SEBI is the primary regulator of the Indian securities markets. It has wide-ranging powers to register and regulate intermediaries like stock exchanges, as well as protect investors through disclosures and preventing unfair practices. The key statutes governing the capital markets are the SEBI Act, SCRA, and Depositories Act. SEBI also has delegated powers under the Companies Act. It has established a framework of detailed rules and regulations on various aspects of the market. The document discusses the constitutional theme of regulators, interplay between corporate and securities laws, and provides an overview of principal statutes and regulatory framework.

![Regulatory framework – Kinds of Enforcement And

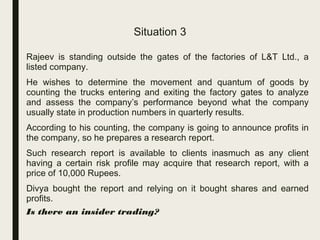

Processes by SEBI

Enforcement Actions:

Directions by the Board [Such as under Section 11,

11B, 11D]

(Disgorgement –a new feature explicit under 2014 amendment)

Enquiry (Suspension/cancellation of certificate

of registration)

Adjudication (Monetary penalties)

Prosecution (fine, Jail term or both)

An Alternate Enforcement Action:

Consent / Compounding - Settlement

Caution to Investing Public through a Press

Release

44](https://image.slidesharecdn.com/ffd77102-121c-4acb-abbc-4b76aa14699d-161206042632/85/SECURITIES-LAWS-WELLINGKAR-44-320.jpg)

![Appellate Mechanism in Securities Laws

Review of AO by

SEBI [Sec. 15 I

(3)]](https://image.slidesharecdn.com/ffd77102-121c-4acb-abbc-4b76aa14699d-161206042632/85/SECURITIES-LAWS-WELLINGKAR-46-320.jpg)

![Appellate Mechanism in Securities Laws

• Appeal to the Securities Appellate Tribunal (SAT):

• Any Person Aggrieved

– By Any Order of the Board

– By an Order made by an Adjudicating Officer

i. Appeal to SAT in 45 days from SEBI/AO Order

ii. Condonation of delay by SAT (any time but reasonable)

iii. SAT should make efforts to dispose of the appeal within 6

months of receipt of the appeal.

iv. SAT can confirm, modify or set-aside the order. [15T(4)]

v. SAT can review its own decisions. [15U(2)]

48](https://image.slidesharecdn.com/ffd77102-121c-4acb-abbc-4b76aa14699d-161206042632/85/SECURITIES-LAWS-WELLINGKAR-48-320.jpg)