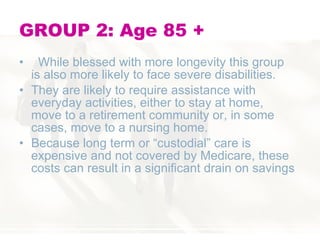

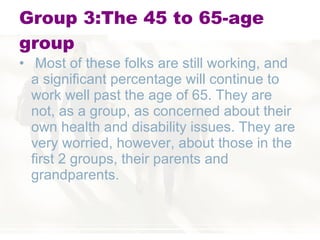

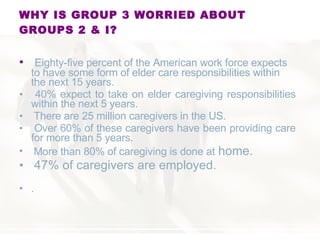

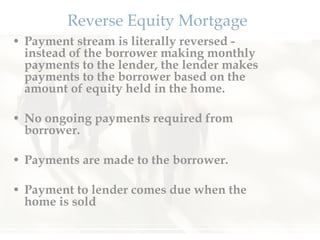

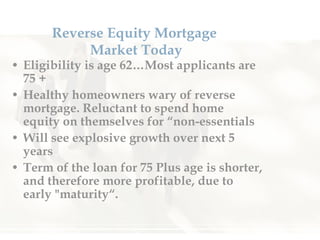

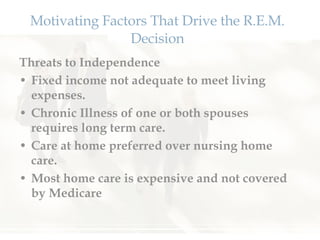

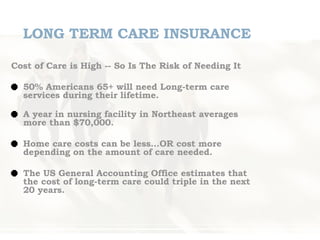

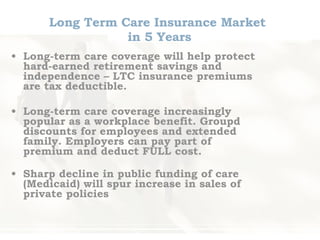

The document discusses the growing importance of elder life planning for banks to strengthen customer relationships and sales in the senior market, particularly as the population aged 65+ is increasing rapidly. It highlights the financial strategies banks can implement, such as offering long-term care insurance and reverse equity mortgages, to assist maturing consumers and retain deposits amidst rising care costs. With 85% of the workforce expected to take on elder care responsibilities, banks must provide knowledgeable guidance and a comprehensive marketing approach to tap into this expanding market.