Embed presentation

Download as PDF, PPTX

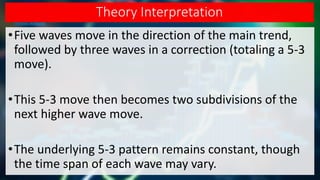

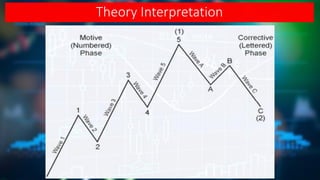

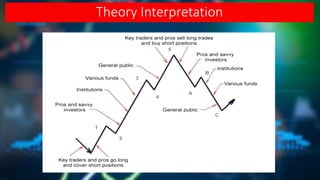

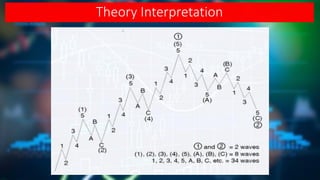

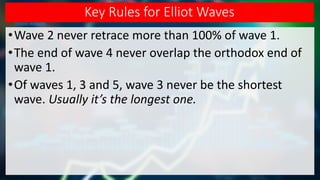

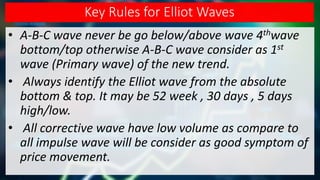

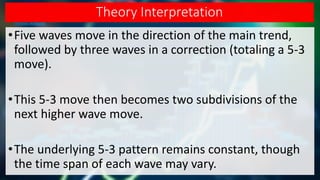

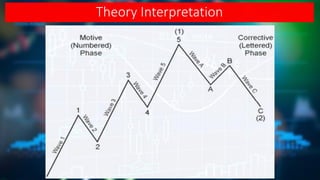

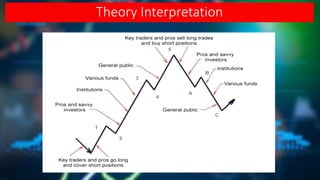

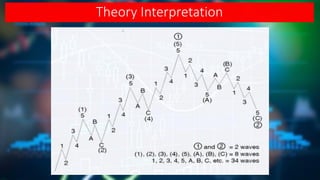

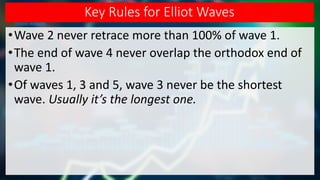

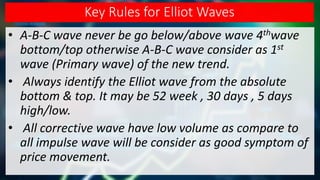

Elliot Wave Theory proposes that financial market prices move in recurring patterns or "waves" due to shifts in crowd psychology. According to the theory, waves move in five-wave patterns in the direction of the main trend, followed by three waves moving counter to the main trend. This 5-3 pattern then repeats at higher time scales. The theory provides key rules for identifying waves, such as wave 2 never retracing more than 100% of wave 1, and wave 3 typically being the longest of waves 1, 3, and 5. Analyzing price movements according to Elliot Wave patterns can provide insight into crowd behavior and market trends.