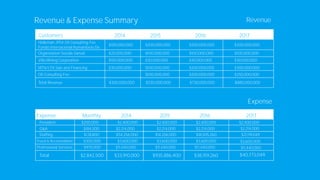

This document provides an overview of S3M Technology Limited, an advisory firm established in 2008 that helps clients monetize financial instruments to generate funds for approved projects. It details S3M's customers and transactions from 2014-2017 which increased revenues from $300 million to $880 million in that period. Expenses have also risen from around $33 million to $40 million. The document outlines S3M's services, revenue model, growth strategy, team, forecasts, expenses and competition in the advisory space. It notes a weakness is the lack of wealth management and private banking services to better manage finances across S3M's various companies.