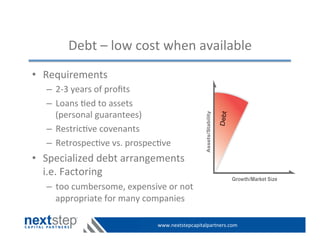

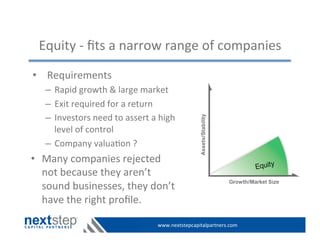

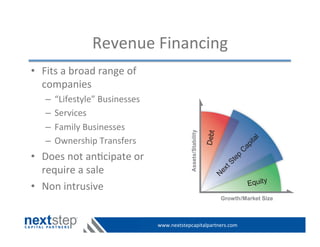

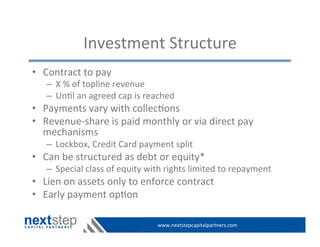

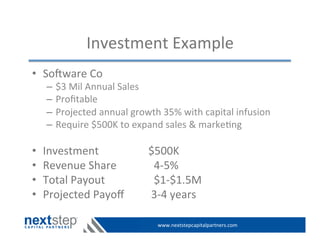

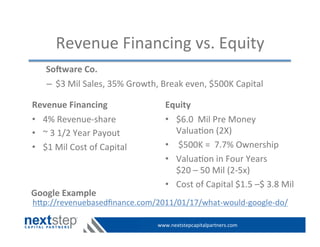

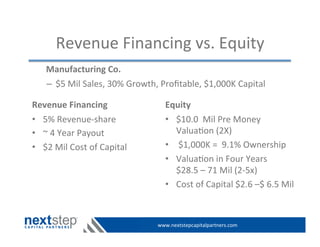

The document discusses alternative financing options to equity and debt for growing companies, including revenue financing. Revenue financing involves an investment in a company in return for a share of topline revenue until an agreed cap is reached. This allows companies to retain full ownership and control without requiring a company valuation. Examples are provided comparing revenue financing to equity for two hypothetical companies.