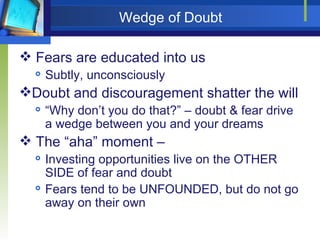

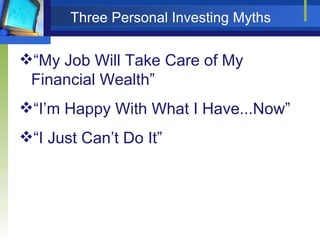

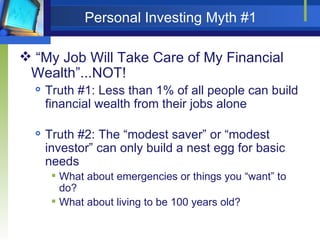

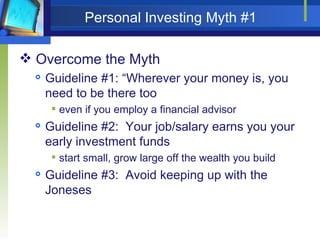

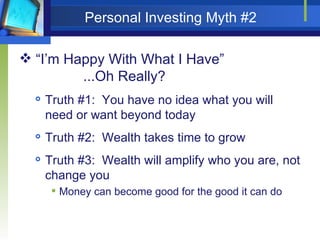

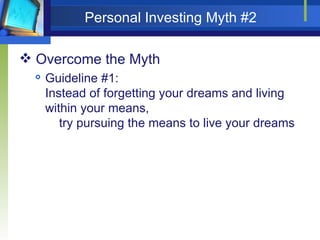

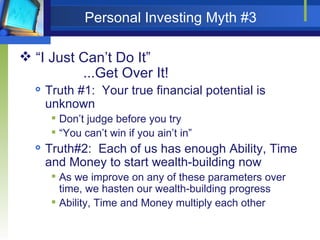

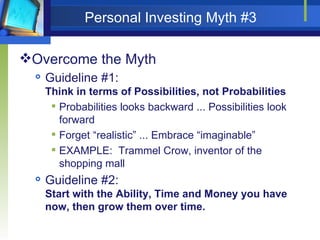

The document discusses three common personal investing myths and provides truths and guidelines to overcome each myth. The three myths are: 1) That one's job will take care of their financial wealth, 2) Being happy with what you have now, and 3) That you just can't do real estate investing. The document provides counter arguments for each myth and recommends starting small with the ability, time, and money you have to begin building wealth over time. It encourages focusing on possibilities rather than probabilities when it comes to investing opportunities.

![Dispel the Investing Myths! Let Company ABC customize a Financial Life Plan to help you ... Eradicate the fear and doubt that give life to Investing Myths Work to overcome Investing Myths Contact Jim Shoe at 1-888-555-xxxx [email_address]](https://image.slidesharecdn.com/sample-pres1-120127125210-phpapp01/85/The-Millionaire-Real-Estate-Investor-10-320.jpg)