The document discusses the "Sandwich Generation" which refers to adults who are supporting both children and aging parents. Key points include:

- 44% of 45-55 year olds have at least one living parent and child under 21, placing them in the Sandwich Generation.

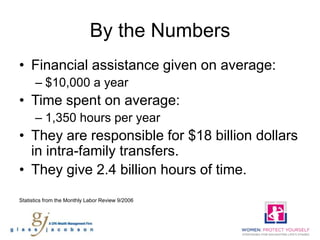

- On average, Sandwich Generation members provide $10,000 per year and 1,350 hours per year in support to parents and children.

- It is important for Sandwich Generation members to have conversations with parents about their financial situation and long term care needs to help prepare for medical expenses.