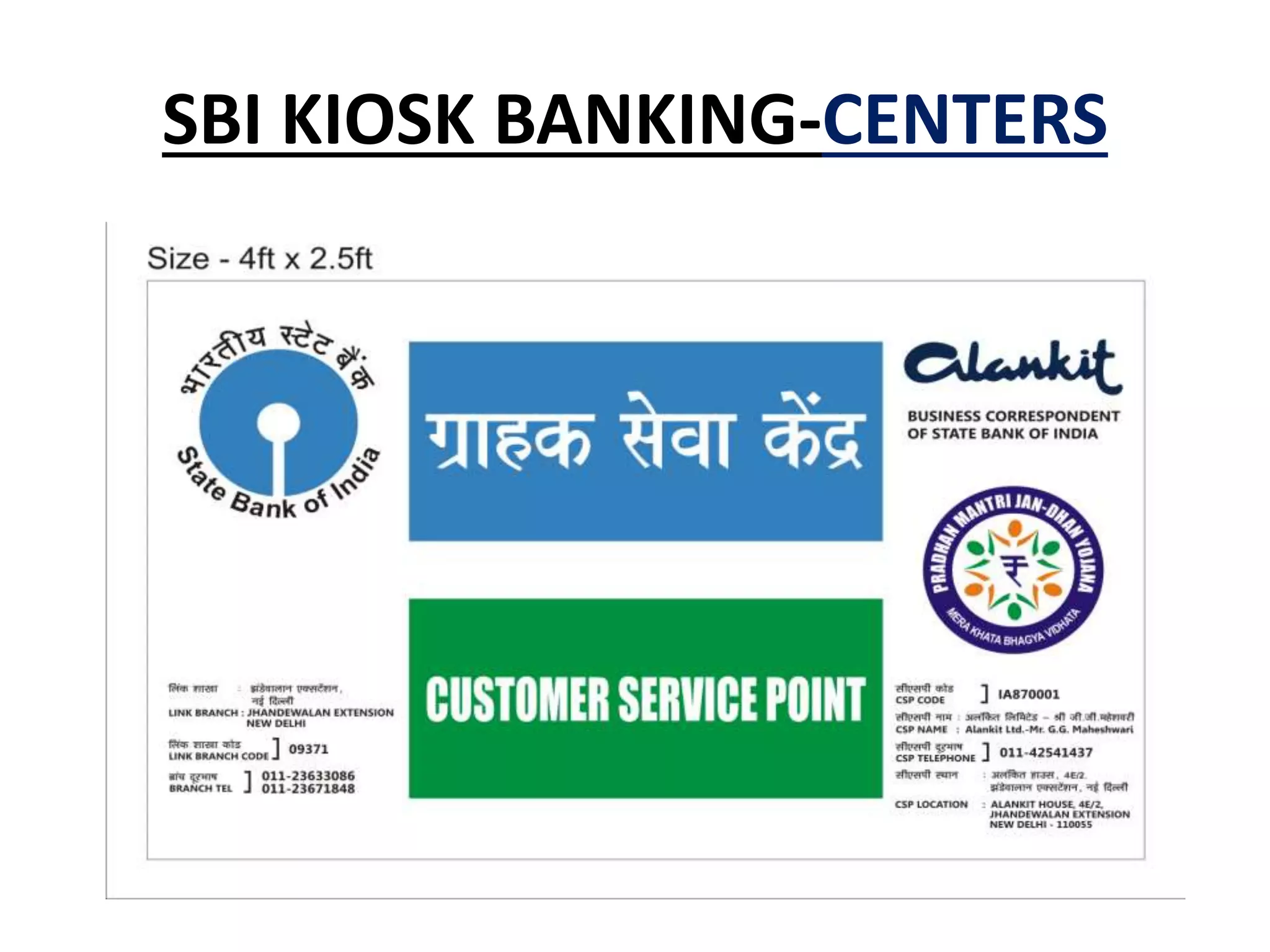

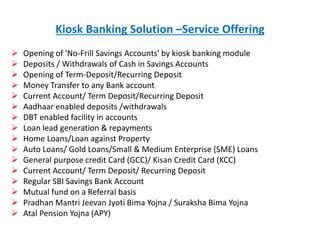

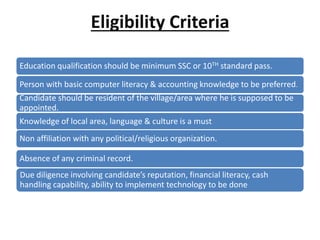

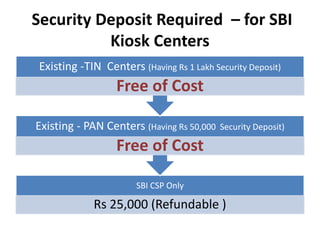

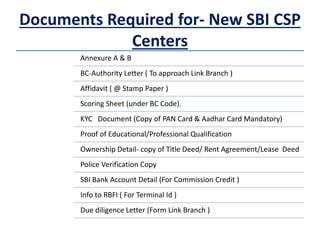

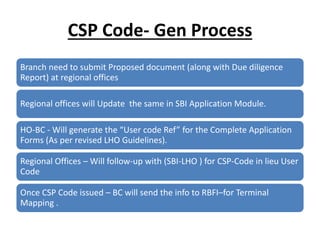

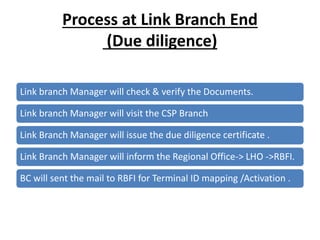

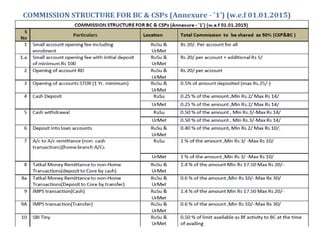

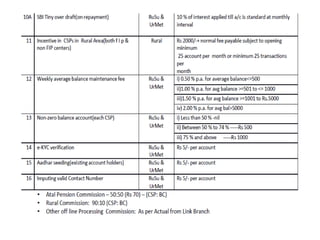

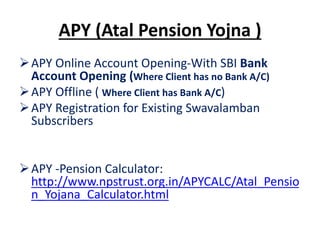

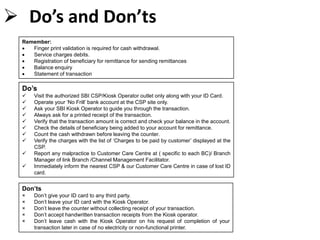

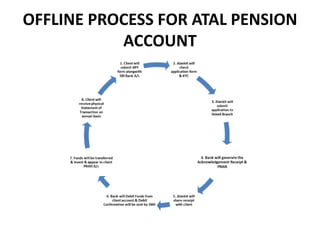

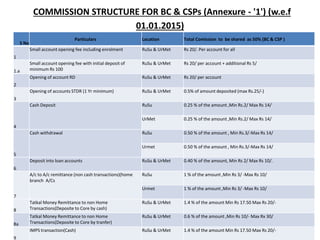

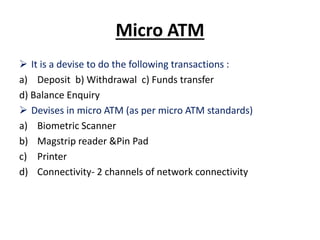

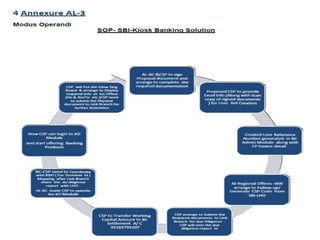

SBI is promoting kiosk banking centers and financial inclusion through their CSP program. CSPs gain benefits like social recognition, incentives, and attractive remuneration while providing doorstep banking services to customers. Services offered through kiosk banking include account opening, deposits, withdrawals, money transfers, loans, and government scheme assistance. Eligibility requirements for CSPs include education, computer literacy, local residency, and passing due diligence checks. The document outlines the application process, required documents, security deposits, and commission structure for CSPs in the program.