Presentation in no way constitutes an advice service, in particular an investment advice. In any case, you are responsible for reading regulatory documents of the fund and collecting any legal, accounting, financial, or tax consultancy service you may consider necessary, in order to assess the adequacy of your constraints to investment and its merits and risks. This document is a non-contractual document and serves for information purpose only. This document is strictly confidential and it may not be used for any purpose other than that for which it was conceived and may not be copied, distributed or communicated to third parties, in part or in whole, without the prior written consent of Mirova. This Presentation may not be used in some juridictions where such offers or promotions have not been authorized by the competent authorities. Each investor must ensure he complies with these requirements and prohibitions. No information contained in this document may be interpreted as being contractual in any way. Information contained in this Presentation is based on present circumstances, intentions and beliefs and may require subsequent modifications. No responsibility or liability is accepted by Mirova towards any person for errors, misstatements or omissions in this Presentation or, concerning any other such information or materials, for the adequacy, accuracy, completeness or reasonableness of such information. While the information contained in this Presentation is believed to be accurate, Mirova expressly disclaims any and all liability for any representations, expressed or implied, with respect to this Presentation or any other written or oral communication to any interested party in the course of the preparation of information concerning the Fund. Prices, margins and fees are deemed to be indicative only and are subject to changes at any time depending on, inter alia, market conditions. Mirova reserves the right to modify any information contained in this document at any time without notice. More generally, Mirova, its parents, its subsidiaries, its reference shareholders, the funds MIROVA manages and its directors, its officers and partners, its employees, its representative, its agents or its relevant boards will not be held liable on the basis of the information disclosed in this document, nor for any use that a third party might make of this information. This document consists of a presentation created and prepared by Mirova based on sources it considers to be reliable. However, Mirova does not guarantee the accuracy, adequacy or completeness of information obtained from external sources included in this document. Contacts: Philippe Zaouati, Gautier Quéru CEO, Mirova Team Leader, Mirova Philippe.Zaouati@mirova.com Gautier.Queru@mirova.com 35

- 36. GLOBAL ENVIRONMENT FACILITY Investments in Forest Landscapes and key figures of implementation Pascal Martinez, Sr Climate Change Specialist Forest Landscapes Investment Forum 16-17 May 2017, Kigali, Rwanda

- 37. History and achievement of GEF support for forests • Multilateral fund, serving 5 environmental Conventions (Climate, Biodiversity, Desertification…) • Country driven, trough 18 Implementing agencies • Since 1991, 411 forest projects and programs • Investments: $2.7 billion + $13.8 billion (co-financing) • Improving local people livelihood

- 38. GEF investment on forests in GEF-6 • Period 2014-2018 • 44 projects and programs • Investments: $711 million + $4.3 billion (1/6 co-financing) • Utilized 89% of the $250 million envelope 21 13 8 12 0 5 10 15 20 25 1 Regional Distribution by number of countries Africa Asia ECA LAC

- 39. Examples of recent programs relevant to East Africa • The Restoration Initiative: contribution to Bonn Challenge (Kenya, Tanzania…): $50 M (+$200 M cofinance) • Taking Deforestation Out of Commodity Supply Chains: $45 M (+$440 M cofinance) • Moringa Agro-forestry Fund for Africa: (Kenya, Tanzania, Zambia…): $13 M (+$50 M cofinance) • National projects, ex. Restoring Degraded Forest Landscapes… (Eritrea): $9 M (+$23 M cofinance) Several financing modalities: mainly Grants but also blended finance, involving the private sector

- 40. GEF-7 under preparation and forests • New cycle 2018-2022 • Building on previous success • Still under discussion with member countries • More integration -> Impact programs (IP) • In particular: - Forest Landscape Restoration - Commodity supply chains • Same ration of financing sought (around 25%)

- 41. Thank you for your attention!

- 42. Unleashing Business Opportunities for Sustainable Landscapes Forest & Landscape Investment Forum Approaches, Challenges & Partnerships for Investing in Forest & Landscape Restoration Investors/Financiers Perspective David Odongo - EADB

- 43. Forest & Landscape Investment Forum A. Basic Supporting Information for Project 1. Back-ground Information Legal status & ownership 2. Market Analysis Demand/Supply trends Market Size & marketing plan – E.g. Off-take Contracts Competition/Competing projects/products 3. Technical Aspects Production/Operations – e.g. project scale; variety & justification; maturity period; tree density per acre/Ha; Husbandry details; Harvest plan; Equipment/machinery requirements Organization & Management Details of management/managers Project implementation schedule 4. Financial Aspects Total estimated costs Proposed financing plan Projections – Key Liquidity (Solvency) & Debt Service Ratios; IRR/ROI 5. Risk Assessment Anticipated Weaknesses/Risks of project Proposed mitigation 6. Environmental, Social & Gender Issues ESIA & Evidence of approval by statutory authority ESMP during project implementation

- 44. Forest & Landscape Investment Forum B. Main Approaches Usually Debt (Loan) or Equity 1. Key Factors for Debt Considerations: Tenor of Loan; Moratorium; Pricing (Rate); Other Fees; Collateral (Asset/Cash-flow basis); Purpose/ Application of loan funds (E.g. land acquisition; machinery/equipment; infrastructure?) 2. Key Factors for Equity Considerations: Invitation to take up shares; Nature of equity availed by project sponsor – Ordinary/Preferential? Prospectus by sponsors indicating anticipated returns to investors Indications on level of participation permitted in management – e.g. board representation; voting rights. Proposed dividend policy; Procedure for exit if applicable

- 45. Forest & Landscape Investment Forum Case Study Examples 1. Loan Profile of Bank Client: SME engaged in Agroforestry; Note existence of complementary income generation activities. Facility & Tenor : Equiv. USD 500,000; LTL - 10 Years (12 month moratorium on Principal repayments) Documents submitted: Evidence of site ownership; Loan Application in prescribed format Application of Funds: Equipment/Machinery; Complimentary Activities – Commercial Apiary Risk Mitigation: Facility Agreement; Charge over Sponsor's property; Debenture; Commercial Insurance – Tree Cover – trees with commercial value identified by insurer & assigned value; annual policy renewal with inspection report & tree audit by insurer; Additional PRC – during high risk period may be necessary through ATI/AGF. 2. Equity Profile of Bank Client: PE firm – large scale commercial agroforestry Facility & Tenor : Placement of USD 350,000 funds in Equity (Ordinary Shares); Subsequent conversion to Preferential Shares with fixed dividend over 5 Years & exit at Year 5. Documents submitted: Investment prospectus; Application of Funds: Large scale commercial agroforestry establishment with details of plantation sites – owned/concessions; Working Capital Risk Mitigation: Share Agreement; Debenture; Assignment of Agreements/Concessions; PRC – through ATI/AGF – Portfolio cover option. Ordinary Shares (OS) - the shares issued to members of a limited company. OS represent the equity/risk capital of a company. They carry no prior rights in terms of entitlement to dividend or return of capital on a winding- up. Ordinary shares generally carry full voting rights. Preference shares (PS) - entitle the holder to a stipulated fixed rate return in the form of a dividend (E.g. the fixed rate return to which holders of loan stock are entitled), whereas dividend declared in respect of OS is purely a matter for the directors & subject to approval by the shareholders in general meetings. In the event of a winding-up, holders of PS are entitled to be paid before OS.

- 46. THANK YOU 46

- 47. FOREST AND LANDSCAPES INVESTMENT IN AFRICA – PERSPECTIVES FROM THE WORLD BANK Ademola Braimoh

- 48. Good Quality Bankable Projects • Strong linkage to the World Bank’s twin goals of ending extreme poverty and boosting shared prosperity. • Contributes to the country’s development plans and climate change goals e.g. the NDC commitments • Support rural communities to better manage forests, reduce deforestation and curtail unsustainable agricultural expansion • Enhance benefits rural communities receive from forestry, agriculture, and wildlife; and reduce their vulnerability to climate change 48

- 49. Characteristics of investment products • Innovative mix of funding. For instance, Zambia Integrated Forest Landscape Project (ZIFLP) has a combination of an IDA credit, a GEF grant, and a BioCF TF grant all supporting the implementation of activities in a landscape approach. • Fully aligns with the country’s vision for low carbon development pathway. The vision statement of Eastern Province is “to improve rural livelihoods in Eastern Province by reducing deforestation and forest degradation using a low emission pathway through local community participation by 2030.” • Private sector financing window to promote deforestation-free agricultural value chain • Implemented at a jurisdictional level. National or jurisdictional governments need to consider the trade-offs and synergies between different land uses that may compete in a jurisdiction—such as agriculture, energy, and forest protection—and successfully identify integrated solutions that serve multiple objectives. 49

- 50. Minimum project design requirements • Net emission reduction. Project must aim to have a net emission reduction in the jurisdictional project area through 2030 • Public private partnership. Project must aim to deliver emission reductions, at least in part, through an agreed PPP between the government and one or more private sector entities. • Improve the enabling environment. Utilize Technical Assistance (TA) funds to improve the ‘enabling environment’ for emission reductions delivery. Strengthening institutional arrangements, developing benefit sharing mechanisms, leveraging additional investments, building implementation capacity, MRV, etc • Livelihoods and low C investment e.g. for ZIFLP covering agriculture, forests, wildlife • Results-based payments. Payments will become due upon verified emissions. The payments should be used as an incentive to sustain low emissions trajectory. Emissions reductions from Ag, Energy and REDD could qualify for results based payments (not limited to REDD) provided there is independent verification and monitoring. 50