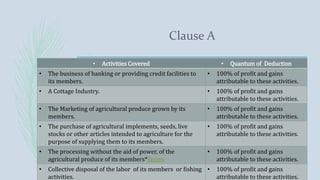

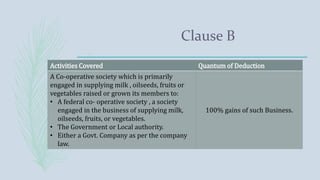

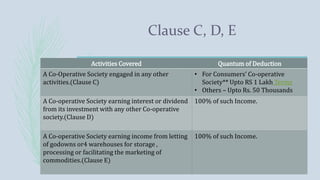

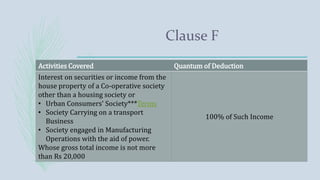

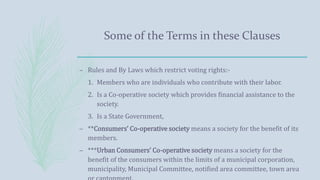

This document summarizes Section 80P of the Indian Income Tax Act, which provides for deductions in respect of income earned by cooperative societies. It discusses the definitions, activities eligible for deduction and their corresponding deduction amounts. Key points include that a cooperative society is treated as an Association of Persons under the tax law. Section 80P allows for full deductions of income from specified activities like banking, agriculture, and certain other businesses. The deduction is calculated after reducing any deductions under other tax sections. Cooperative banks regulated by the RBI are excluded from the Section 80P deduction.