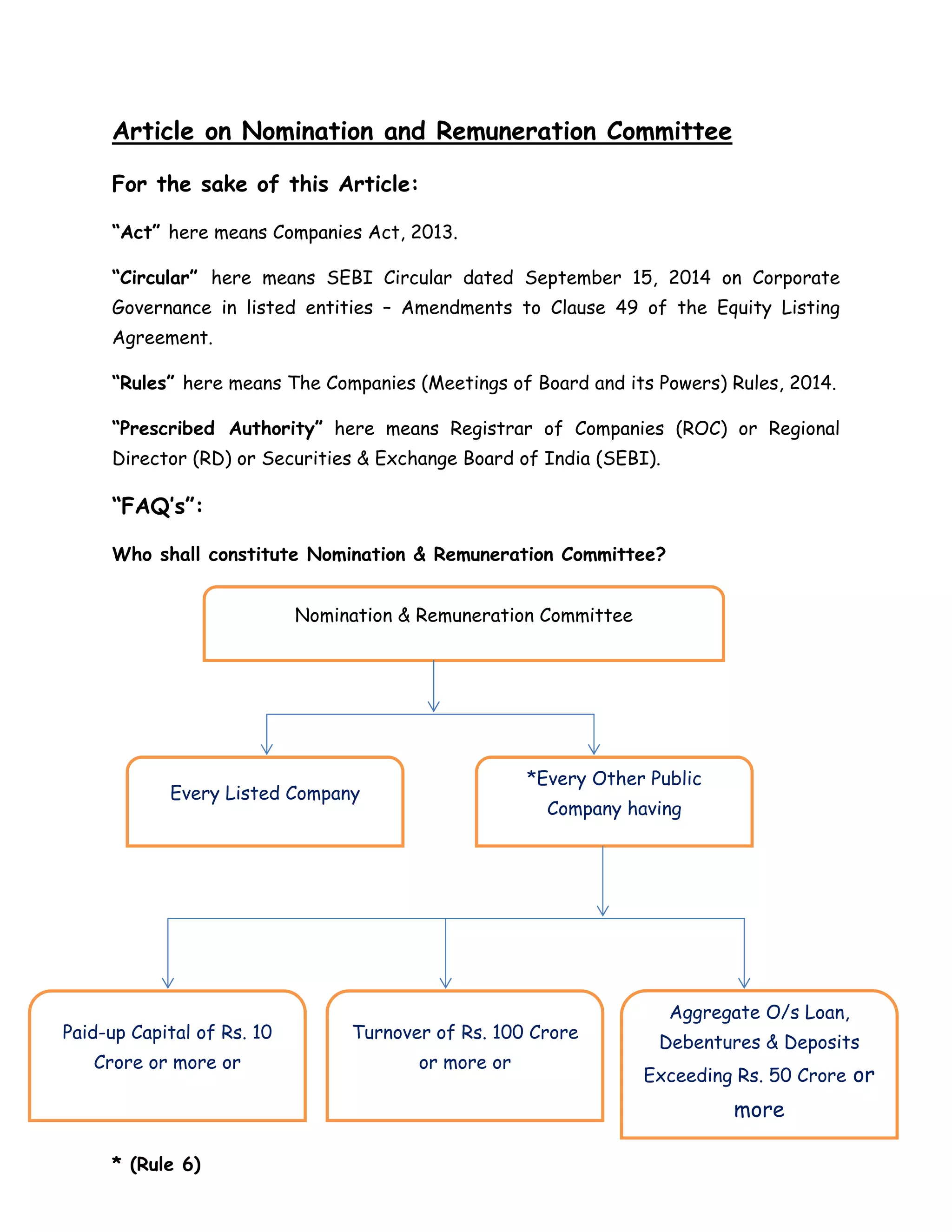

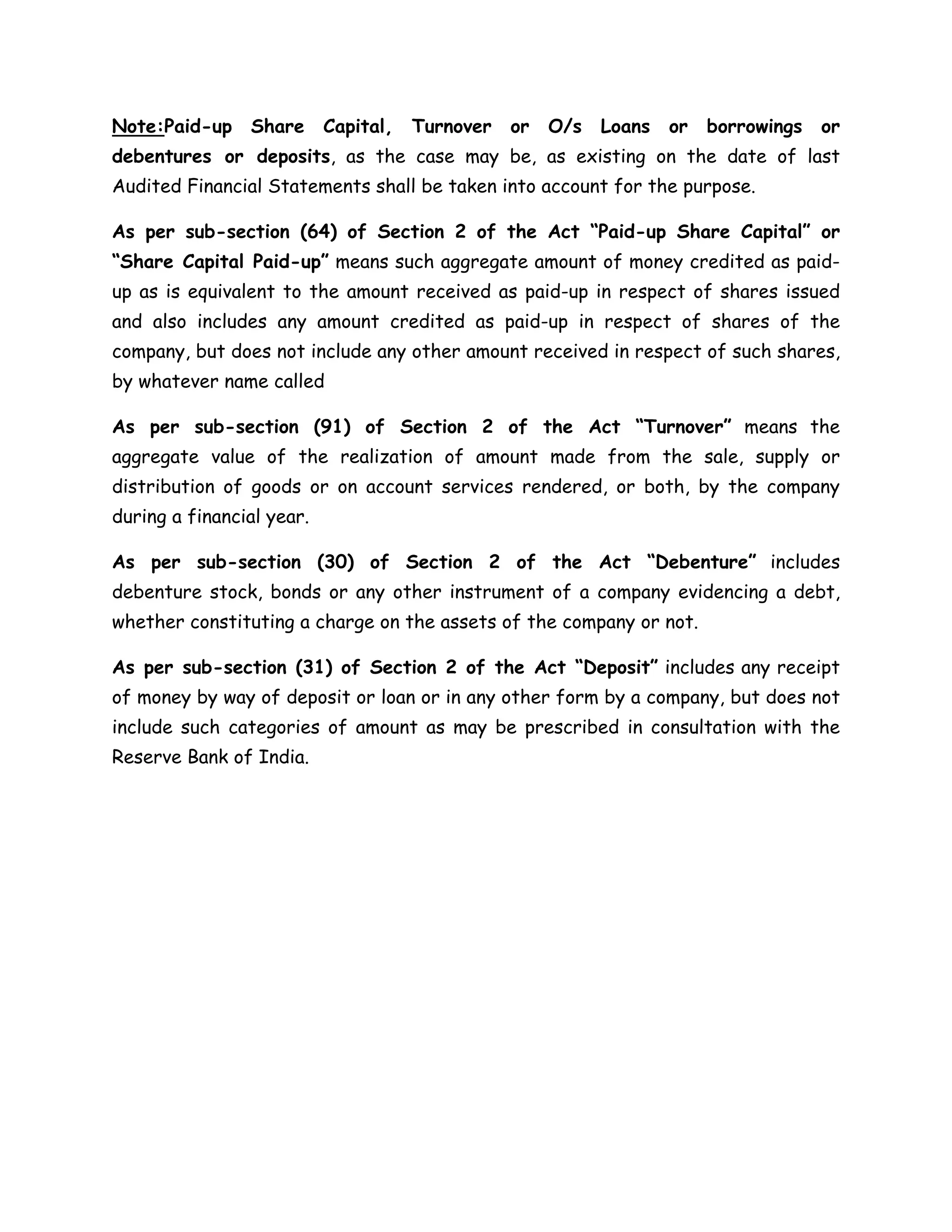

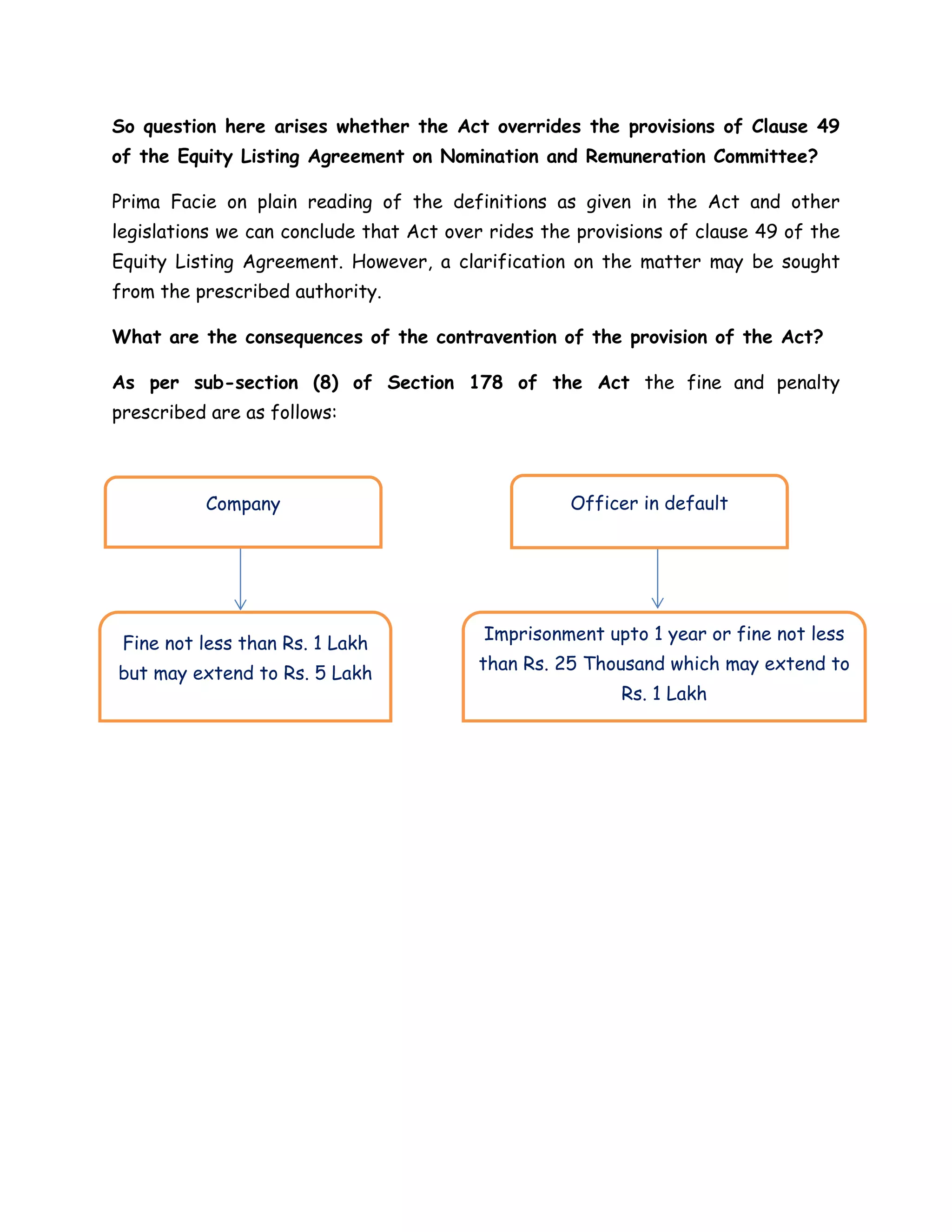

The document discusses the composition and requirements for the Nomination and Remuneration Committee according to the Companies Act 2013 and SEBI regulations. It notes some potential contradictions between the Act, which requires the committee for all listed companies, and Clause 49 of listing agreements, which provides some exemptions. Specifically, it examines whether the Act takes precedence over Clause 49. It also outlines penalties for non-compliance with the Act's provisions for this committee.