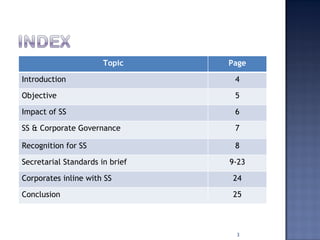

The document discusses secretarial standards in India and their importance for corporate governance. Secretarial Standards were introduced by the Institute of Company Secretaries of India to standardize and harmonize diverse secretarial practices and improve compliance. Adopting these standards leads to more transparency, higher investor confidence, and increased recognition for complying companies. The standards cover areas like board meetings, shareholder meetings, maintaining registers and records, and other secretarial functions.